Blockstream Launches ‘BASIC Note’ To Capitalize On Anticipated ASIC Market Recovery

Blockstream, a top-tier Bitcoin infrastructure firm, has joined forces with STOKR, a trailblazing digital platform for alternative assets based in Luxembourg. Their collaboration has birthed a new investment offering: The Blockstream ASIC (BASIC) Note.

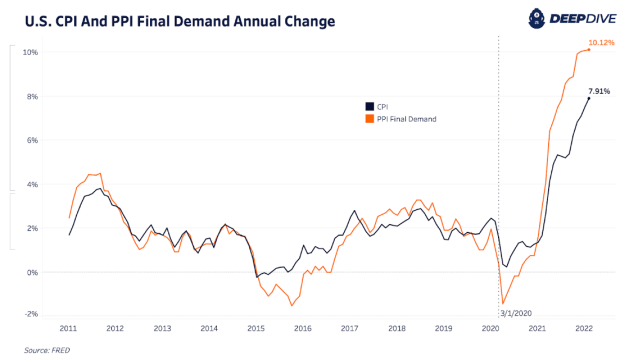

During the latest bitcoin bull market, prices for bitcoin mining machines, otherwise known as ASICs, witnessed a significant surge. This was followed by a major crash, bottoming in December 2022. The value of ASICs tend to have a pattern: They seem to be undervalued during bear markets, while enjoying outperformance during bull runs. This pattern points to a potential profit shift when measured in bitcoin terms.

This new BASIC investment vehicle is seeking to raise $5 million through the sale of its Series 1 BASIC Notes, priced at $115,000 each. The aim? To acquire ASICs in bulk now, store them and then strategically sell them as the market rebounds, especially keeping the upcoming Bitcoin halving event in April-May 2024 in mind.

Considering the resounding success of the Blockstream Mining Note (BMN), which attracted $50 million from global investors through eight rounds between 2021 and 2022, the BASIC Note’s introduction has already garnered considerable market attention. This investment tool is designed to focus on a bitcoin-centric return strategy and fees are only charged when the product outperforms bitcoin.

Interestingly, the investment product will be pitched as an EU-compliant digital security on the Liquid Network.

The rationale behind the BASIC structure includes:

- Market Forecasting: There’s a predicted surge in the bitcoin price, potentially from late 2023 to 2024. This is expected to couple with an increase in ASIC prices.

- Supply/Demand Dynamics: With the imminent Bitcoin “halving” event on the horizon, miners are likely to update their machinery, pushing demand for modern, energy-efficient devices.

- Liquidity and Access: As capital gradually becomes more available, miners will likely have better access to resources in order to procure ASICs.

Blockstream CEO and Co-founder Dr. Adam Back remarked, “Since our founding in 2014, Blockstream has continuously been a leader in Bitcoin mining, from providing world-class mining infrastructure to delivering innovative investment vehicles like the Blockstream Mining Note. The BASIC Note arrives at an opportune time in the market, presenting a unique and carefully timed investment opportunity for any bitcoin-focused portfolio.”

Arnab Naskar, STOKR’s Co-founder, envisions digital securities transforming capital markets and believes that products like the BASIC Note will play a significant role in bridging traditional finance with Bitcoin.

It’s worth noting that the BASIC Note won’t be accessible in every jurisdiction. Each Series will feature its own distinct set of BASIC Notes, issued via the Liquid Network.