BTC Dipped Below $30K for the First Time Since July 2021, LUNA Plummets 45% (Market Watch)

The bears continued to pressure the crypto market in the past 24 hours and pushed bitcoin below $30,000 for the first time since mid-July. The altcoins are in no better shape, but Terra has lost the most. Following the recent drama, LUNA plummeted by 45% in the past day alone.

Bitcoin Dipped Below $30K

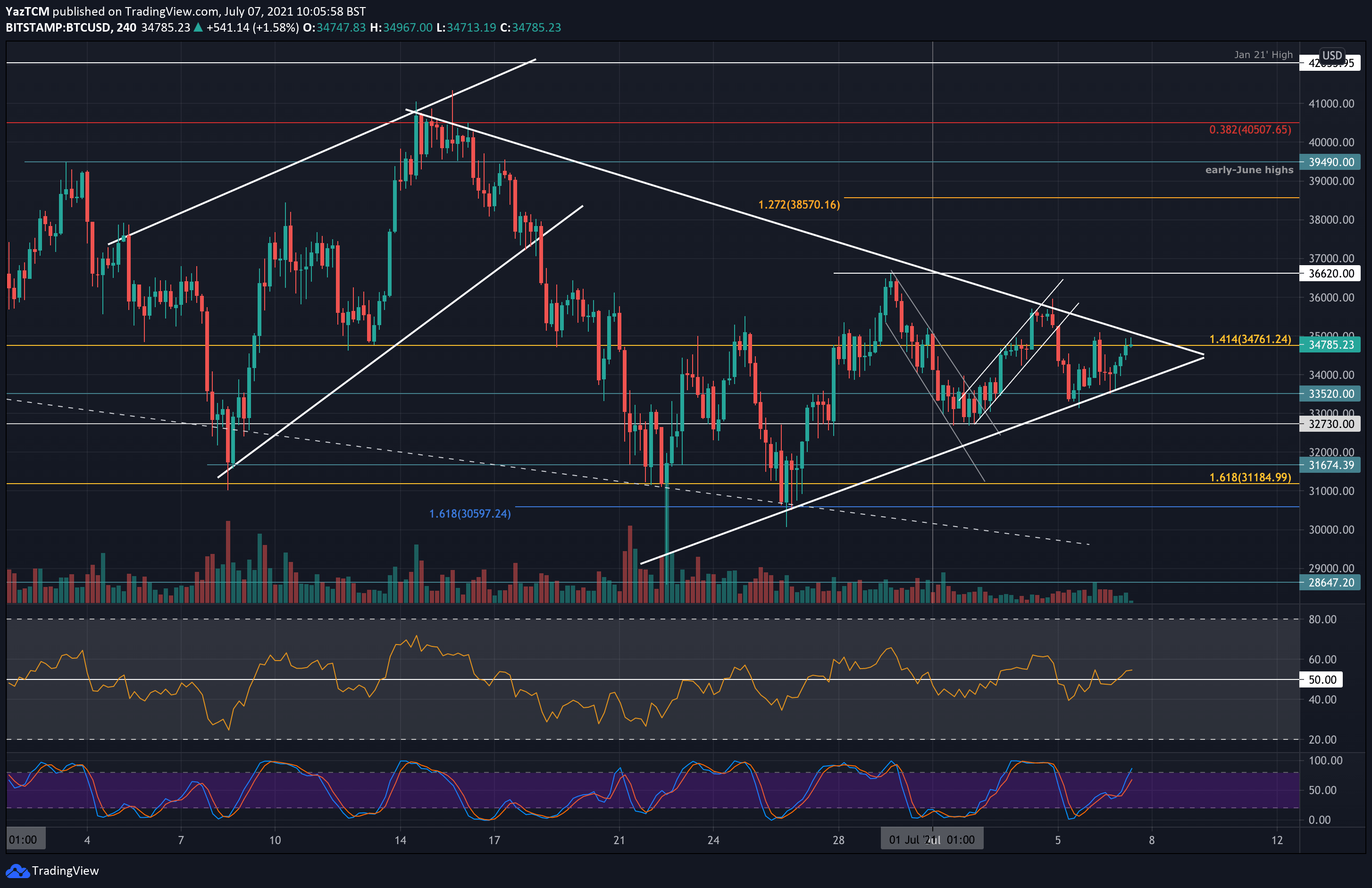

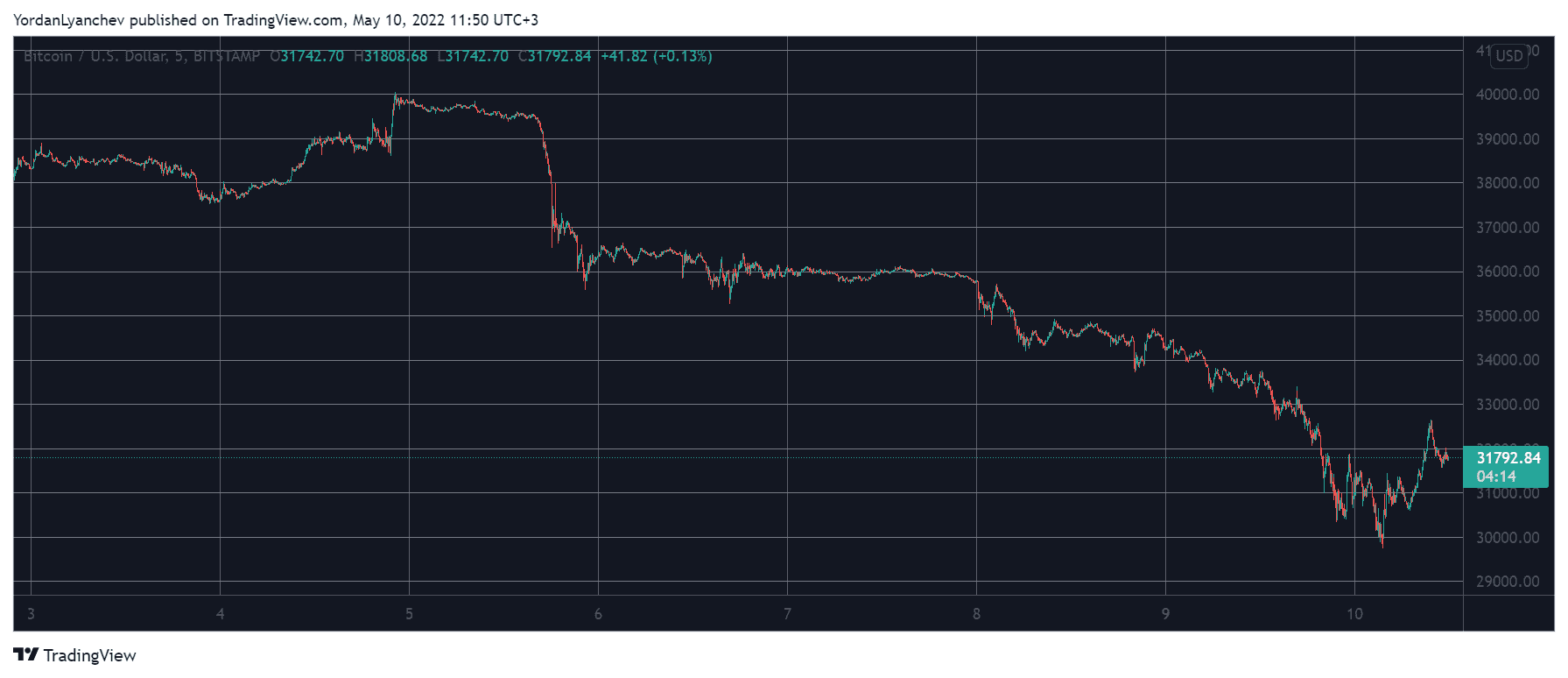

The gloomy market conditions only intensified in the past 24 hours. Less than a week ago, the primary cryptocurrency challenged $40,000 following the latest FOMC meeting, but to no avail.

Just the opposite, the landscape changed vigorously, and BTC started losing value fast. At first, it dumped by $4,000 to a multi-week low of $36,000, but that turned out to be just the start.

A few days later, bitcoin dropped by another $2,000, and yesterday it struggled at around $33,000. Yet, that was not all either.

In the following several hours, it plummeted by more than $3,000 and fell below $30,000 for the first time since mid-July 2021. This meant that the cryptocurrency had lost $10,000 in about five days.

Bitcoin reacted relatively well to the latest price drop and bounced to $33,000. It failed there and now stands just under $32,000, but its market capitalization is down to approximately $600 billion.

LUNA Loses The Most

As it typically happens in times of enhanced volatility, the majority of the alternative coins are in an even worse situation. Ethereum, which traded at $3,000 days ago, dumped to $2,200 yesterday evening. As of now, ETH stands close to $2,400, but it’s still more than $600 down in a week or so.

Binance Coin has declined to $325, XRP is at $0.5, and SOL is down to $70. Even more price losses are evident from Dogecoin, Polkadot, Avalanche, Shiba Inu, and NEAR Protocol.

However, none has lost more than Terra’s native cryptocurrency. Following the recent saga with the protocol’s stablecoin UST, LUNA has plunged by 45% in a day alone (65% weekly) to $33.

With the lower- and mid-cap alts in the red once again, the crypto market cap has seen another $50 billion evaporated. The metric is down to $1.450 trillion, meaning it has lost $350 billion in five days.