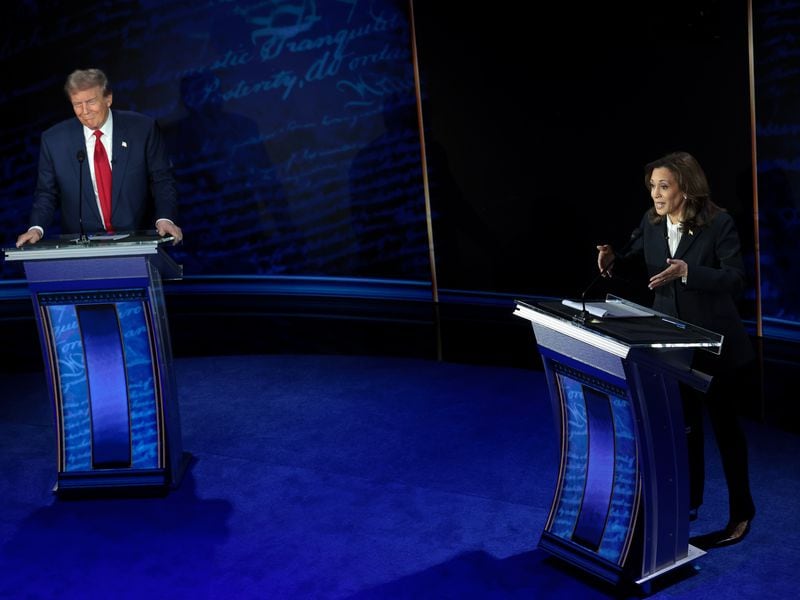

BlockFi Bet Big on FTX and Alameda Even After Seeing Infamous Balance Sheet, Creditors Say

Cryptocurrency lender BlockFi misled investors, cut corners and bet big on FTX even after seeing a secret balance sheet that revealed fundamental flaws in Sam Bankman-Fried’s empire, BlockFi creditors said.

The company’s Committee of Unsecured Creditors, representing customers owed money after its November bankruptcy, are arguing the company should be liquidated right away without further costly legal delays, and without freeing executives from future litigation risks.

The report, made in a court filing unsealed Friday, alleges that mismanagement at the company, and in particular its overexposure to failed crypto exchange FTX, exposed the company and its creditors to “losses of a staggering quantum,” which were not just foreseeable, but actually foreseen.

In a Nov. 2 article, CoinDesk revealed that much of the balance sheet of FTX’s hedge fund arm Alameda Research was made up of its own FTT token. That revelation was so fatal to confidence in the exchange that FTX filed for Chapter 11 bankruptcy just nine days later (the coverage also, incidentally, won CoinDesk two awards for journalism).

Yet seeing FTX’s toxic internal arrangements failed to deter BlockFi, which collapsed a few weeks after FTX, BlockFi creditors claim.

“BlockFi had the exact same balance sheet published by CoinDesk ….before it placed any of the cryptocurrency placed on the FTX/Alameda platform in the second half of 2022,” the Friday filing by creditors said, adding that BlockFi’s investment – including nearly $900 million re-lent to Alameda between July and September 2022 – is “money that now may be irretrievable.”

BlockFi “failed to complete basic due diligence” on Bankman-Fried’s empire, offering “special treatment for FTT and Alameda… that cast risk management principles entirely to the wind,” added the report, based on a review of 30,000 internal documents, and interviews and depositions with key individuals including founder and chief executive Zac Prince.

Warnings from BlockFi’s own internal risk committee went unheeded or were overruled by Prince, who, instead of increasing collateral requirements, said the company should “offer terms that we think the client [Alameda] could say yes to,” the filing said.

Blockfi had also misled investors about its risk management strategies, asset concentration and the honoring of customer withdrawals, the filing added.

Creditors have previously argued they should be allowed to file their own plans to wind up the company, accusing BlockFi management of “extortion” by delaying proceedings to ensure they can negotiate a legal release from personal liability.

In an emailed statement, BlockFi told CoinDesk it “disagrees with the Committee’s report,” and cited its own July 10 filing, which said that none of BlockFi management had misused client funds for their own purposes, or directed transactions without reasonable understanding of the risk.

“The Special Committee has not uncovered any evidence that the Released Parties knew, should have known, or reasonably could have known, about FTX’s and Alameda’s true nature” and any legal claims “do not justify prosecution from a cost/benefit perspective,” the July 10 filing on behalf of the company said.

Edited by Marc Hochstein.