BTC Price Analysis: Bitcoin Retests $30K But Is There More Pain to Come?

Bitcoin’s price has been consolidating for the last few days, and the decrease from $48K has slowed down by forming support at the $30K level.

Technical Analysis

By Edris

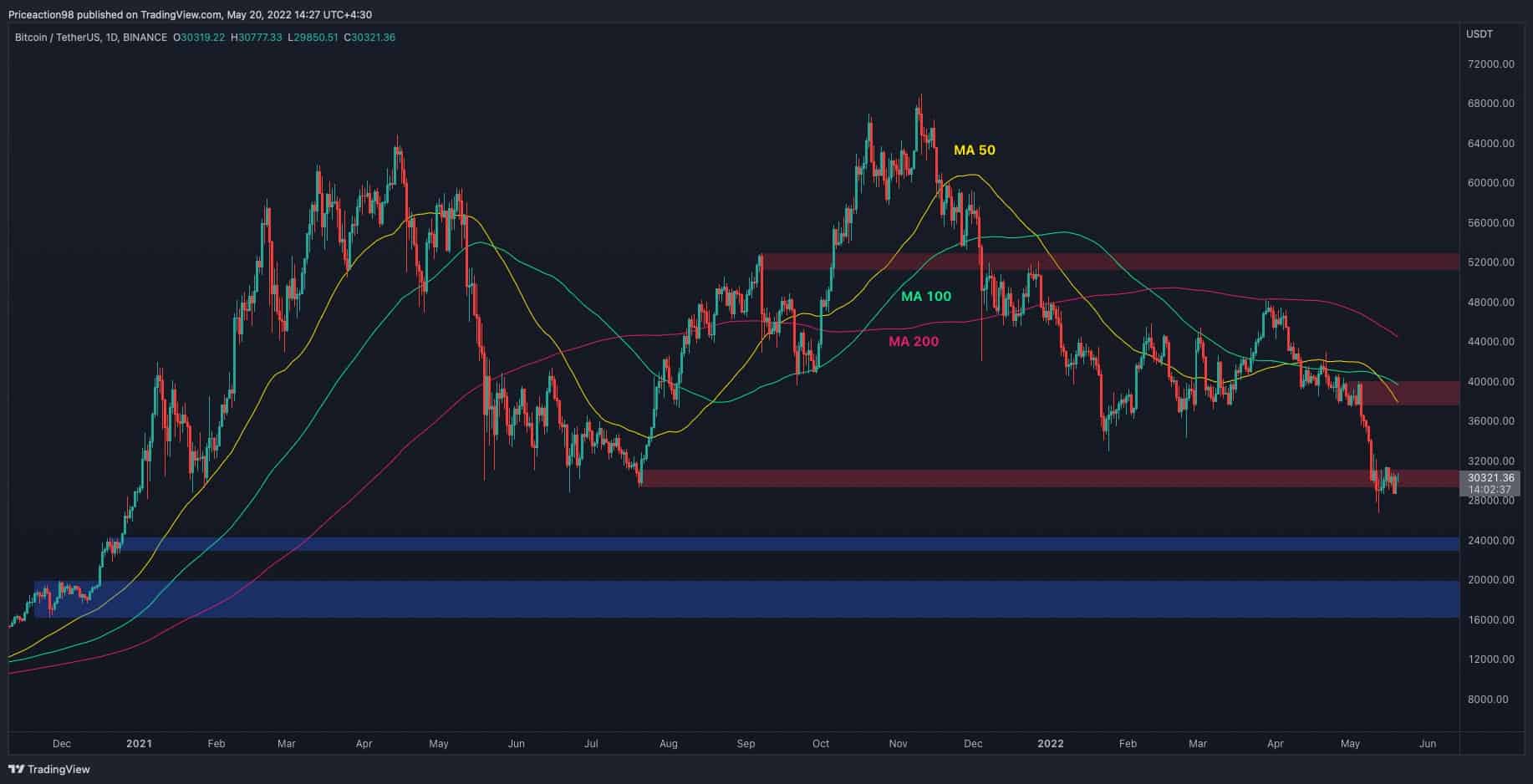

The Daily Chart

Considering the current macro sentiment, it may be too early to call the current area the bottom, as price action could easily be a mid-downtrend consolidation before another leg to the downside. Assuming a more favorable scenario, the price could also bounce from where it currently trades. If that plays out, the two significant challenges would be the $37-$40K supply zone alongside the bearish crossover of the 50-day and 100-day moving averages. On the other hand, if $30K fails, the $24K area could be the next potential bearish target.

The 4-hour Chart

On the 4-hour timeframe, the price fluctuates around the $30K area while forming a symmetrical triangle pattern. This is a neutral classical price action pattern that could be broken to either side and acts as a continuation or reversal pattern.

If the price successfully breaks towards the upside and retests the broken trendline, the $34K area, the mid-point of the current bearish leg, could be the first target. However, a negative scenario seems more likely because the price is in the middle of a strong bearish trend.

