Block’s Q1 Bitcoin Revenue Rises 18% From Q4, Gains 25% From a Year Ago

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/86c43cde-6640-4a7c-98af-5e25273f0e17.png)

Stephen Alpher is CoinDesk’s co-regional news chief, Americas. He holds BTC above CoinDesk’s disclosure threshold of $1,000.

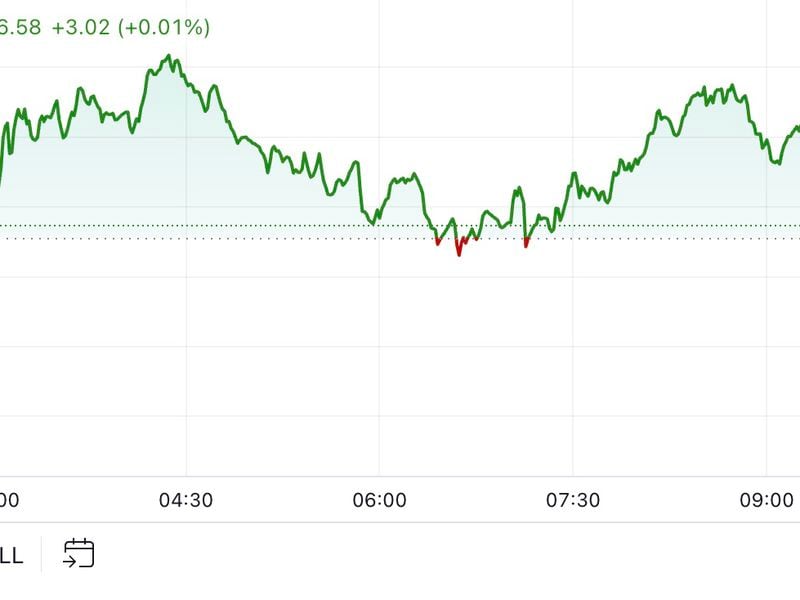

Fintech firm Block (SQ) reported $2.16 billion in bitcoin revenue in its Cash App unit during the first quarter, up 18% from $1.83 billion in Q4 and up 25% from Q1 2022, the company said in its shareholder letter on Thursday. Block reports the total sale amount of bitcoin to customers as revenue.

Cash App generated $50 million in bitcoin gross profit in the first quarter, up 43% from Q4 and ahead 16% year over year. The company as a whole reported $770 million in gross profit in Q1, up 16% year over year.

Thanks to a rise in the price of bitcoin, the company did not book an impairment loss on its bitcoin holdings in the first quarter. Block reported an impairment charge of $9 million in Q4 on its bitcoin investment and an impairment of $47 million for the full year in 2022.

As of March 31, the fair value of Block’s bitcoin holdings was $229 million versus the carrying value of $126 million recognized on the balance sheet. Block’s original purchase price on its bitcoin holdings was $220 million.

Overall, the company reported Q1 revenue of $5 billion, topping estimates by $390 million; non-GAAP earnings per share of 40 cents beat expectations by 6 cents.

Shares are higher by 2.4% in after-hour trading.

Edited by Stephen Alpher.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/86c43cde-6640-4a7c-98af-5e25273f0e17.png)

Stephen Alpher is CoinDesk’s co-regional news chief, Americas. He holds BTC above CoinDesk’s disclosure threshold of $1,000.

Learn more about Consensus 2024, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/s3.amazonaws.com/arc-authors/coindesk/86c43cde-6640-4a7c-98af-5e25273f0e17.png)

Stephen Alpher is CoinDesk’s co-regional news chief, Americas. He holds BTC above CoinDesk’s disclosure threshold of $1,000.