Breaking Down Elon Musk’s Misunderstandings About Bitcoin

In a recent tweet explaining why Tesla would no longer accept bitcoin, Elon Musk displayed a poor understanding of Bitcoin’s energy use.

Bitcoiners yearn for the good old days of great debates with informed critics who were up for the intellectual challenge. It allowed the community to hone its thought processes, build knowledge and skills to widen the debate and discussion, and generally strengthen our resolve and commitment to our investment thesis.

Unfortunately, we have been completely out of training for about seven years, with not one single new criticism of Bitcoin surfacing that hasn’t already been factually refuted to death. The old critics were a cold glass bottle of Classic Coke, now all we get is lukewarm, off-brand, generic cola.

Et tu, Elon? After all we’ve been through together?

In order to keep this article readable within a reasonable amount of time, I will rely on the reader to dig into the refutations of these arguments, prepared by industry experts based on hard data and computer science, and I will be extensively linking to their work throughout this piece.

We will go through the three paragraphs in Musk’s tweet one by one…

1. “Tesla has suspended vehicle purchases using Bitcoin. We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel.”

I have two words for you Mr. Musk: “Prove it.” Prove that the use of fossil fuels for Bitcoin mining is rising. Unfortunately for everyone, this is:

- Impossible to do with 100% accuracy due to the decentralized nature of the industry and the impossibility of surveying every single mining operation in the world.

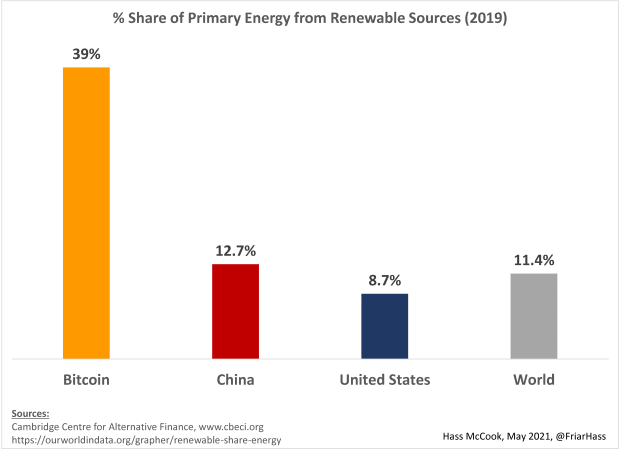

- Not what the literature has been saying: A) The Cambridge Centre For Alternative Finance estimates that 76% of all miners use renewable energies as part of their mix, with between 29% and 39% of all energy used coming from renewables, based on industry data from the world’s largest miners and mining pools B) CoinShares estimates that total share of renewables may even be as high as 73%.

2. “Cryptocurrency is a good idea on many levels, and we believe it has a promising future, but this cannot come at a great cost to the environment.”

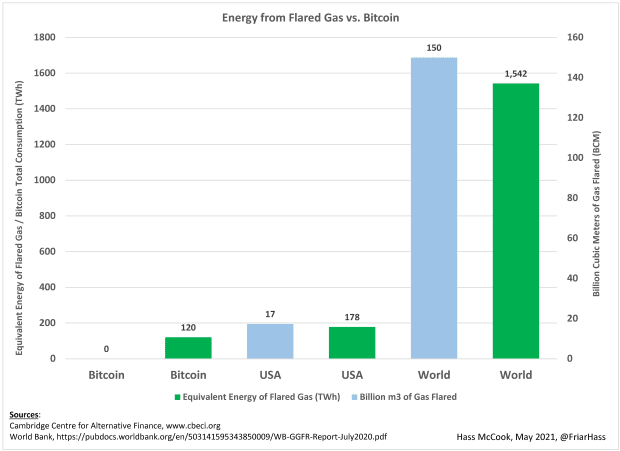

This is where it seems that Musk might be making this statement under duress. Obviously, Musk clearly knows that methane has over 50 times the greenhouse gas effect as carbon dioxide and surely he knows that there are now miners who use waste methane to mine bitcoin, such as Upstream Data, Great American Mining, Giga Energy, Crusoe Energy and Wesco Operating, Inc, to name just a few.

Maybe he just doesn’t know that in the U.S. alone, 538 billion cubic feet (cf) of methane was vented and flared in 2019. We know that 1 cf of methane equates to 0.29 kilowatt hours (kWh) of energy (and 1 cubic meter equates to 10.28 kWh), therefore we calculate that 156 terawatt hours (TWh) is wasted to flaring, more than enough to power Bitcoin for a year. Globally, the total figure for flaring is 150 billion cubic meters, or, 5.3 trillion cubic feet, resulting in 1536 TWh wasted, enough to power Bitcoin more than 10 times over.

Is Bitcoin actually saving the planet? The Aker Group seems to think so in its recent letter to shareholders and through the establishment of Seetee.io, a venture dedicated to achieving these environmental ends. This is even being seen in several other industries, with heat from Bitcoin miners being used to increase greenhouse farming yields in arctic environments, build residential water boilers, brew whiskey and even produce gourmet flake salt. The International Energy Agency (IEA) tracks flaring reduction regularly, with its “Sustainable Development Scenario” (SDS) not-surprisingly having a current status of “Not On track.”

“There is an increasing number of voluntary government and industry commitments to eliminate flaring by 2030,” according to the IEA. “The SDS relies on a rapid reduction in flaring, with government policies and industry commitment all but eliminating it by 2025.”

I hate to break it to you guys, but the only way to even come close to such a lofty goal as eliminating all international flaring by 2025 is with a lot more Bitcoin mining!

3. “Tesla will not be selling any Bitcoin and we intend to use it for transactions as soon as mining transitions to more sustainable energy. We are also looking at other cryptocurrencies that use <1% of Bitcoin’s energy/transaction.”

