British Virgin Islands Court Orders 3AC Founders to Attend Examination on May 22

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

:format(jpg)/www.coindesk.com/resizer/Wsw21Z13uYNeMwlEy09fcHX_LHw=/arc-photo-coindesk/arc2-prod/public/Z2G3HHMTVJGWRAQIH4UHCT3FEY.jpg)

Jamie Crawley is a CoinDesk news reporter based in London.

Join the most important conversation in crypto and Web3 taking place in Austin, Texas, April 26-28.

CORRECTION (March 29, 10:35 UTC): An earlier version of this article incorrectly said the examination was scheduled for Dec. 19, 2023

Three Arrows Capital (3AC) founders Kyle Davies and Su Zhu have been ordered to attend court in the British Virgin Islands on May 22 as part of the liquidation proceedings for the crypto hedge fund, which collapsed last year.

The 3AC founders will be found in contempt of court if they fail to reply to the order.

Kyle Davies and Su Zhu are required to provide liquidators with all documents relevant to the firms’ bankruptcy by April 14.

Should they fail to meet this deadline, the examination will be moved to April 27 and last 30 minutes, rather than the two hours it is scheduled for in May.

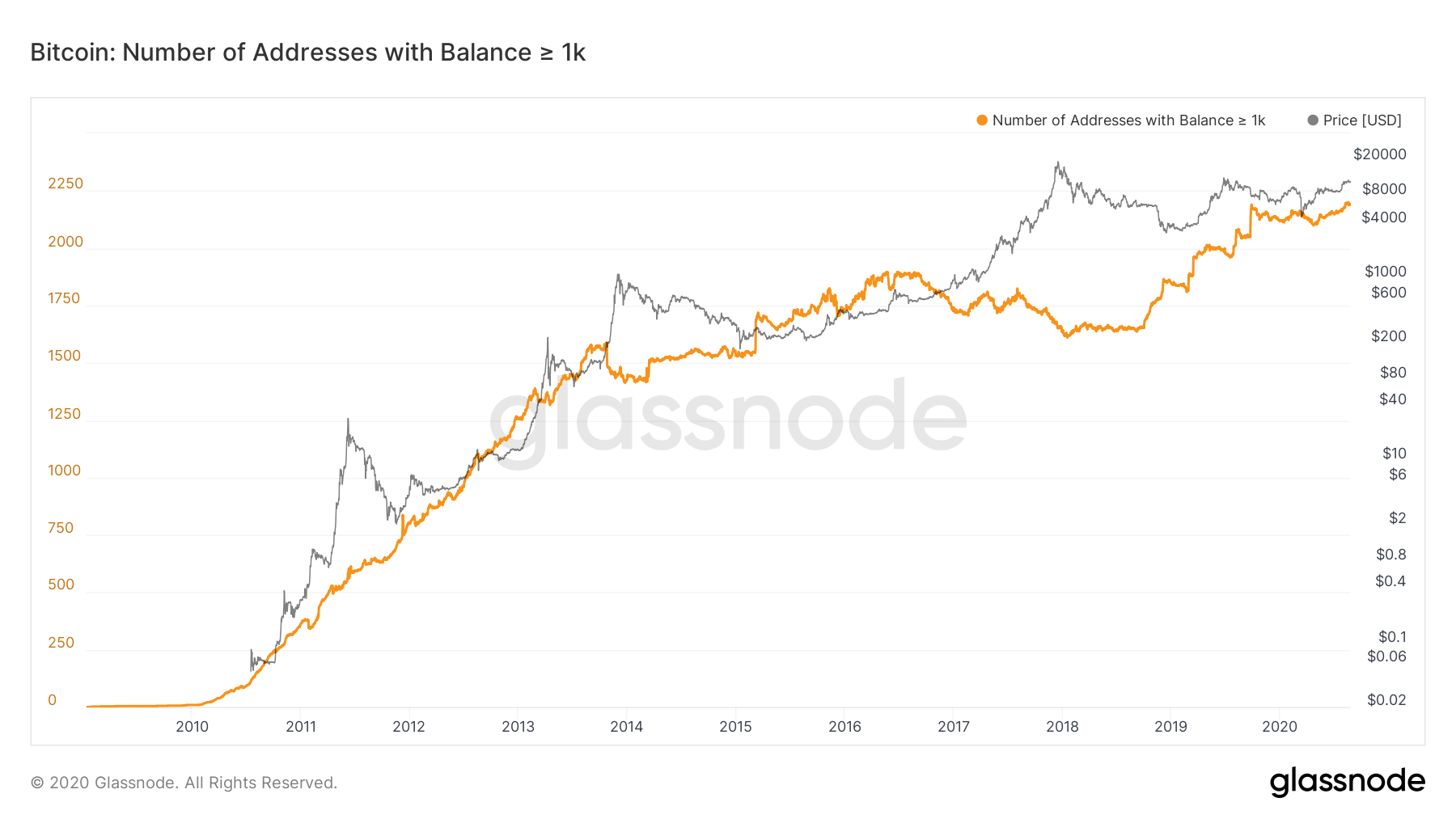

3AC imploded last June as a depressed crypto market exposed the firm’s long-only trading strategy. The 3AC estimated its assets to stand at around $1 billion compared to liabilities of $3 billion.

The collapse was one of the flashpoints in the onset of a crypto winter, bringing about similar collapses from multiple other crypto firms. Companies with 3AC exposure such as Voyager Digital, Celsius and Genesis Asia Pacific (which, like CoinDesk, is part of the Digital Currency Group) subsequently filed for bankruptcy.

Edited by Greg Ahlstrand.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Wsw21Z13uYNeMwlEy09fcHX_LHw=/arc-photo-coindesk/arc2-prod/public/Z2G3HHMTVJGWRAQIH4UHCT3FEY.jpg)

Jamie Crawley is a CoinDesk news reporter based in London.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Wsw21Z13uYNeMwlEy09fcHX_LHw=/arc-photo-coindesk/arc2-prod/public/Z2G3HHMTVJGWRAQIH4UHCT3FEY.jpg)

Jamie Crawley is a CoinDesk news reporter based in London.