BTC Blasts Through $30K: Bear Market Finally Over? (Bitcoin Price Analysis)

After a lengthy period of uncertainty, Bitcoin’s price has finally managed to break through a critical technical resistance level.

This has led some investors to question whether the bear market has finally come to an end or if this recent rally is just a bull trap, a temporary rise in price.

Technical Analysis

By Shayan

The Daily Chart

Bitcoin has reached a significant and decisive resistance region of $30K, bringing back the bullish sentiment in the market. Now that the price has broken above that static sentimental level, many participants believe that the bear market is over and that Bitcoin has found its bottom at $15K.

However, it is still premature to declare this recent uptrend as the initiation of the next bull market, as the price needs to surpass the upper trendline of the ascending channel and then retest it in the form of a pullback.

Additionally, if the price gets rejected from this vital region and falls, the $25K range will serve as the most powerful support since it also aligns with the 50-day moving average.

The 4-Hour Chart

Bitcoin recently experienced a significant spike, breaking above the upper threshold of a consolidation correction wedge pattern and printing notable green candles in the 4-hour timeframe.

If the price manages to stay above the $30K resistance region and successfully retests it as a pullback, there is potential for an extended bullish rally toward the $38K region.

However, there is currently a considerable divergence between the price and the RSI indicator, which increases the likelihood of a short-term plummet.

The RSI indicator has entered the overbought region, suggesting that a short-term correction is necessary for the next healthy bullish rally.

On-chain Analysis

Bitcoin’s price has made a significant move by breaking through a critical technical resistance level. However, this price surge could simply be a temporary increase, known as a bull trap.

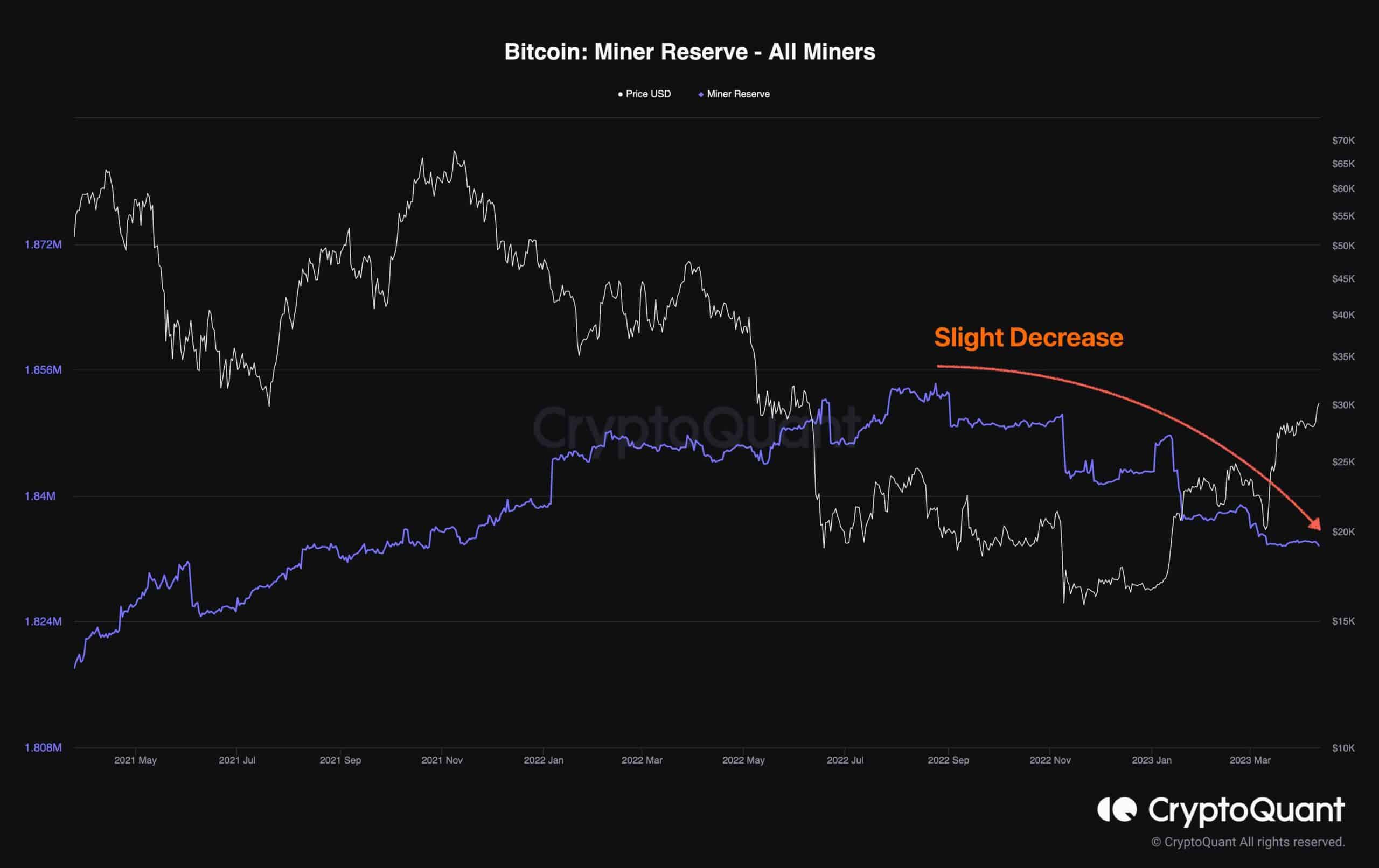

To gain some insight into what may happen next, it’s worth looking at the behavior of Bitcoin miners. By examining their reserves, it is clear that they have been using the recent price increase to sell off some of their holdings to cover their operational costs.

This metric has been in a slight downtrend over the past month, indicating that miners have been selling off their coins at an increasing rate, and there are no signs that this trend will slow down anytime soon.

If this selling trend continues, there would be an increased risk of a bearish reversal in the short term, as the market will be flooded with excess supply. This could cause prices to drop again as demand struggles to keep up with the influx of coins being sold by miners.

Therefore, keeping an eye on the behavior of miners will be important in determining the direction that Bitcoin’s price may take soon.

The post BTC Blasts Through $30K: Bear Market Finally Over? (Bitcoin Price Analysis) appeared first on CryptoPotato.