BTC Holds at $64K as Bulls Eye This Level Next (Bitcoin Price Analysis)

Bitcoin’s price has been consolidating since early March, failing to continue its uptrend. Yet, the cryptocurrency might soon get back on track and create a new all-time high.

Bitcoin Price Analysis: Technicals

By TradingRage

The Daily Chart

On the daily chart, the Bitcoin price has been consolidating between the $60K and $70K levels over the past couple of weeks. The recent rejection from the $70K zone has driven it down toward the $60K support level.

Yet, the level has held and initiated a rebound. The market is now expected to potentially retest $68K – an important resistance. On the other hand, if things go wrong and the price drops below $60K, the $48K-$52K area would be a probable target in the coming weeks.

The 4-Hour Chart

Looking at the 4-hour timeframe, it is evident that the BTC price has been creating a descending channel above the $60K zone. A breakout above the channel would be a classic bullish reversal signal, and the market could finally exit the correction phase.

The Relative Strength Index also shows values above 50%, indicating that the momentum has again shifted in favour of the buyers, and a bullish scenario is slightly more likely.

On-Chain Analysis

By TradingRage

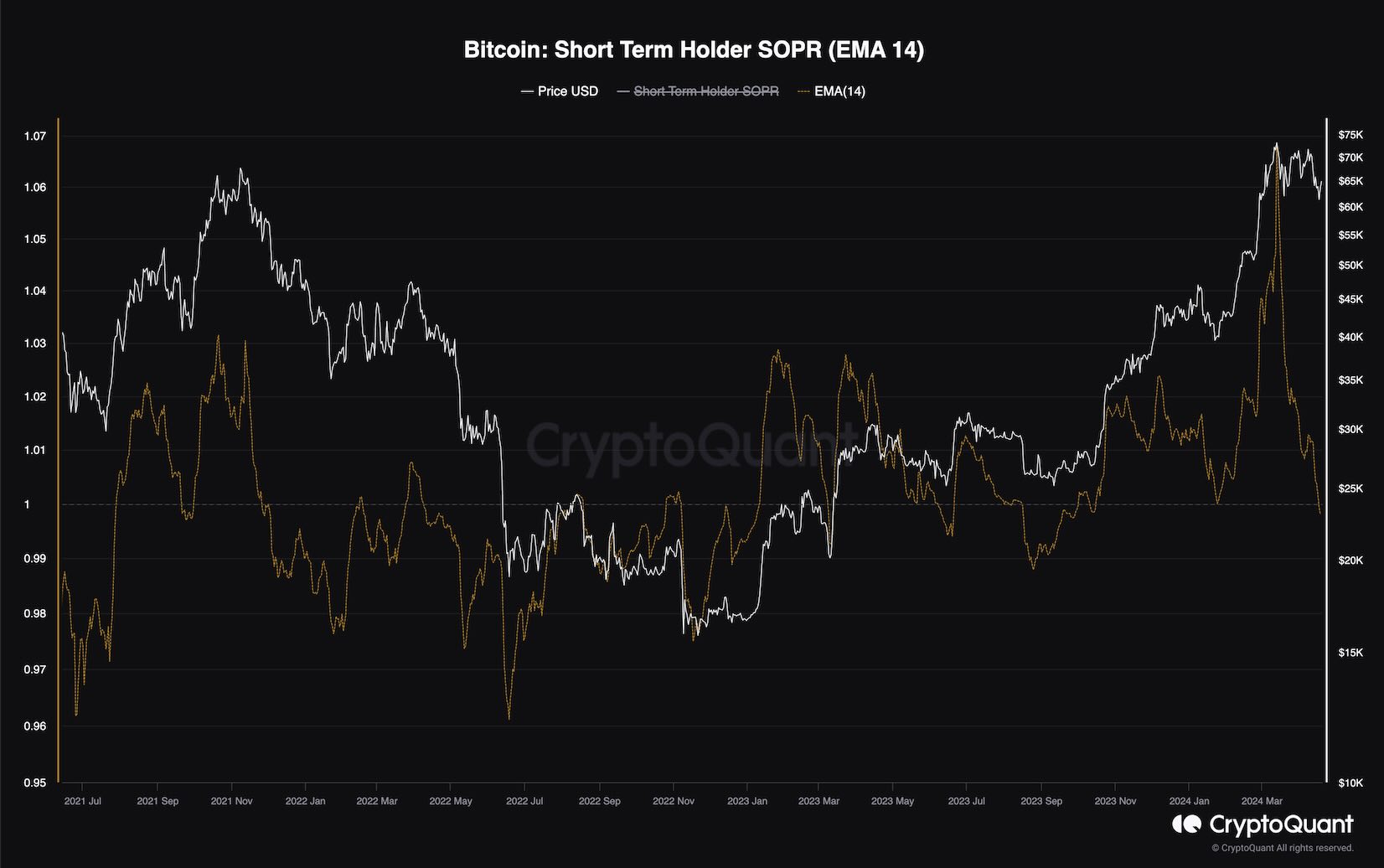

Bitcoin Short-Term Holder SOPR

Bitcoin’s consolidation over the recent weeks has caused many investors to panic. Some assume the bull market is over and BTC is topping out, while other holders view the recent correction as a buying opportunity.

This chart presents the Bitcoin short-term holders’ spent output profit ratio or SOPR in short. The metric measures the ratio of profits being realized by investors who have held their coins for less than 155 days.

As the chart demonstrates, the STH SOPR has recently put in a record high, showing values much higher than during the previous all-time high. This significant profit realization has likely taken its toll on the market, as the subsequent selling pressure has prevented the price from climbing higher.

The STH SOPR has even dropped below 1 in previous days, indicating that the short-term holders are now realizing losses. So, the market might need more demand to meet the current excessive supply and rebound higher.

The post BTC Holds at $64K as Bulls Eye This Level Next (Bitcoin Price Analysis) appeared first on CryptoPotato.