BTC Technical Analysis: These Are Bitcoin’s Two Upside Targets on the Path to $50K

Bitcoin was unable to continue above $43K despite its most recent attempts to do so. The price has circled back to $42,000. In this analysis, we take a closer look at the main technical challenges before the cryptocurrency on the path to recovery up to $50K.

By Shayan

Technical Analysis

Long-Term – The Daily

In the recent past, Bitcoin was successfully supported by the local level around $37K and started a bullish rally. However, the 100-day moving average has been the main barrier for the price to explore higher levels. BTC is currently attempting another attack on the moving average, and if it succeeds, the $46K supply zone will be the next challenge.

There are two major resistance levels in Bitcoin’s way to the $50K-$60K channel in higher timeframes; The first one is the $46K supply zone which is a major resistance zone, and based on the lower time frame behavior, it’s worth keeping an eye on it. The 200-day moving average is the second. The trend reversal will be confirmed if Bitcoin breaks above the moving average, and a new bullish rally will be expected after.

Short-Term – 4H

As seen in the above chart, after finding support at $37K, the price has been forming higher highs and higher lows, which is a clear sign of a healthy bullish rally. A valid breakout above the $46K supply zone, however, will be the final confirmation of the reversal. There are two possible scenarios for the coming days:

1)Bitcoin continues to create higher highs and higher lows and breaks above the $46K supply zone, and consolidates in form of a pullback to the referenced region in order to validate the breakout.

2)Bitcoin gets rejected from the major supply zone and plummets to lower demand/support areas triggering another round of futures market liquidations. In the lower timeframes, the major support levels will be the bottom of the range around $34K and the bottom trendline of the bearish continuation correction flag.

Funding Rate Overlook

By Shayan

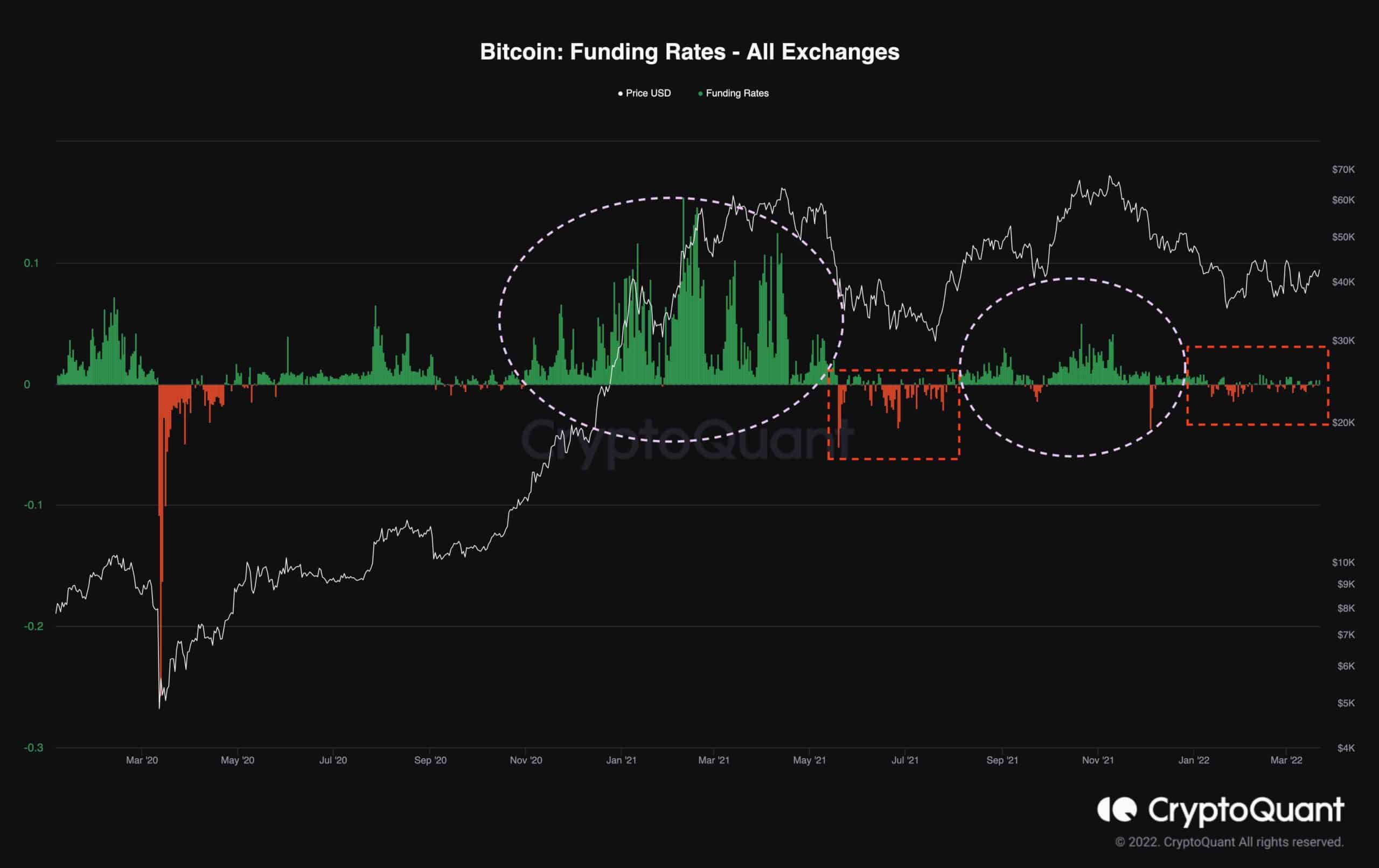

The funding rates had significant positive values and even went beyond the 0.1 mark throughout the 2021 bull run and until the $64K all-time high was in. These high levels show that the market was overbought and that the bulls were aggressively longing as the price increased.

The market had become overheated, and a long-squeeze was imminent. The price began to collapse from the $64K high, liquidating the over-leveraged long positions, and this cascade has resulted in a crash down to the $30K level. The bears were actively shorting BTC, anticipating that the bull market was over, and this big flush-out was followed by a couple of months of negative funding rates.

The funding rates have been swinging around zero and have been mostly negative during the previous few months, following another significant drop, indicating that bearish sentiment is prevailing in the futures market.

Today, however, the sentiment does not appear to be as negative as it was during last year’s collapse. This might indicate that the market is still not afraid enough, and lower prices are not out of the picture yet or that there is less panic now than there was last year at the $28K bottom, as a result of less excitement from the $69K in November all-time high compared to $64 in April 2021.