Blood Bath: Total Market Cap Shrunk $23 Billion As BTC Lost 5% and ETH 15%

Over $20 billion of total market cap have disappeared in the past 24 hours as most cryptocurrencies are retracing heavily.

Bitcoin lost $700 following a rejection at $12,000, Ethereum drops by 8%, as of now, following a 15% daily plunge at the peak (as of writing these lines).

Polkadot becomes the top 5 cryptocurrency, enjoying Chainlink’s 10% loss.

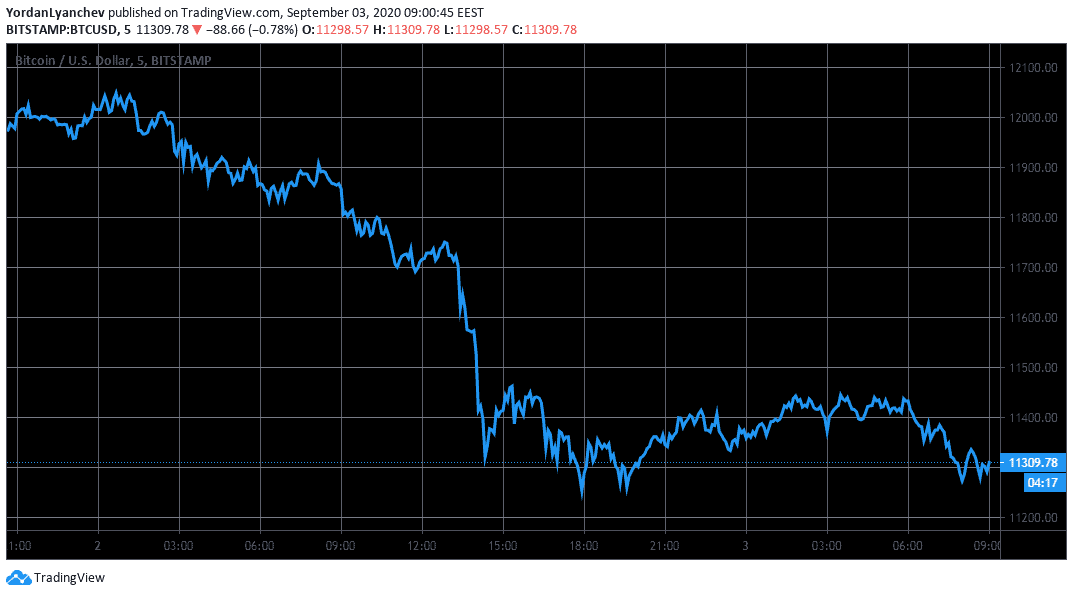

Bitcoin Dives By 5%

Less than 36 hours ago, Bitcoin attempted another overtaking maneuver to surpass the coveted $12,000 mark. However, the bears didn’t allow it to materialize, and BTC’s price faced a serious rejection, as predicted by CryptoPotato’s latest BTC analysis.

While the initial drop took the asset down to $11,800, the situation rapidly worsened and sent BTC to its daily low of $11,160 (on Binance).

The primary cryptocurrency bounced off and has recovered slightly to its current position of around $11,300. Nevertheless, this still represents a 5% price drop.

From a technical perspective, Bitcoin can rely on $11,100 and the psychological level of $11,000 as the first lines of support in case of another dip. On the other hand, if the asset manages to return to its recent uptrending, it would have to pass by the resistance levels at $11,450 and $11,600.

As it typically happens when a sharp price dip occurs in the cryptocurrency market, the community speculates on possible reasons. In this case, they connected the price actions with reports from South Korea that local authorities have raided the headquarters of the giant digital asset exchange – Bithumb.

It’s worth noting that BTC’s increased correlation with gold continues, while both assets oppose the stock markets. The precious metal also dropped in the past 24 hours from an intraday high of $1,975/oz to a low of $1,930. At the same time, Nasdaq closed amidst 1% gains, the S&P 500 with 1.5%, and the Dow Jones – 1.6% in the green.

Altcoins Bleed Out, Market Cap Losses $23 Billion

Red is the predominant color in the altcoin market as well. Ethereum, which just painted a 2-year high of nearly $490 and ETH bulls wondered how long it will take to reach $500, is down by 8.5% to $435.

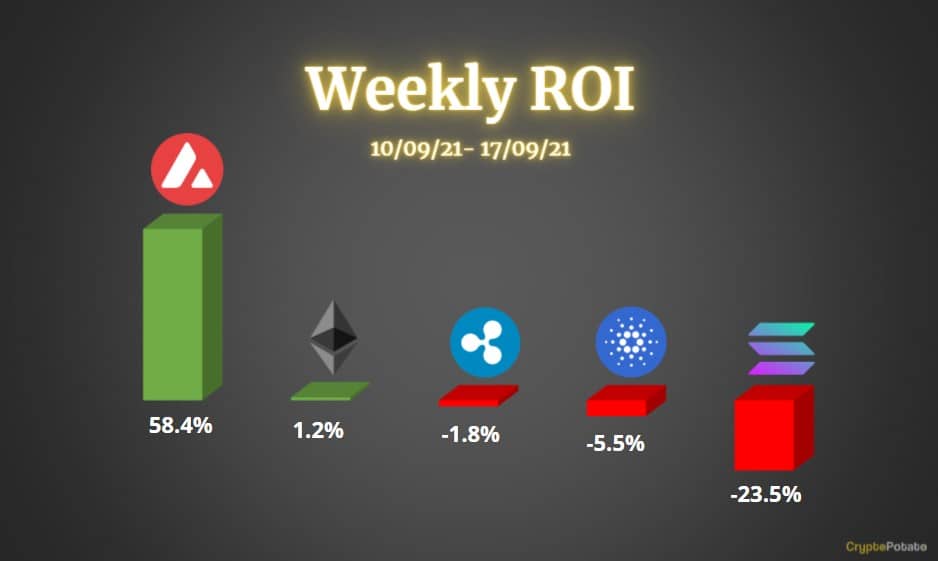

Ripple’s price drop is similar (8.6%), and Tether has taken advantage by overtaking it as the third-largest digital asset by market cap. Another rotation materialized between Polkadot and Chainlink. Despite being 4% down, DOT has replaced LINK (-10%) in the top 5.

Double-digit price drops are evident from numerous coins. Those include Ampleforth (-30%), Aragon (-20%), OMG Network (-16.5%), Swipe (-16%), Algorand (-16%), Cosmos (-14%), DFI.Money (-14%), Reserve Rights (-14%), and many more.

Nevertheless, there are a few exceptions trading in green. Kusama is up by 12%, UMA (10%) after a listing on Coinbase Pro, JUST (9.5%), Loopring (9%), and Tron continues to reap benefits from its recent Band Protocol partnership with another 3% pump.

Despite those few gainers, the total crypto market cap has plummeted by 6% from yesterday’s high of $394 billion to $371 billion at the time of this writing.

The post Blood Bath: Total Market Cap Shrunk $23 Billion As BTC Lost 5% and ETH 15% appeared first on CryptoPotato.