BlockFi Raises Deposit Rates as Bitcoin Crash Juices Loan Demand

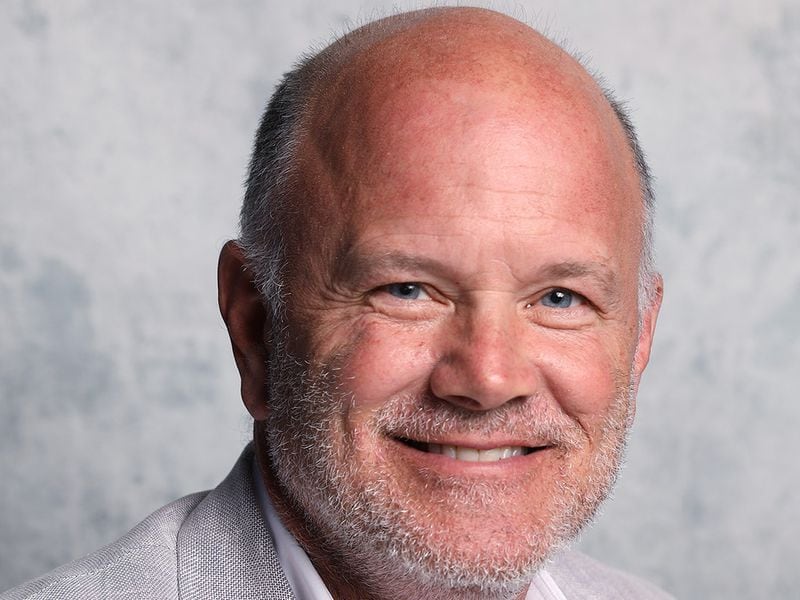

BlockFi CEO Zac Prince image via CoinDesk archives

An increase in borrower demand is driving crypto lender BlockFi to raise interest rates for bitcoin (BTC) and ether (ETH) deposits on April 1, said CEO Zac Prince.

The second-largest price drop in bitcoin’s history last Thursday created a gulf between prices on the bitcoin futures and spot markets. In the following days, BlockFi saw a 10x increase on the trading side of the house, and a surge in loan demand from its two largest client pools: market makers and proprietary trading firms.

Institutional borrowing across all assets made up for a decrease in retail U.S. dollar borrowing, and BlockFi saw a record number of transactions as traders took advantage of arbitrage opportunities.

In the past, the crypto lender has had to cut rates because borrower supply had not met depositor demand. Since Thursday, BlockFi has seen a slowdown in net deposit growth to roughly 0 percent but not an outright decrease.

Next month, Tier 1 BTC holders (those who keep up to 5 BTC on BlockFi) will earn 6 percent annual percentage yield (APY) and Tier 1 ETH holders (up to 500 ETH) will earn 4.5 percent APY. Currently, Tier 1 BTC holders and Tier 1 ETH holders earn 4.9 percent and 3.6 percent APY, respectively.

Rates for the GUSD and USDC stablecoins will stay the same at 8.6 percent APY.

The higher rates on deposits stem from the firm’s ability to increase interest rates on crypto lending, Prince said. A week ago, BlockFi had interest rates on loans in the mid-single digits. The firm is now charging rates in the ballpark of 10 percent, Prince added. By contrast, crypto lender Celsius has raised interest rates on ETH loans to an astounding 260 percent from the 15 to 20 percent under normal circumstances.

While not revealing the number or volume of margin calls BlockFi made during the crash, Prince said that the firm had to request less additional collateral than rival firms Genesis and Celsius. Last Friday, CoinDesk reported that Genesis alone had called in $100 million in additional crypto from about 40 clients.

“It could be due to the construction of the [loan] book,” Prince said. “For example, we have no loans with bitcoin miners at BlockFi. … HUD8 was a public mining operation company that was talking about their margin call with Genesis.”

Prince also said no changes would be made to BlockFi’s underwriting standards.

BlockFi did see less than 10 percent of liquidations in its dollar-denominated loan book. These liquidations happened prior to bitcoin’s dip below $4,500, Prince said, and were a result of the firm’s risk management system which manages margin calls, liquidations and monitoring of liquidity on the market. The BlockFi team, which is currently working remotely, monitors and controls the system on a day-to-day basis.

“It is a tough time from the sentiment perspective,” Prince said. “Take crypto out of the picture, the fear level and things people are going to go through over the next few days, weeks and months is very challenging.”

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.