Bullish: Bitcoin Charts Similar Market Structure As of June 2021’s Bottom (BTC Price Analysis)

While bitcoin is recovering from its massive 50% crash since reaching the ATH in November 2021, the onchain and technical indicator are not showing strong momentum and signs of a bull run renewal.

The market structure is similar to 2021’s Jun – July bottom, and without a catalyst, a likely case for bitcoin is to be traded sideways in the mid-term.

Technical Analysis

By: Grizzley

Long-Term: The Daily

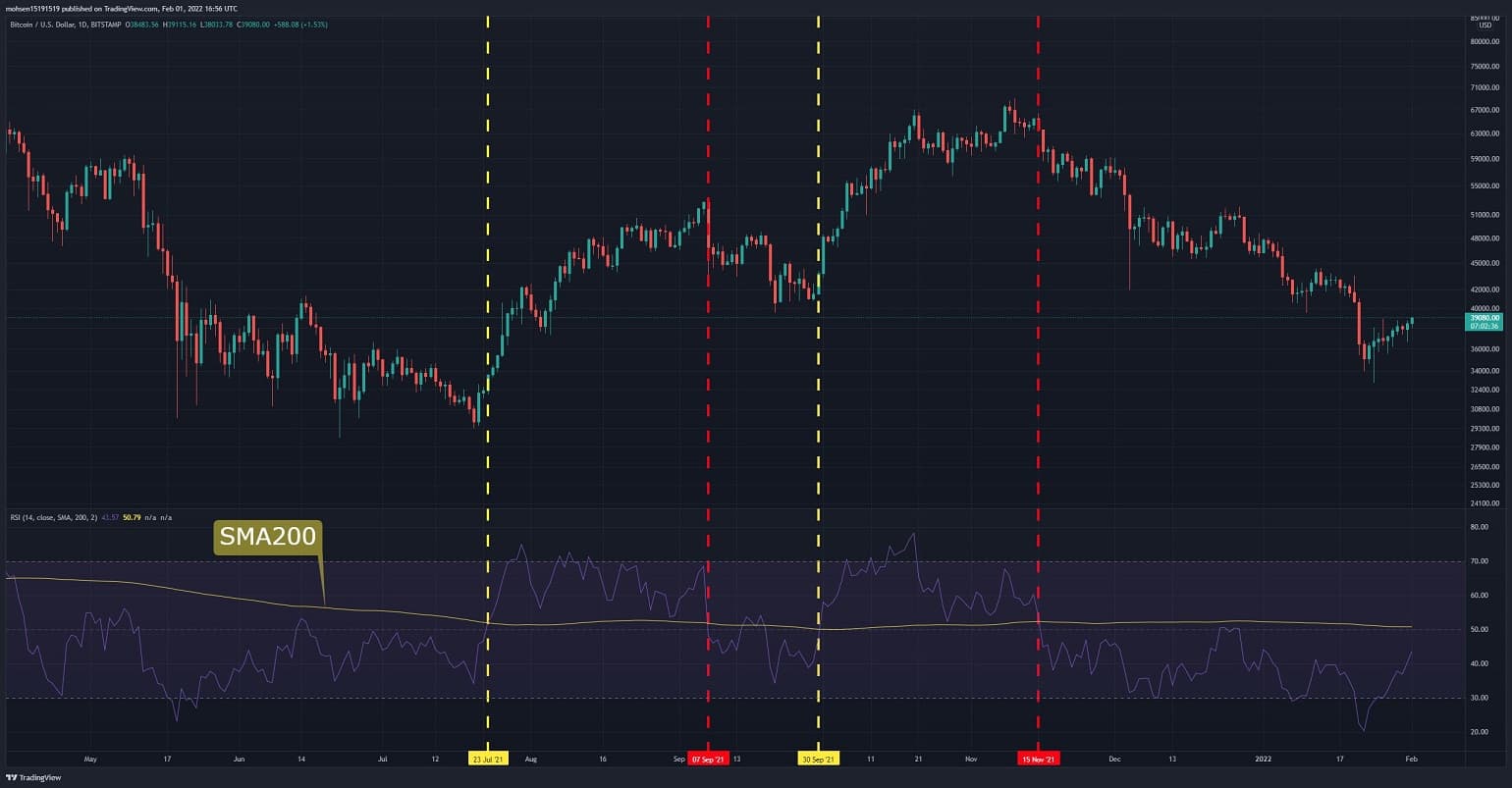

On the daily timeframe, by examining historical data of the previous two market corrections, the trend was reversed after the 14-Day RSI (marked by yellow vertical lines) broke above the SMA- 200 line.

Also, the beginning of the downtrend has been associated with breaking below this long-term moving average line, marked by red vertical lines. Therefore, if history repeats itself, a possible crossing in the mid-term can provide a better opportunity for traders to rejoin the market.

