BNY Mellon partners with Chainalysis to track users’ crypto transactions

Bank of New York Mellon, the world’s largest custodian bank, has partnered with blockchain software firm Chainalysis to track its users’ crypto transactions.

584 Total views

6 Total shares

The Bank of New York (BNY) Mellon has announced a partnership with blockchain-data platform Chainalysis to help track and analyze cryptocurrency products. BNY Mellon is the world’s largest custodian bank, currently overseeing $46.7 trillion in assets.

Chainalysis is a blockchain-data analysis platform that offers services to traditional financial institutions, allowing large firms to manage the legal risks that come with cryptocurrency more easily. As part of the partnership, BNY will utilize Chainalysis software to track, record and make use of the data surrounding crypto assets.

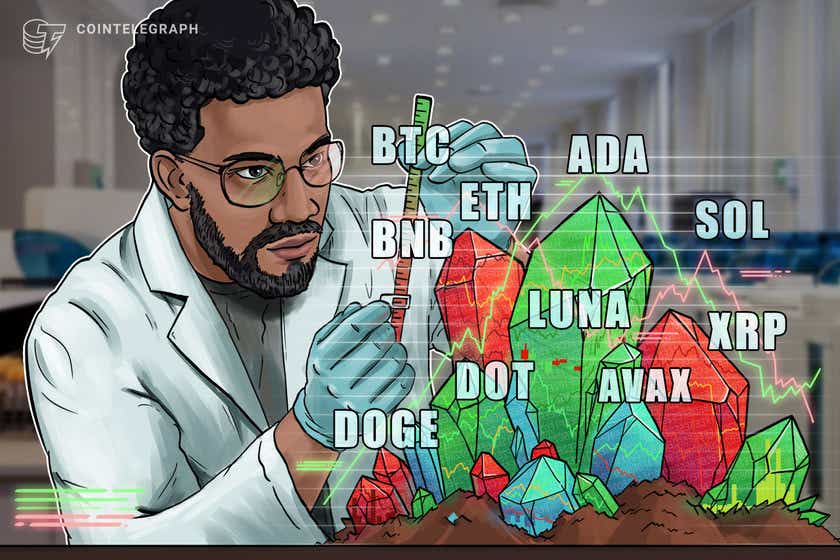

The risk management software offered by Chainalysis includes KYT (Know Your Transaction), Reactor, and Kryptos, with the most important being the KYT flagging system — which automatically detects whether cryptocurrency transfers are deemed “high risk.”

If the KYT software sees crypto being transferred to a sanctioned wallet address it can preemptively block the transaction. Reactor provides firms with further investigative power on the blockchain while Kryptos collects and translates complex data into cogent information for institutions.

Speaking on the partnership, Caroline Butler, head of global custody, tax and network management at BNY Mellon, highlighted the importance of ensuring trust as the banks enters the world of digital assets:

“At BNY Mellon, we enter the digital asset market with the title of the most trusted asset service provider. Working with Chainalysis and other leading fintech companies, we are developing our capabilities in the growing cryptocurrency industry and reflecting this in our products.”

Despite the services that Chainalysis offer drawing criticism from more privacy-oriented crypto users, its ability to provide critical monitoring services to large firms helps legitimize the adoption of cryptocurrencies into traditional finance.

“Chainalysis has always believed that financial institutions are critical to the overall growth and success of the cryptocurrency industry,” Chainalysis co-founder Jonathan Levin said in a statement.

Related: America’s fifth-largest bank launches crypto custody service

BNY Mellon’s push into cryptocurrency began in February last year, when it announced plans to hold, transfer and issue Bitcoin and other cryptocurrencies as an asset manager on behalf of its clients.

This follows a broader trend of traditional finance warming to the idea of cryptocurrency, with household names such as Morgan Stanley, Citibank and JPMorgan now managing and actively investing in cryptocurrency.