Blockware Estimates 10% Global Bitcoin Adoption By 2030: Report

Blockware’s report uses data provided by Glassnode to provide estimates on global Bitcoin adoption relating to the standard S-curve of disruptive technology.

- Blockware Solutions released a report detailing the likely adoption curve of Bitcoin.

- The report compares Bitcoin to other disruptive technologies and calculates adoption rates as it relates to the global population.

- The company estimates Bitcoin will not surpass 10% of global adoption until 2030.

Blockware Solutions, an infrastructure provider for blockchain technologies, just published Bitcoin User Adoption, a conceptual perspective towards adoption as it relates to disruptive technological adoption cycles.

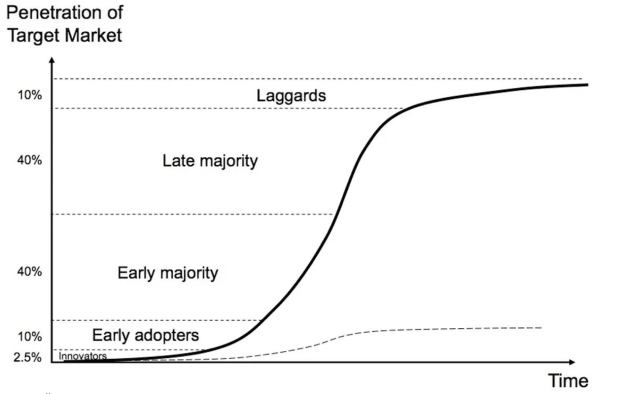

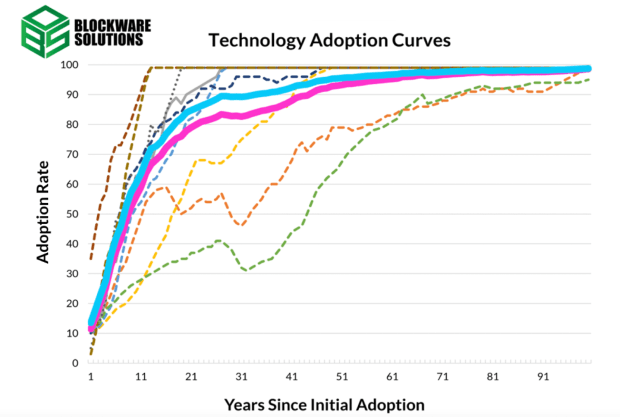

The report begins by outlining what an adoption curve is, which can be described as a sociological measurement of a particular idea’s life cycle. While technologies change, human reaction to innovation is largely predictable. This prediction is outlined in the widely-used “S-Curve,” depicted in the chart below.

Blockware

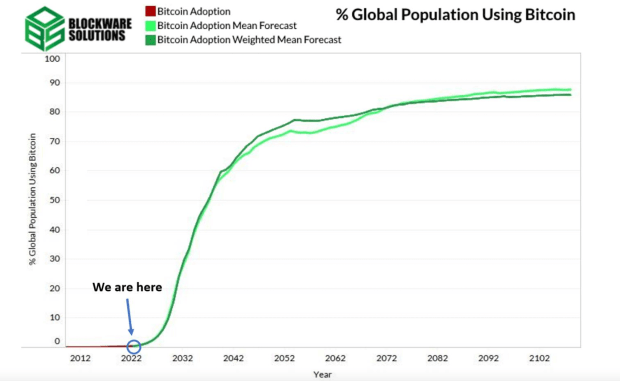

Spoiler Alert: Blockware’s report notes that we are still in the “early adopters” phase. But, how is this quantified? How can adoption be viewed as a metric?

Blockware took nine disruptive technologies and calculated the percentage of U.S. households that use them. The list includes: Automobile, Radio, Landline, Electric Power, Smartphone, Tablet, Cellular Phone, Internet and Social Media.

Then, of those metrics, the company calculates a weighted average (60%, denoting 20% to each) for: Internet, Smartphones, and Social Media. The results are staggering.

Blockware

The report goes on to explain adoption of Bitcoin will likely outpace other technologies for two main reasons. Bitcoin provides a monetary incentive to adopt as the price rises, and the internet allows an exponential increase to the speed in which information is spread.

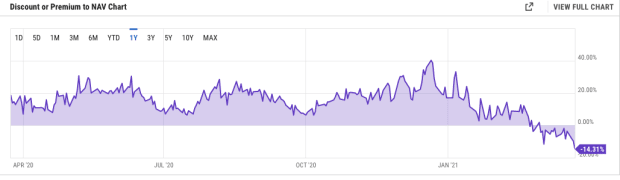

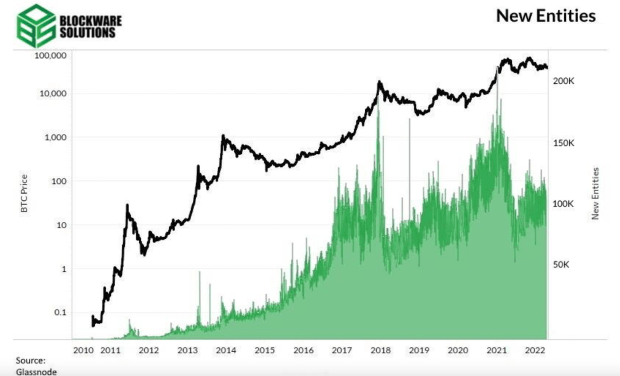

Blockware initially quantifies the growth through bull markets through the eyes of new users, defined as “New Entities,” on Glassnode, a blockchain heuristics company sourcing data provided in the report.

Blockware

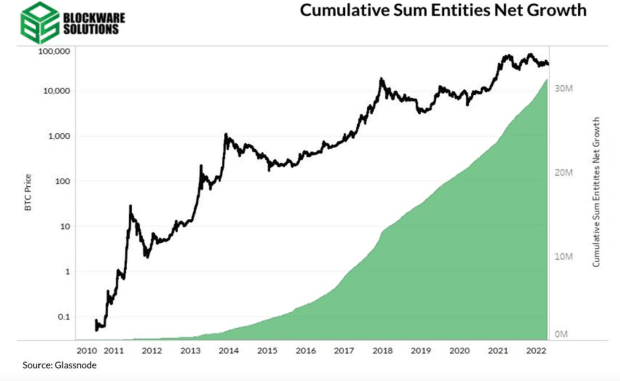

These new users set the tone for a new bull run on the market as convicted holders remain. However, the flaw of this metric is it does not track users who left the network. This is where “Net Entities Growth,” comes in to explain the difference between new users and “disappeared,” users. But even by this calculation, the trend remains largely unchanged.

Blockware

When the 30.8 million users are divided by the global population, we are left with 0.36% global adoption. This estimate would still have us in the innovators section of the S-curve. However, it is important to note that this is on-chain data only.

“Using the Cumulative Sum of Net Entities Growth and its [10-year compounded annual growth rate] CAGR of 60% we forecast that global Bitcoin adoption will break past 10% in the year 2030,” Blockware stated in the report.

Blockware

We are still so early.