Bloomberg Report: Bitcoin At $100,000 Is Path Of Least Resistance

Bloomberg said Bitcoin is set to reach $100,000 soon and become the world’s reserve asset as its unique properties become more evident.

Bloomberg has published the September edition of its Crypto Outlook report, sharing how the company’s analysts are navigating the market and measuring adoption rates as well as demand and supply dynamics. According to the report, Bitcoin is set to reach the $100,000 mark soon, a “path of least resistance,” as well as establish itself as the global reserve asset.

Making a parallel to the dollar status as the global reserve currency, Bloomberg has asserted how Bitcoin can reap the benefits of an ever-more digital society, one hungry for a liquid, always-available asset suitable to become the world’s reserve currency.

“The dollar’s more than 300% advance vs. peers since President Richard Nixon ended the gold peg in 1971 is evidence the greenback is the least-worst currency, but we believe Bitcoin represents the digital future,” the report said.

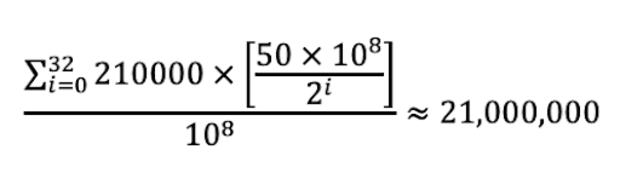

Bitcoin has intrinsic advantages over the dollar, which are long-known to Bitcoiners, including that it is government-agnostic, has a predictable monetary policy and a fixed supply, much better salability across scales, space, and time, as well as verifiable transaction finality. But such advantages have now apparently become evident to Bloomberg as well.

Bitcoin “may have solved the age-old problem of a global reserve asset that’s easily transportable and transactionable, has 24/7 price discovery, is relatively scarce and is nobody’s liability or project,” the report said.

As central banks worldwide choose not to cease quantitative easing and not shrink their balance sheets or decrease liquidity in the economy, scarce assets and stocks tend to outperform. As the risk-on mentality is nourished by the macroeconomic landscape of negative or near-zero real interest rates worldwide, liquidity usually floods into the S&P 500 and other “riskier” trades, coming from conservative investment vehicles that used to provide considerable returns but now see zero gains. But Bloomberg elicits that Bitcoin has not only outperformed, but its unique use cases could set it apart from other assets and sustain its rally of increased gains in purchasing power going forward.

“The equity market [has] basically [been] tracking quantitative easing as measured by the upward trajectory of G4 central bank balance sheets,” the report said. “Both indexes represent risk exposure, but unlike the S&P 500, the [Bloomberg Galaxy Crypto Index] includes Bitcoin, which is well on its way to becoming the digital reserve asset in a world going that way.”

As more investors worldwide begin realizing how the current macroeconomic scenario aligns perfectly with Bitcoin’s value proposition like never before, the more obvious its use cases become, and more money is set to flow into the world’s best money. Moreover, in a world rapidly shifting into a more digitized economy, Bitcoin can provide global monetary certainty and antifragility in the form of unstoppable open-source code, predictable policies, and distributed consensus, brilliantly bridging the physical and digital worlds with Proof of Work’s high-stakes, well-incentivized mining process.