BTC Breaks ATH But Dominance Declines as ETH Eyes $2500 (Market Watch)

Following the latest all-time high just shy of $65,000 and a subsequent $4,000 retracement, bitcoin has calmed down around $63,000. However, its dominance continues to suffer and is below 53%. This comes amid an impressive increase from Ethereum, which neared $2,500 and marked yet another record of its own.

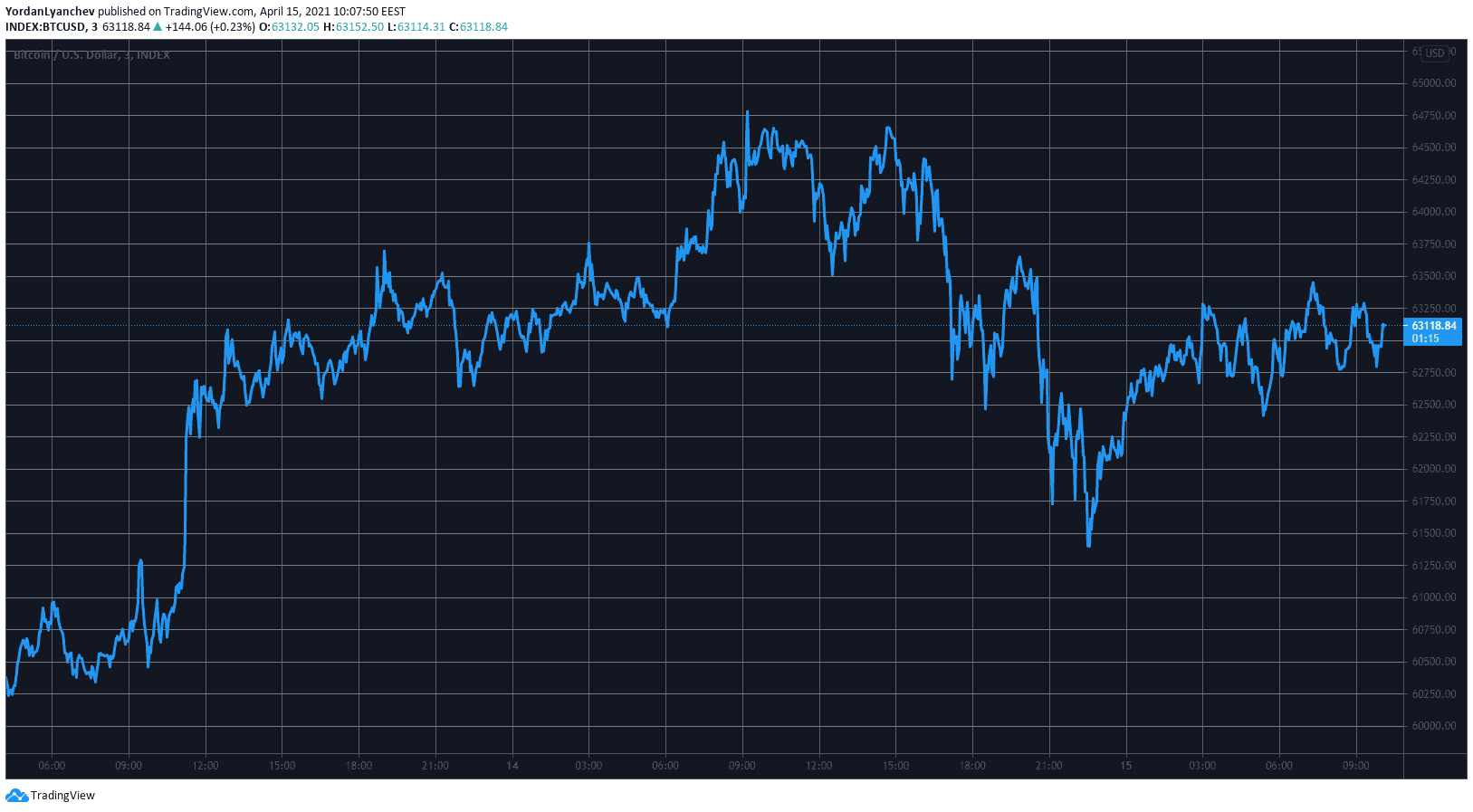

Bitcoin’s ATH and $4K Turbulence

As reported two days ago, the primary cryptocurrency had finally broken above its long-time nemesis at $60,000. Furthermore, the asset continued upwards to new all-time high levels on the same day at about $63,000.

Yesterday seemed even more bullish as BTC added roughly $2,000 of value to its latest ATH record of almost $65,000 (on Bitstamp).

However, the infamous volatility struck again, perhaps led by the anticipation for the public listing of the largest US crypto exchange – Coinbase.

Approximately at the time when it became official, bitcoin dropped by nearly $4,000 from its peak and tested $61,000. Nevertheless, the asset has bounced off and currently stands just above $63,000.

Despite its bullish week, though, bitcoin’s dominance over the market keeps declining. The metric comparing BTC’s market capitalization with all other cryptocurrencies has fallen beneath 53% for the first time in more than two years.

Just for comparison, bitcoin’s dominance was well above 72% in early January 2021.

Ethereum Aims at $2,500

Most alternative coins followed their leader north in the past few days, which led to new all-time high records for Binance Coin, Cardano, Dogecoin, and Ethereum. Although the first two have declined by roughly 5% since yesterday, the second-largest cryptocurrency by market cap has only enhanced its performance.

ETH spiked once more and exceeded $2,480 for its latest ATH. However, it has failed to overcome $2,500 so far and has retraced slightly to about $2,470.

Uniswap is also well in the green from the top ten coins. A 6.5% surge has taken UNI above $38. Chainlink has surged by nearly 10% and, with a price tag of almost $41, is back in the top ten.

More price pumps come from DigiByte (22%), WazirX (20%), VeChain (18%), Yearn.Finance (15%), Stacks (15%), Ravencoin (13%), Avalanche (10%), and Maker (10%).

Ultimately, the total crypto market cap has remained well above $2.2 trillion.