Blockstream Breaks into Japanese Market with JPY Stablecoin, Partnership

Blockstream is partnering with Japanese fintech giant Digital Garage to bring a JPY stablecoin to the Bitcoin network.

To spearhead the project, Blockstream and the ¥120 billion (just over $1 billion) firm are working under the label Crypto Garage with the help of Tokyo Tanshi, the “largest inter-dealer broker in Japan w/ billions in trades daily,” according to Samson Mow, Blockstream’s chief strategy officer.

The collaborative is building the yen-pegged coin (JPY-TOKEN) on Blockstream’s Liquid network, a Bitcoin sidechain that tacks additional technical features onto the blockchain, like smart contracts.

It’s also the inaugural asset for SETTLENET, a new Liquid product suite that Blockstream claims will “enhance trading efficiency and security for participants in the Bitcoin market.”

“SETTLENET will definitely make it easier for Liquid Issued Assets to be created. Currently savvy users can already create assets with command line tools, but having GUI’s and frameworks for asset issuance will speed up adoption,” Mow wrote to Bitcoin Magazine via email.

Leveraging SETTLENET, Crypto Garage’s JPY-TOKEN can be atomic swapped for L-BTC, a Liquid asset token that maintains a 1-1 peg to bitcoin on the Bitcoin mainnet. Like its dollar, pound and euro counterparts, JPY-TOKEN will go 1-for-1 with the yen.

By the Book

The partnership has Blockstream embedded with two of Japan’s fintech heavyweights, so Blockstream is operating within the bounds of Japan’s financial regulations.

Both Blockstream’s blog post and Samson Mow’s tweet on the announcement stressed that the Japanese Financial Services Agency has approved the product.

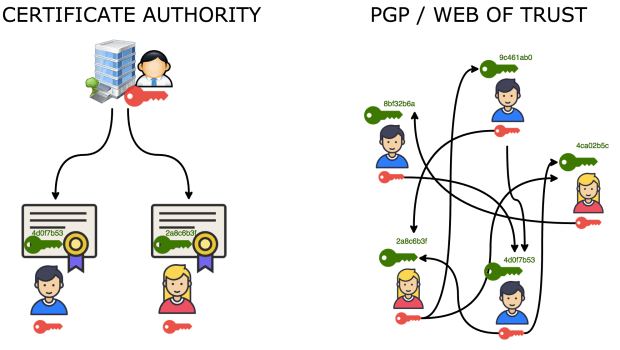

To assist the exchanges that will be issuing and redeeming the asset, the product suite will come with an authorizer, a “rule-based transaction authorization” tool that will let users process payments under pre-set conditions.

“[The Authorizer] will help ensure regulatory compliance for certain transactions that may need to stay within a certain group of users. For example, a security token offering may only able to be transacted amongst accredited investors,” Mow added in our correspondence.

To start, the JPY-TOKEN liquidity partners, the trusted parties who facilitate the swaps between Liquid and Bitcoin’s networks, “will be limited to FSA licensed crypto exchanges in Japan,” Mow indicated.

“It’s not yet clear what the exact distribution model will be for the JPY stablecoin,” he added.

“A Natural Extension”

Mow stated that the partnership had been some time in the making.

One of Blockstream’s board members, Reid Hoffman, connected the company with Joi Ito, the director of the MIT Media Lab and one of Digital Garage’s co-founders. The blue chip would become a lead investor in Blockstream’s $55 million Series A funding round, after which time Samson wrote that they “started to explore a technology partnership to focus on blockchain initiatives in Japan.”

That exploration would begin to materialize in 2017 as Digital Garage Labs, Digital Garage’s research and development arm, which Tokyo Tanshi, a Japanese brokerage services company, would join in the same year.

Samson calls Crypto Garage “a natural extension of [these] relationships,” the culmination of each company’s professional relationships after Blockstream fully committed to the project.

Before Crypto Garage, Blockstream had helped Digital Garage use Blockstream’s enterprise-facing blockchain platform, Elements, “to develop real-time exchange systems for loyalty points and digital currencies, as well as regional money systems,” Mow told Bitcoin Magazine.

Under this new partnership, Blockstream will take in another $10 million in funding from Digital Garage, which it will use to focus on Liquid, its cryptocurrency data feed and “new product lines.”

SETTLENET Sets Expectations for Future of Liquid

While the JPY-TOKEN will position Blockstream in the Japanese market, SETTLENET isn’t confined to its first asset.

“SETTLENET will provide Liquid Network participants, including cryptocurrency exchanges, OTCs and financial institutions, with the functions required for issuance, trading and transaction monitoring of digital assets,” the suite’s website states.

As Mow indicated, it’s made to make the process of issuing Liquid assets easier. In the future, he’s hopeful that it will be used to support more sidechain assets that can interoperate with Bitcoin’s network.

Mow believes that the JPY-TOKEN could be the first of many stablecoins native to Blockstream’s Liquid, telling Bitcoin Magazine that interest from stablecoin creators could mean more to come soon.

“We’ve been in talks with many of the stablecoin issuers and I think there’s a lot of interest to leverage something robust and secure like Liquid — there’s also the added bonus of confidentiality for stablecoin transactions within Liquid thanks to the Confidential Assets feature, and multisig issuance so multiple parties have to sign off on any new issuances. You can expect more stablecoins on Liquid soon!”

This article originally appeared on Bitcoin Magazine.