In this case, a breakdown of the pattern would be the more likely outcome and could lead to another rapid drop towards the $24K level. The RSI indicator also points to a state of equilibrium in the market as neither the bulls nor the bears are in control.

The RSI’s should be monitored closely in the next couple of days, as a move above or below the 50% mark could signal the beginning of the direction of the next price leg.

On-chain Analysis

By Edris

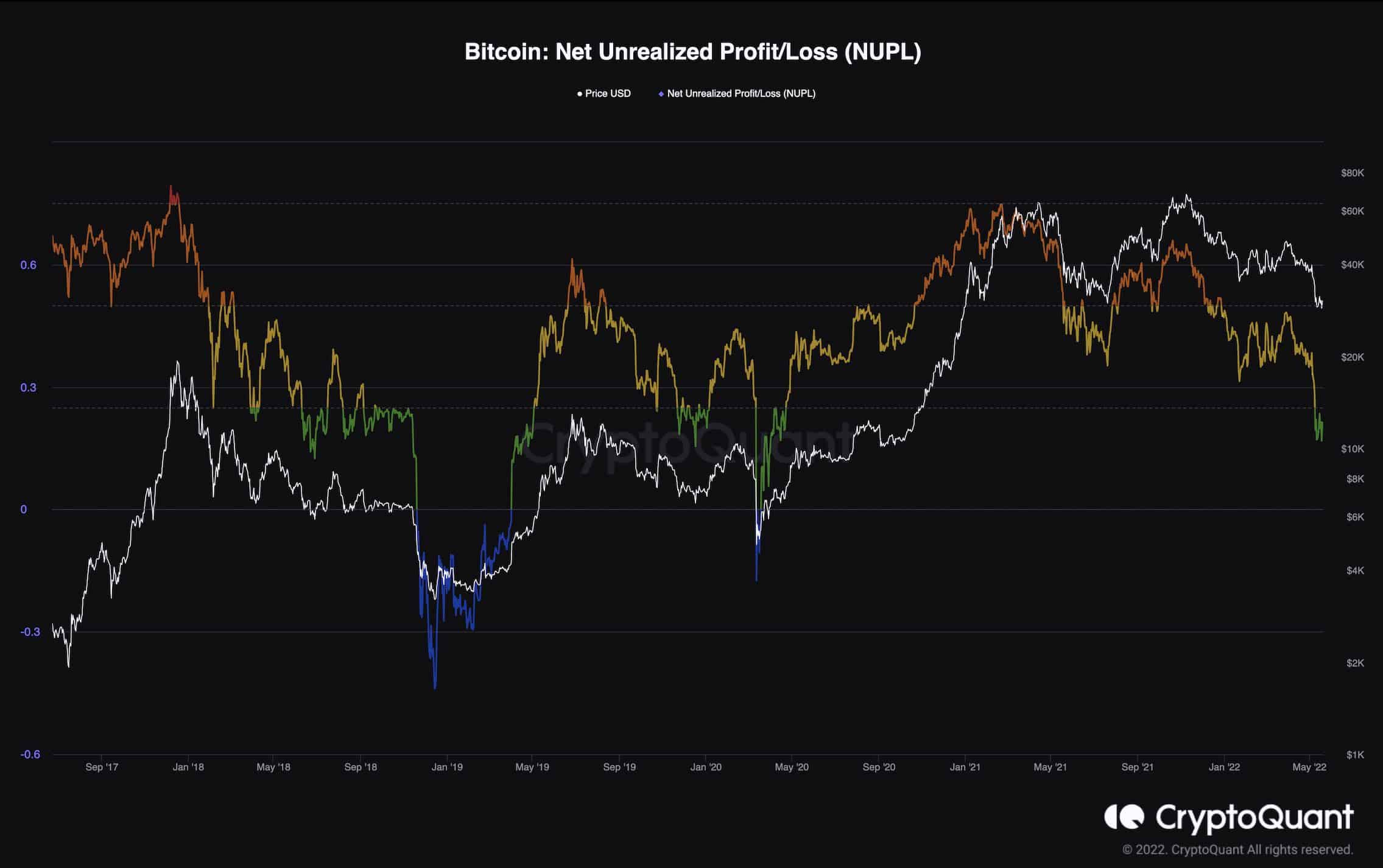

Bitcoin Net Unrealized Profit/Loss

The decline that Bitcoin’s price has been going through has led to tremendous (realized and unrealized) losses for market participants.

The NUPL metric shows the ratio of unrealized profits and losses in the Bitcoin network and could be a helpful tool to identify local and cycle tops/bottoms. The NUPL has broken below the 0.25 mark, entering a range that coincided with local bottoms and the first phase of capitulation in bear markets.

Although it can be argued that Bitcoin has entered the undervalued zone according to this metric (green), the second round of capitulation could also be on the horizon, which would drive this indicator into the negative territory (blue). Therefore, from a traditional bear market point of view, lower prices could be expected before a cycle bottom is in.