Blockware Solutions’ 2023 Forecast Estimates Bitcoin Low Is In

In its 2023 Market Forecast, Blockware Solutions highlighted bullish metrics, slowing ASIC advances and the global energy crisis.

Blockware Intelligence, the research arm of Blockware Solutions, has released its 2023 forecast, which indicated, among other things, that the bitcoin price bottom could be in soon.

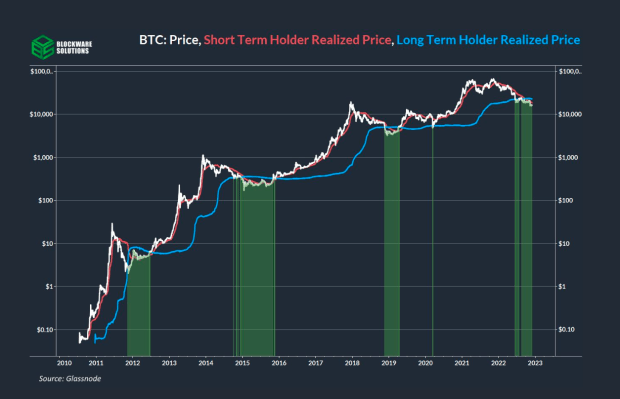

The report included a larger macroeconomic overview and forecast, alongside bitcoin’s response as well as on-chain indicators that suggest potential future movements. Short-term holder realized price (STH RP), as indicated by the report, is a more volatile, quick-to-move metric determined by the price of coins moved during a certain period, while long-term holder realized price (LTH RP) is a less volatile, more sticky metric determined by the price of coins held that have been unmoved for longer periods. When price dips below LTH RP, meaning that most long-term holders are underwater, it often coincides with previous bear market lows. The report suggests that the price of bitcoin is likely to flip both LTH RP and STH RP, which it is currently under, which could signal the low of the bear market.

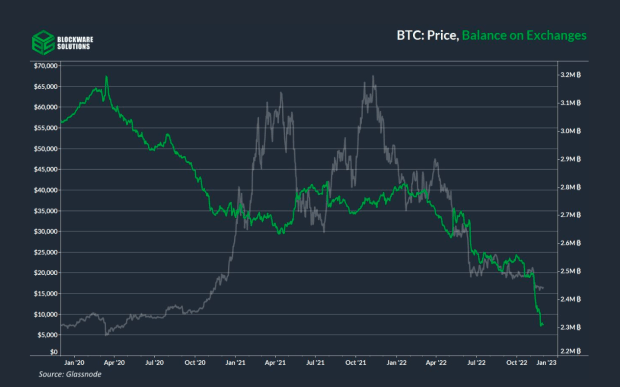

The report also noted the recent collapse of several exchanges, namely Celsius, BlockFi and FTX, which has contributed to increasing self-custody of BTC. Self-custodying of bitcoin has a tendency to increase prices as the price suppression potential created by exchanges is eliminated.

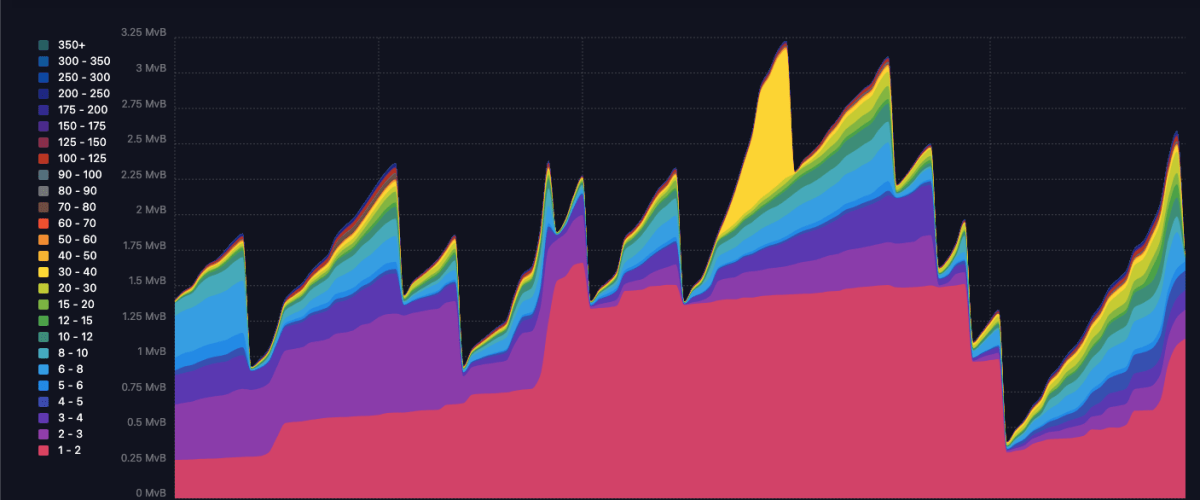

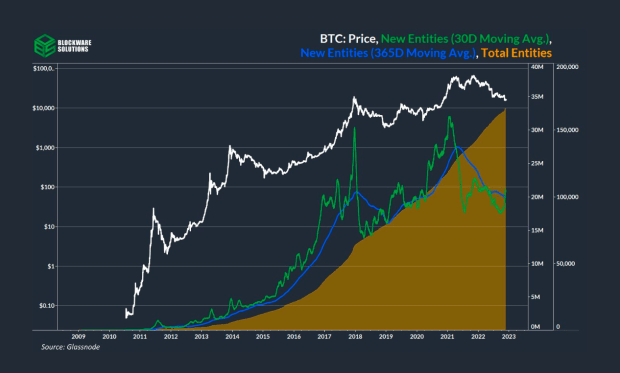

Also predicted is a major increase in the number of on-chain users of bitcoin. In the previous 2018 cycle, the number of on-chain users growing at an increasing rate indicated the start of the bull run. We now see once again that a positive momentum shift in the number of on-chain entities, suggesting increasing adoption and potential seeds for the next bull market.

In addition, it is suggested that current state of the art ASICs, namely the S19XP, could retain their value for longer than previous generations of ASICs, as manufacturers approach what is thermodynamically possible. This would have ramifications on the price of the ASIC and plans for future cash flows for miners.

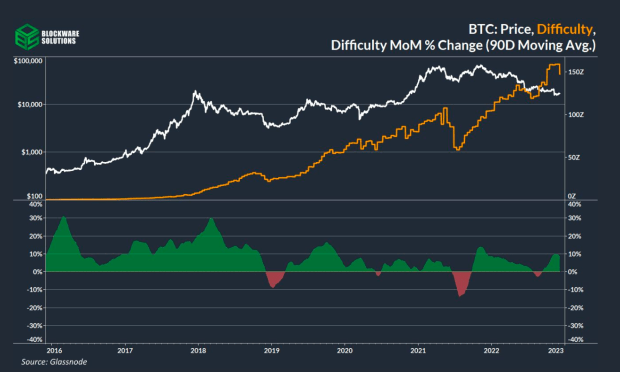

This is taken into account as well in the subsequent theory that Bitcoin hash rate growth will slow progress in 2023, noting three factors:

“1. ASIC Commoditization

2. Lack of Mining Investment in 2022

3. Global Energy Crisis (lack of available cheap energy).”

The global energy crisis is further detailed — as regulators put more pressure on oil and hydrocarbon sources of energy, further driving up the price, miners with fixed power purchasing agreements will be the ones insulated from this volatility.

The report finishes with the prediction that in 2023, the United States will be the preeminent destination for bitcoin mining due to the strength of the dollar, the stability of energy prices here and the lesser impacts of inflation within the country.