There are actually three statements that need to be addressed here, despite this paragraph only having two sentences! Obviously, Tesla isn’t selling any bitcoin; but possibly buying more in the wake of Musk’s tweet, which caused $3.45 billion of liquidations (https://archive.is/wjcb7), including $1.8 billion of bitcoin, $120 million of dogecoin, and unsurprisingly, $60 million of shiba inu coin, where 2.85 trillion (yes, trillion with a “t”) coins were liquidated. Wow.

On second thought, Tesla announcing additional purchases would probably trigger a visit from the authorities, as Musk’s recklessness has triggered a wipe-out of over $1 trillion of wealth in the weeks since his tweet, so Tesla doubling down wouldn’t have the best optics from a market manipulation point of view. He’s also done significant damage to Tesla shareholders with his antics, so perhaps he may also need to answer questions from them as to why he would decide to nuke Bitcoin from orbit when his company holds over $1.5 billion of it. But I digress…

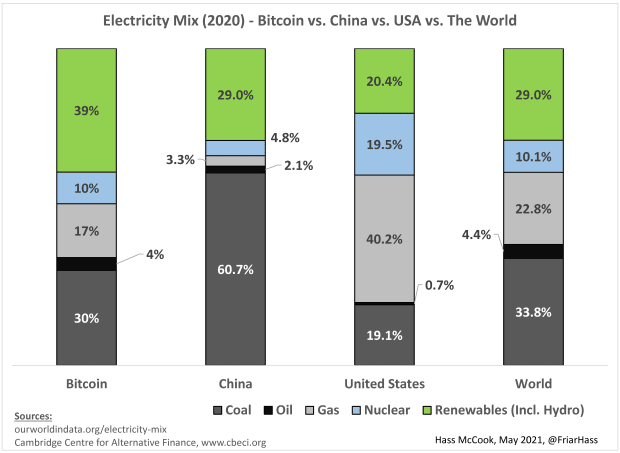

Musk then goes on to say that they intend to use bitcoin when mining transitions to more sustainable energy. The U.S. energy grid is 20% renewable and 19% coal, and Tesla’s second biggest market, China, has a grid that is 28% renewable, and 64% coal. As mentioned earlier on, in the worst case, Bitcoin is 29% renewable, and in the best case, around 73%, but probably closest to about 39%.

This is a better figure than either the U.S. or Chinese grid. So, if Musk is serious about sustainable grids, we invite him to stop selling his cars in the U.S. or China, as the electricity going into his cars is dirtier than that going into Bitcoin. Perhaps he can resume sales once the grid is 100% sustainable? He hasn’t yet bestowed us with his knowledge on what the ideal grid mix would have to be before he starts to feel good about using Bitcoin.

Finally, he says that he is looking at cryptocurrencies that have less than 1% of Bitcoin’s energy per “transaction.” Well, he’s in luck! There is a cryptocurrency that has been live for almost three years now, which uses as little as one-octillionth of Bitcoin’s power “per transaction” — it’s called Bitcoin! Yes, you heard that correctly — an octillionth, or 0.0000000000000000000000001%, of the energy per transaction!

Now, Musk may not have learned about how Bitcoin settlements and transactions work before he splurged $1.5 billion on it, but, effectively, how Bitcoin works is that every 10 minutes or so, the entire world’s money supply, alongside every settlement in history, is meticulously vetted and audited, and up to a few thousand more settlements are stamped into Bitcoin’s base layer blockchain. That’s about as broad and simple a description of the fundamental mechanics of Bitcoin as you can possibly get. Furthermore, all of Bitcoin’s energy use is more so geared towards auditing and securing the money supply, with settlements effectively having a marginal energy use of zero.

Note the repeated deliberate and bold use of the word “settlement” leading up to this point, as I hope to impress upon you the criticality of distinguishing settlements and transactions from each other (this article by the legendary Nic Carter is a great place to start!). Every settlement is a transaction, but not every transaction is a settlement. What is meant by this is that even though it’s true that Bitcoin can only do around 3.5 settlements per second, the number of transactions within any individual settlement can range from “one transaction” to several hundred through techniques such as transaction batching.

On Bitcoin’s second layers, such as the Lightning Network or the Liquid sidechain, the number of transactions per second are theoretically infinite. New developments such as Taproot, which will likely be activated later this year, will make the base layer even more efficient, although not exponentially so as Musk would have hoped.

Musk is great at mathematics and calculus, and he hopefully understands the concept of limits, so he should note that as the denominator in a fraction tends toward infinity, the resulting answer will approach zero. For example, Bitcoin currently uses around 116 TWh per year. Let’s assume that there are about 3.5 settlements per second, or around 110 million settlements per year. If it’s assumed that each settlement only contains one transaction, then yes, Bitcoin would consume 116,000,000 kWh / 110 million = ~1 MWh per transaction.

Considering the average U.S. house used 77 million British thermal units (BTU) of energy per year (equivalent to 22.5 MWh) in 2015, one “transaction” could power a U.S. house for just over two weeks. However, if you assume that 10 transactions happen in a settlement, then your “per-transaction energy use,” despite actually being zero as explained above, can be said to be only 100 kWh instead of 1 MWh. If you go further and learn about the second layers like the Lightning Network, you will learn that the limit for transactions per settlement is theoretically infinite. Therefore, average energy per transaction is 116 TWh per year divided by infinity, which is as close to zero as one can get.

We will never really know for sure why Musk said and did what he did. What we can all take from this episode, however, is that knowledge and proliferation of the facts are of utmost importance to the growth of Bitcoin, as even a “genius billionaire” can easily get sucked into false narratives and do a trillion dollars’ worth of damage.

This is a guest post by Hass McCook. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.