Bloomberg Startegists Bullish on Bitcoin in a Favorable Comparison Against Gold

Bitcoin’s endurance above the $30,000 level despite a few brief dips beneath it will help the asset to resume its bull run and head towards $50,000 soon, asserted Bloomberg strategists. In their February report on the cryptocurrencies’ performance, the analysts also highlighted the substantial inflows towards BTC, while gold ETFs have stalled in attracting fresh funds.

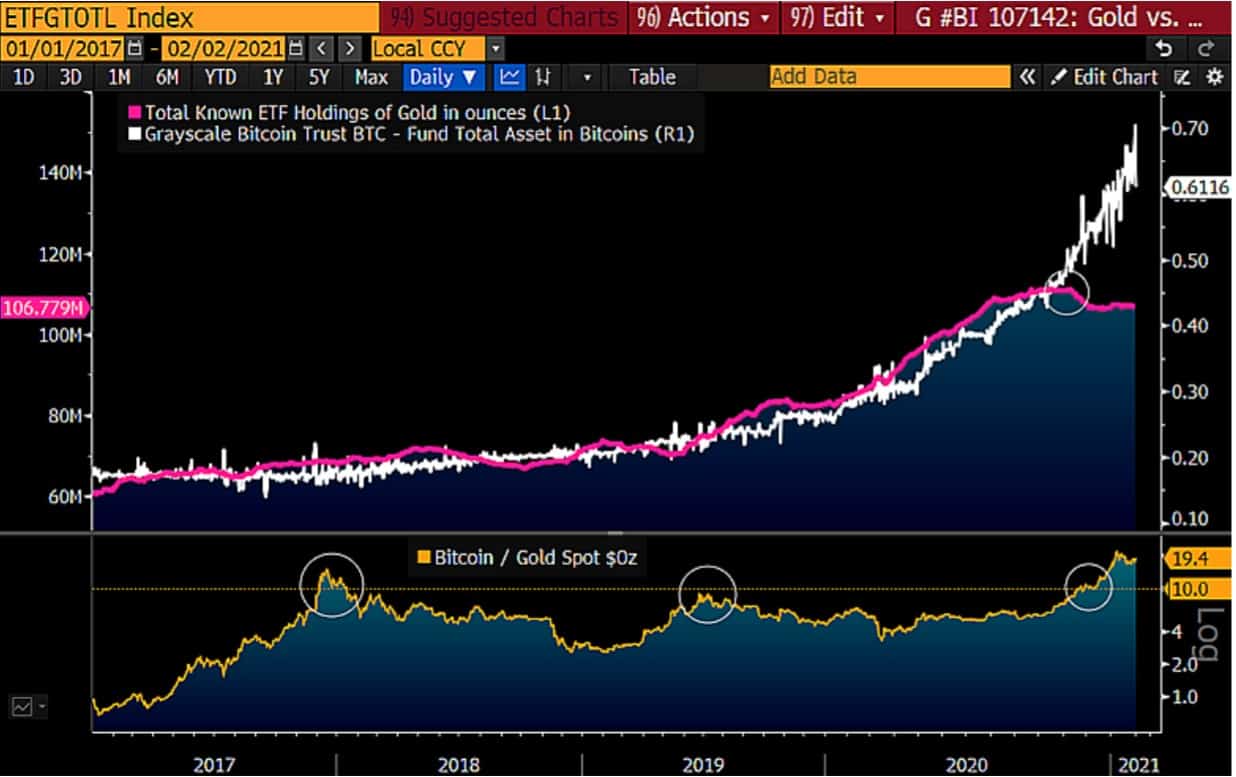

Bitcoin Vs. Gold: Inflows And Outflows

The notion that the primary cryptocurrency has been gradually claiming shares of gold’s market cap was recently discussed by JPMorgan. The giant investment bank even predicted adverse price developments for the precious metal, and now Bloomberg’s strategists have shared the same opinion.

In the February 2021 report, they also suggested another narrative. Despite the growth of the funds allocated in BTC, there’s still a sizeable difference when compared to gold. This could make the cryptocurrency more attractive to institutions and large investors because BTC has more room for growth.

They explored the performance of Grayscale’s Bitcoin Trust (GBTC) and all exchange-traded funds (ETFs) that follow the yellow metal. With GBTC’s AUM growing above $24 billion, as reported recently, it represents less than 12% of the $210 billion in gold-tracking ETFs (as of February 2nd).

This also exemplifies GBTC’s massive growth in the past year as its market cap was closer to 1% of gold in early 2020.

Bitcoin To Add Another Zero Against Gold?

As far as price performance and predictions go, the analysts outlined the significance of BTC’s rapid reclaim of the $30,000 level. The cryptocurrency fell beneath that mark on a few occasions after its ATH in early January at $42,000 but managed to bounce off immediately.

In the following weeks, BTC stayed within $30,000 and $40,000, which could “refresh bull toward $50,000” in the short term. Earlier today, bitcoin climbed just above the coveted $40,000, which Bloomberg sees as the first obstacle towards resuming the bull cycle.

On a more macro scale, though, the analysts seemed even more optimistic on BTC’s price developments, especially when compared with gold’s value.

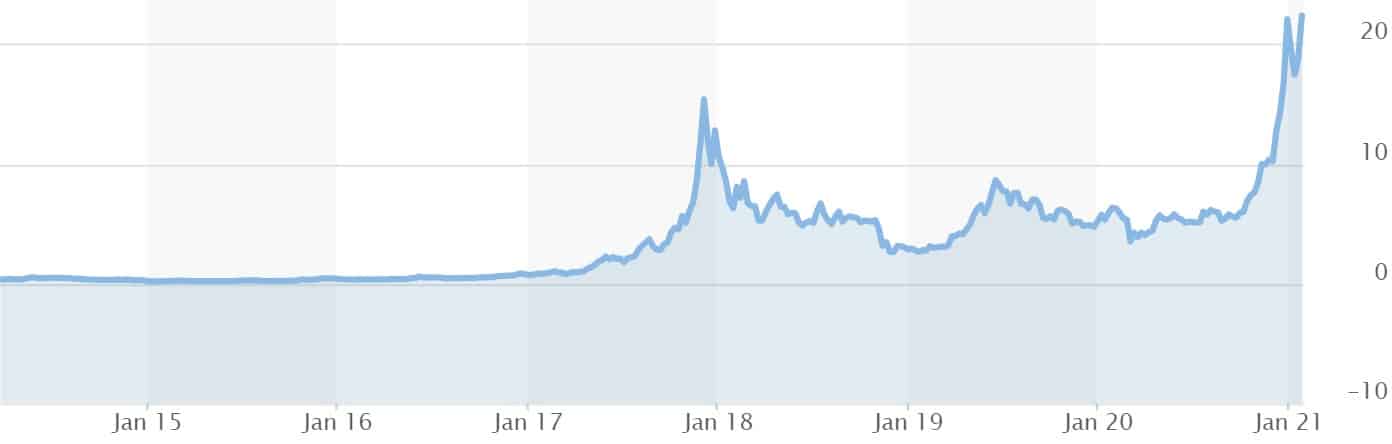

Interestingly, their conclusion is based on bitcoin’s declining volatility against gold, which carries “potential for the Bitcoin price to accelerate its advance vs. gold,” and, more specifically, to “add another zero.”

The trading pair BTC/XAU already reached a new all-time high today of over $22, according to data from MarketWatch. If the cryptocurrency indeed proceeds with adding another zero, it would go north of $220 compared to the precious metal.