BTC Miners Reserves Reach Their Lowest Point in a Decade

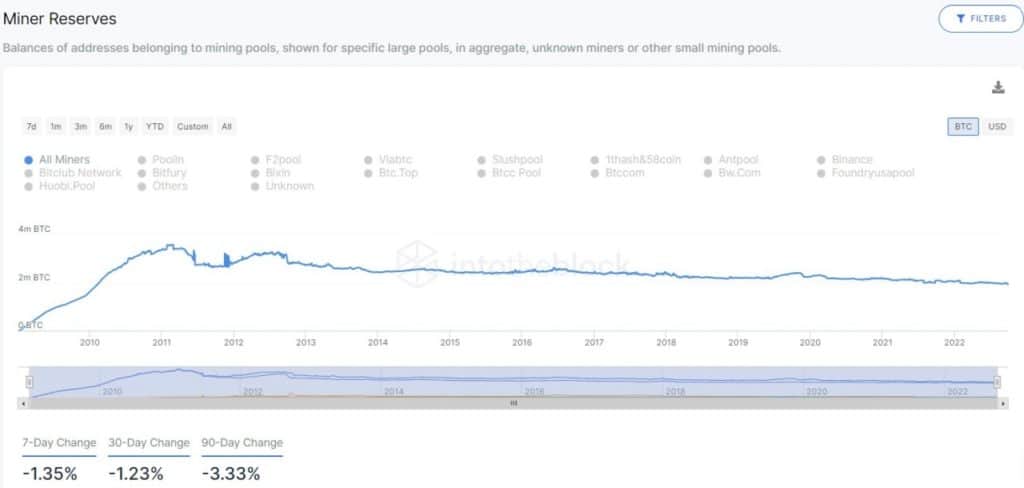

Bitcoin miners are now holding fewer than 2 million BTC on reserve, according to data from IntoTheBlock.

That’s the lowest amount of Bitcoin held by all tracked pools and miners since 2010, following a steady decline over the past decade.

Dwindling Miner Reserves

IntoTheBlock’s data tracks the Bitcoin belonging to the on-chain addresses of various major miners and mining pools – including Poolin, F2Pool, Binance, Bitfury, and others.

In aggregate, total reserves numbered 1.92 million BTC as of October 2nd. Total reserves fell below 2 million BTC starting around June 13th, while Bitcoin’s price collapsed and industry heavyweights started going insolvent.

Though that doesn’t tell the whole story: the platform’s data suggests that miner reserves have been steadily declining since September of 2012, from their peak of about 3.1 million BTC. Before 2022, the last time Bitcoin miners held fewer than this month’s reserves was in February of 2010.

In general, the volatility of aggregate miner reserve balances has decreased over time. This may be related to Bitcoin’s supply issuance schedule. Every four years, the subsidy attached to each Bitcoin block is cut in half – meaning early miners could likely accumulate and sell the most Bitcoin within the shortest period of time.

Furthermore, Bitcoin’s price has skyrocketed since its inception, meaning less Bitcoin needs to be sold over time to cover USD-denominated costs. As such, miner balances are still above $44 billion in USD terms – relatively close to its $59 billion all-time high in April 2021.

Pressure on Miners

Despite declines in both Bitcoin’s price and miner reserves, the network hash rate continues to rise to new highs. Improvements in mining technology allow miners to produce hashes using less energy over time.

But a rising hash rate also means more competition for individual miners. Coupled with a bear market that’s ravaged miner revenues, this year’s environment has proven difficult for miners to stay profitable, or even afloat.

Last month, the Bitcoin mining firm North Compute filed for bankruptcy, revealing debts upwards of $500 million. Back in June, the public miner Core Scientific sold the vast majority of its Bitcoin holdings.

Last week, data from Glassnode showed that miners are still selling roughly 8000 BTC per month, while long-term holders, in general, are selling their coins at a loss.

The post BTC Miners Reserves Reach Their Lowest Point in a Decade appeared first on CryptoPotato.