BTC Nosedives to 2-Month Low, ETH Loses $3K Level as Liquidations Skyrocket to $400M

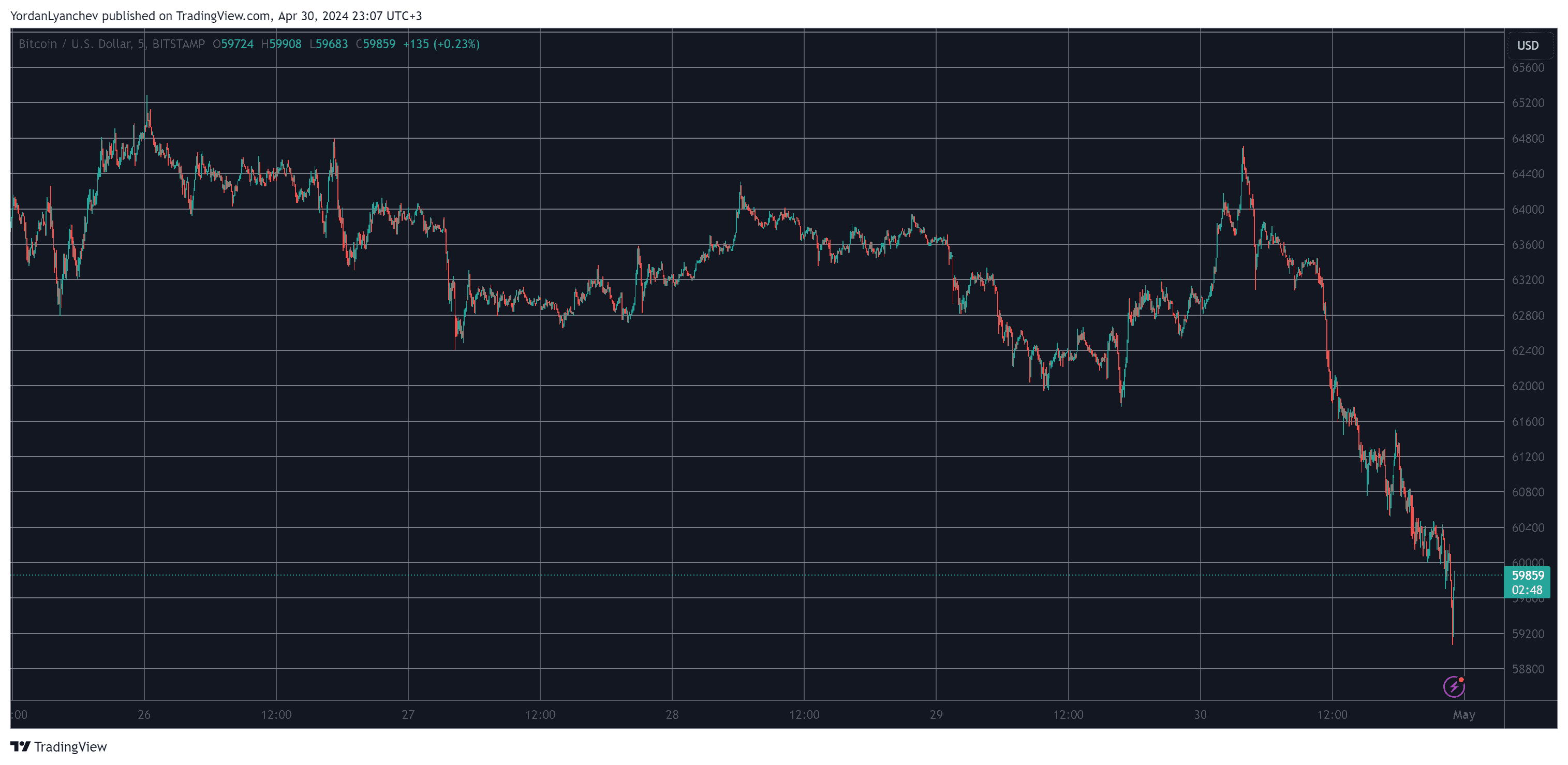

The trading day continues in an even more painful manner for bitcoin as the primary cryptocurrency took another hit and slumped to its lowest price position in over two months of under $59,300.

The altcoins’ situation is worse, with ETH dropping below $3,000, SOL dumping by 8%, and a few double-digit price declines.

It was just earlier today when the bitcoin bulls had taken charge and initiated an impressive leg up that resulted in the asset nearing $65,000 for the first time in a few days.

However, it failed to breach that level, and the subsequent rejection led to dire consequences. Amid the disappointing debut of the spot Bitcoin and Ethereum ETFs in Hong Kong, the largest cryptocurrency fell by a couple of grand during the day and kept plunging in the following hours.

This culminated in dumping below $60,000 and going all the way down to $59,100, which became its lowest price tag since the end of February.

ETH is deep in the red as well. The largest altcoin has declined by over 7% in the past 24 hours and now sits well below $3,000.

Similar or more painful losses come from the likes of SOL (-8%), DOGE (-7%), SHIB (-7%), AVAX (-7%), LINK (-8%), NEAR (-10%), UNI (-10%), HBAR (-10%), and many others.

Consequently, the total value of liquidated positions has skyrocketed to almost $400 million on a daily basis. Over 110,000 traders have been wrecked within the same timeframe, with the largest single one liquidated on Bybit and was worth more than $5 million.

The post BTC Nosedives to 2-Month Low, ETH Loses $3K Level as Liquidations Skyrocket to $400M appeared first on CryptoPotato.