Blockchain Bites: Filecoin’s Mainnet, M&A’s Upswing, Tarbert’s Environmental Concerns

Blockchain Bites: Filecoin’s Mainnet, M&A’s Upswing, Tarbert’s Environmental Concerns

Crypto M&A is up, CoinList set a record mint of wrapped bitcoin and the CFTC Chairman is “impressed” with Ethereum. Not to mention, Filecoin has pivoted to mainnet.

Top shelf

Filecoin flies

The Filecoin network mainneted at 14:44 UTC, beginning its FIL token distribution. Filecoin is a system from Protocol Labs meant to be both a decentralized file storage and content distribution network in one. The new token is very likely to make history as the fastest newly live blockchain to reach a market capitalization of over a billion dollars, though we can’t really know until the FIL tokens enter trading. Despite multiple delays, the Filecoin project has attracted considerable attention, particularly in China, where investors have been speculating heavily on the network’s mining hardware and the FIL token.

M&A Up&Up

The value of crypto M&As in the first half of 2020 has already surpassed that of full-year 2019, according to a PricewaterhouseCoopers report. Around $597 million was spent in 60 deals in the first half of 2020, compared to $481 million spent in all of 2019 for 125 deals. This year is on track to rival 2018’s $1.9 billion total spent on acquisitions in the crypto space. The acquisitions for the first half of this year were driven by an increase in transactions involving crypto exchanges and trading infrastructure, and native crypto companies continue to be the most active purchasers in the space.

Brainiacs

A relic from Bitcoin’s early days, a “brainwallet” refers to a private key that is stored in the user’s memory either in the form of a seed phrase or a password, essentially giving you a portable “bank account” locked inside your head. Once you have the private key memorized, the rationale goes, you can access your bitcoin wallet from anywhere in the world, as long as you have internet access. Since brainwallets rely on the user remembering a passphrase, there is always the risk that you’ll forget it or, in the case of a user-generated phrase, that it will be easily guessed.

Broker deal

Security token firm Securitize is trying to become a broker-dealer (meaning it’s able to buy and sell securities) and alternative trading system for digital assets, the company announced Thursday. The firm signed an agreement to purchase Distributed Technology Markets (DTM), a broker-dealer and alternative trading system registered with the U.S. Securities and Exchange Commission (SEC) and the U.S. Financial Industry Regulatory Authority (FINRA). As part of the acquisition, Securitize will also acquire Velocity Platform, a money services business with licenses in several states. The deal is pending regulatory approval and the terms of the deal were not disclosed.

Wrapped bitcoin

Token investment platform CoinList minted a total of $57.1 million worth of wrapped bitcoin (4,997 WBTC) in back-to-back mints for its customers Wednesday, setting an all-time record for the most bitcoins wrapped by one merchant in a single day. The previous daily record was set on Sept. 18 when Alameda Research minted $44.7 million (4,093 WBTC) in three separate mints, according to transaction data analyzed by CoinDesk. CoinList is responsible for over 30% of all WBTC ever minted. As of Wednesday there were 105,132 WBTC in circulation, according to the project’s website, representing more than 17,000% growth year to date.

Quick bites

At stake

Going green?

Speaking Wednesday during invest: ethereum economy, Heath Tarbert, chairman of the U.S. Commodity Futures Trading Commission, made comments suggestive of the agency’s support of green tech.

While “impressed” by Ethereum’s financial and technological capabilities, Tarbert said the network boasts environmental benefits (at least in comparison with Bitcoin).

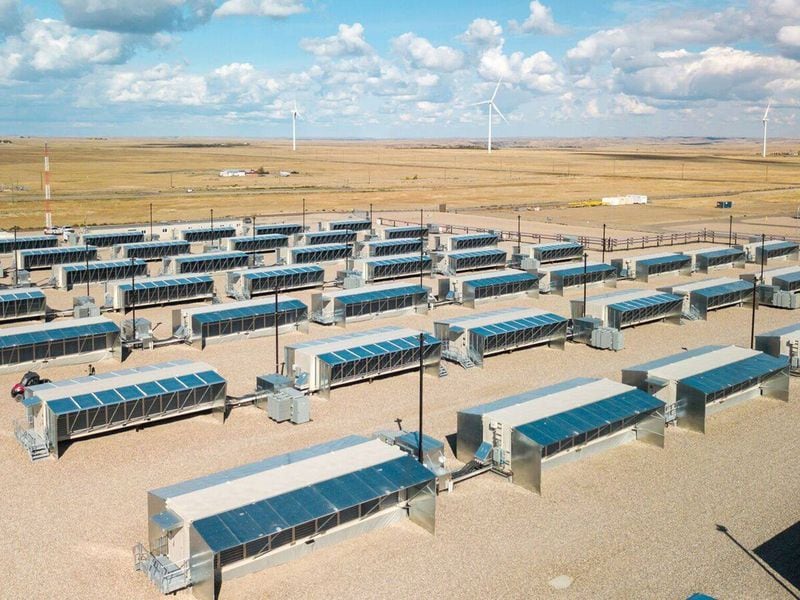

“There are issues with mining, of course, so number one [is] environmental issues,” he said in a conversation with Chief Content Officer Michael Casey. “And so I think we were generally supportive as a larger matter in reducing … the environmental footprint, and moving to proof-of-stake [PoS] clearly does that.”

This line of thought is a continuation of a greener financial system the CFTC is looking to foster, as noted in a brief dated Sept. 9. The CFTC’s report details the growing threat of climate change and the steps needed to manage these risks. It also introduces the Climate-Related Market Risk subcommittee.

“Climate change poses a major risk to the stability of the U.S. financial system and to its ability to sustain the American economy [and] may also exacerbate financial system vulnerability that have little to do with climate change; including vulnerabilities caused by a pandemic that has stressed balance sheets, strained government budgets, and depleted household wealth,” the press release reads.

While the agency does not explicitly cite cryptocurrency or blockchain technology or any specific financial technologies, the agency is pledged to “accelerate the net-zero transition.”

“Policymakers, regulators and stakeholders can begin the process of taking thoughtful and intentional steps toward building a climate-resilient financial system that prepares our country for the decades to come,” CFTC Commissioner Rostin Behnam said in the press release.

Ethereum, the second-largest blockchain by market capitalization, is in the process of shifting to a new PoS consensus model. Nominatively, the shift is designed to help improve the network’s throughput.

Though other speakers throughout the virtual invest conference also noted PoS’ lowered energy consumption. This includes Ethereum founder Vitalik Buterin, who mentioned several times the lower energy requirements of PoS.

That said, Buterin did not indicate when Ethereum will be ready to make the shift. Phase 0, involving an independent beacon chain as a proving ground, will happen “very soon,” he said.

“At some point we’ve got to move in terms of scale and efficiency to deal with environmental issues but also to deal with the cost issue,” Tarbert said. “I see proof-of-stake as being potentially helpful.”

Who won #CryptoTwitter?