Short-Term: The 4-Hour

Bitcoin on the 4-hour timeframe is struggling with the same downtrend line since touching the ATH. So far, the price has been rejected by it.

The intersection of this downtrend and the static resistance at $40K is a critical area to overcome in order to continue the uptrend. Breaking above this area could signify that the bulls are returning to the market.

Onchain Analysis

By: CryptoVizArt

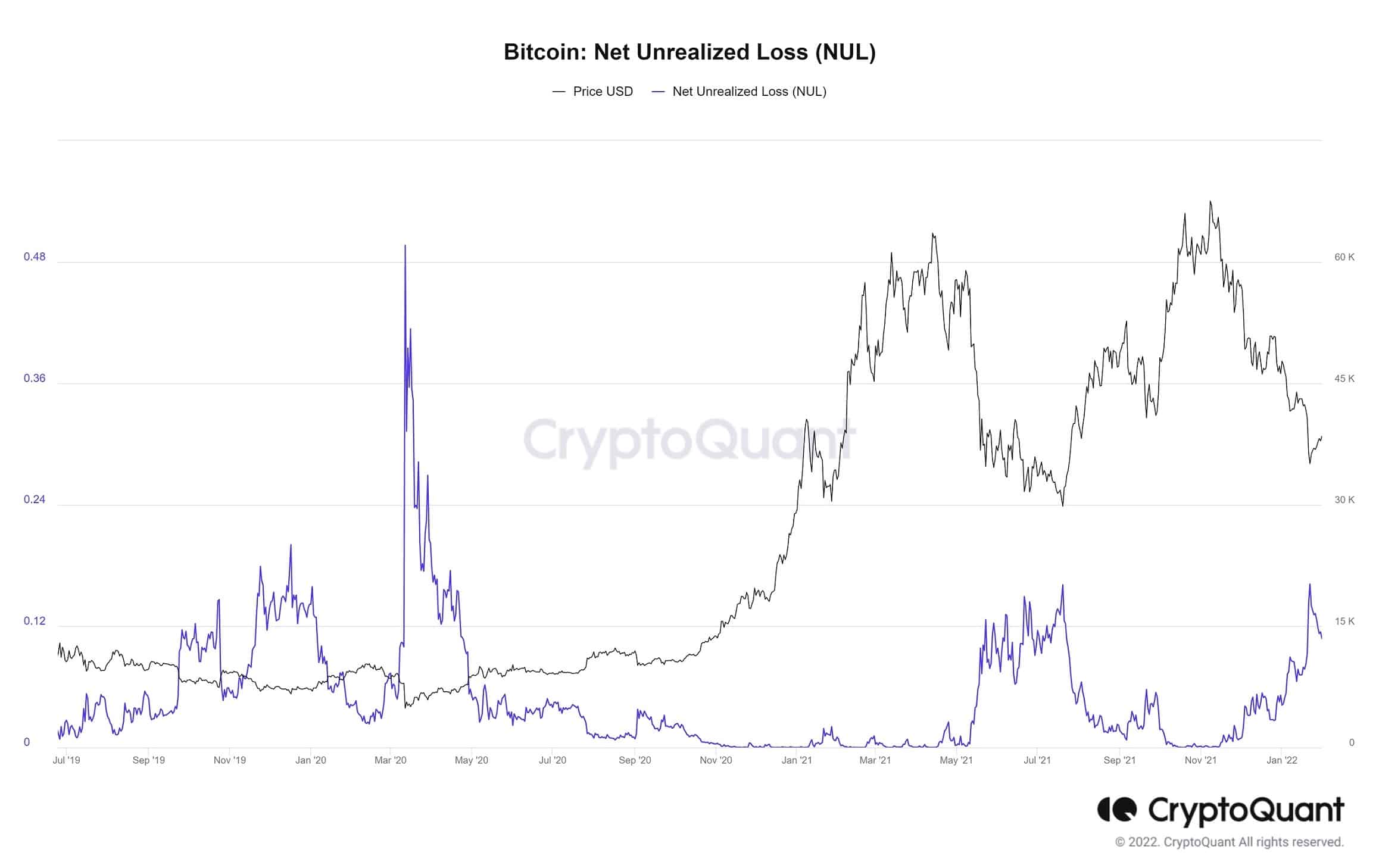

The Net Unrealized Loss (NUL) shows the aggregated value of UTXOs in a loss, divided by market cap. An increasing trend in value means that more investors are starting to be at a loss, which might indicate a possible bottom.

Since touching $33K a week ago, this metric has fluctuated in the 0.1 – 0.17 range, resembling the same structure that the market had seen in 2021 Q2’s bottom reached in June. Based on this metric, a possible scenario is a sideways chopping over the mid-term.