Bloomberg Insists: Bitcoin Could Still Reach $100,000

February’s investment report by Bloomberg Intelligence argued in favor of cryptocurrency investments. In particular, it suggested that Bitcoin, Ethereum, and USD stablecoins will continue to do well.

At the same time, though, smaller digital assets could be in trouble due to excessive speculation, analysts at Bloomberg asserted.

“Some purging of the speculative excesses of 2021 may mark much of 2022, but Bitcoin is poised to come out ahead.”

BTC vs. Oil

In particular, crypto may be in a good place relative to inflation-related commodities. While oil rose on the risk of war in Ukraine, BItcoin and Ethereum dipped.

The report noted that the Bloomberg Galaxy Crypto Index is down about 20% in 2022. On the other hand, the Bloomberg Commodity Index Total Return is up by roughly 10%. However, the document suggested this may be a “temporary blip,” and trends are going the other way.

Supply, demand, adoption, economics, and advancing technology point to cryptocurrencies continuing to outperform commodities. Technological developments will also serve as a boon for crypto vs. oil.

Representing advancing technology, Bitcoin is gaining traction as a benchmark global digital asset, while oil is being replaced by decarbonization and electrification.

Bitcoin’s Limited Supply

Moreover, the report pointed out that Bitcoin is, by design, an asset with a limited supply. In fact, it has no supply elasticity. This means that no matter the demand, the BTC supply will remain essentially the same. That’s not the case with oil, as oil producers will increase output when prices rise.

Nevertheless, competition in the crypto space led to the creation of over 17,000 individual tokens. These tokens eat into the demand for Bitcoin, whose dominance is currently below 42%.

In contrast, in March of 2021, Bitcoin’s total share of the crypto market cap was 20% higher: 62.2%. Still, only a handful of digital assets dominate. About half of the total figure could be due to Ethereum’s rise, which went from 11% to 18.8% in the same period.

Aside from Bitcoin and Ethereum, Bloomberg expects that the market share of stablecoin will also continue to increase due to the enhanced demand for non-volatile assets.

$100K for Bitcoin?

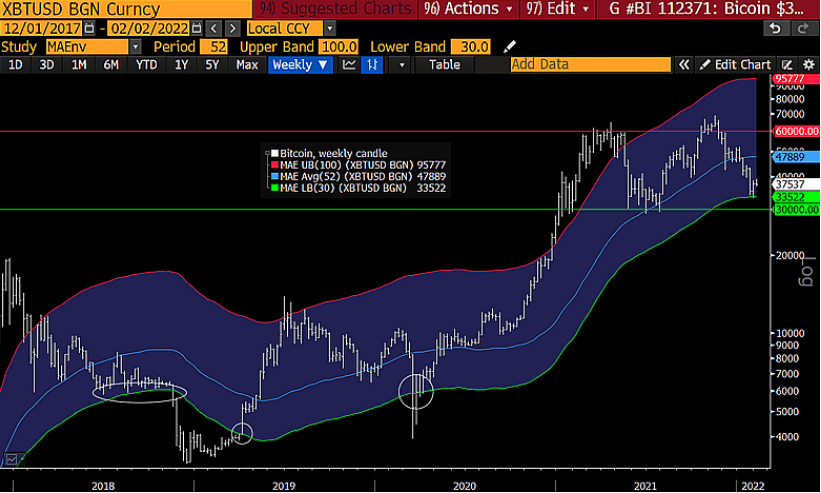

Keeping in mind all of the above, Bloomberg’s analysts outlined that the next “key bitcoin threshold may be $100,000.” It’s worth noting that they have predicted a six-digit price tag for a few years now. However, the asset is yet to reach that far.

They believe that the most recent market crash, which saw BTC dumping by more than $10,000 in days to a six-month low beneath $33,000, could be over.

“Our graphic shows this consolidation period may be ending, with the past of least resistance pointing higher.” – reads the paper.