Blockchain Bites: Ethereum Classic Attacked, Electrum Wallet Drained and Taxable Microtasks

Blockchain Bites: Ethereum Classic Attacked, Electrum Wallet Drained and Taxable Microtasks

Signature Bank gave out dozens more small business PPP loans to crypto firms than previously known, Ethereum Classic has suffered another 51% attack and a digital yuan wallet went live and disappeared this weekend.

You’re reading Blockchain Bites, the daily roundup of the most pivotal stories in blockchain and crypto news, and why they’re significant. You can subscribe to this and all of CoinDesk’s newsletters here.

Top shelf

Third attack

The Ethereum Classic blockchain suffered its third, and worst, 51% attack in a month Saturday evening. Spotted by mining company Bitfly, the attack reorganized over 7,000 blocks, or two days’ worth of mining, compared to 3,693 and 4,000 blocks in the first two attacks, CoinDesk Zack Voell reports. ETC Cooperative, a foundation supporting the network’s development, said it was “aware” of the attack and “working with others to test and evaluate proposed solutions as quickly as possible.” FTX will reconsider its ETC perpetual futures contracts, CEO Sam Bankman-Fried told CoinDesk, following actions earlier this month by OKex and Coinbase to consider delisting ETC and extending confirmation times for the cryptocurrency, respectively. ETC Labs, recently announced it would implement additional security features.

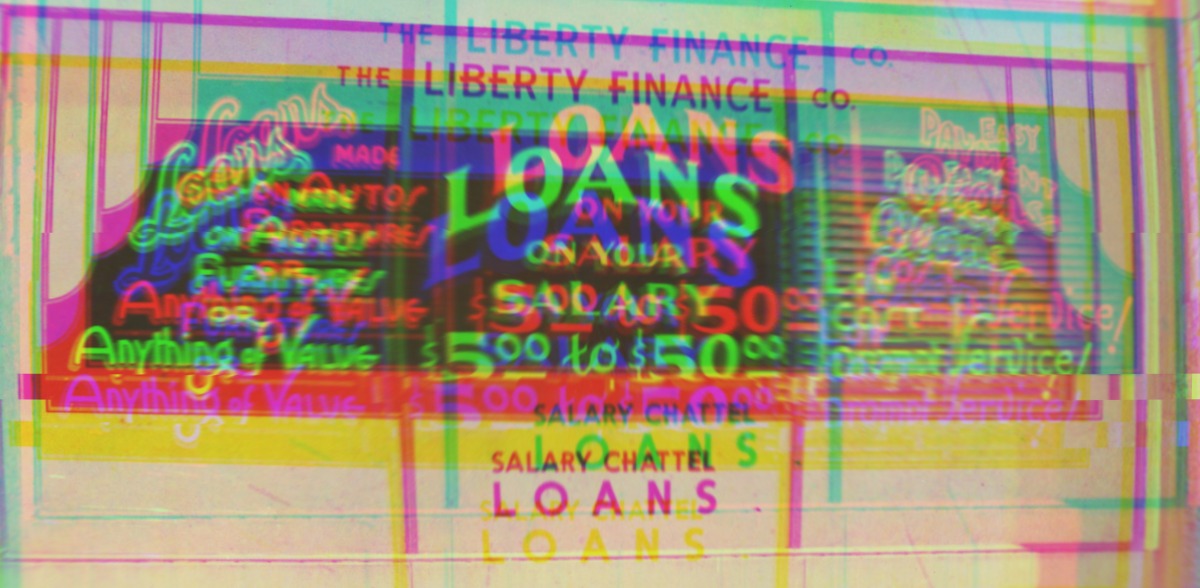

Crypto loans

Signature Bank extended about $20 million to roughly 40 firms in the digital asset space under the federal Paycheck Protection Program (PPP), dozens more than was previously reported. CEO Joseph DePaolo would not name nor confirm the number of firms receiving PPP loans, though he said the bank’s crypto PPP loan volume was due to other banks serving crypto not having the resources to offer the same kind of program. Previously, CoinDesk reported that at least $30 million had been extended to crypto companies by several banks including JPMorgan Chase, Silicon Valley Bank, Cross River Bank and others. Signature loaned a total $1.9 billion, roughly .55% of the entire $350 billion that was disbursed, through the emergency relief program.

Backdoor hack

An Electrum wallet user claims to have lost 1,400 bitcoin (~$16.2 million) after installing an older version of the software from a malicious source, CoinDesk’s Sebastian Sinclair reports. In a Sunday Github post, pseudonymous user “1400BitcoinStolen” said they downloaded a version of the wallet and installed a security update pop-up that triggered a transfer of the user’s entire BTC balance to an address in the possession of a hacker. Electrum allows anyone to “run their own servers or use servers that they trust,” according to another Github user seemingly associated with Electrum. If users download a version from a different source than Electrum and don’t check signatures, they may “install a backdoor.”

Yuan wallet?

A public version of a digital yuan wallet quickly went live and was disabled this weekend, CoinDesk’s Wolfie Zhou reports. Around noon on Saturday local time, users of China Construction Bank (CCB), one of the big-four state-owned commercial banks, had access to a DCEP (digital currency, electronic payment) wallet feature via the bank’s mobile app. The wallet was registered with a phone number associated with their bank accounts and could be linked with their bank funds. It is unclear when CCB opened up the service, but news of the feature quickly spread Saturday among the Chinese cryptocurrency community and media, before being disabled. In app searches for “digital currency” now display: “This function is not yet officially available to the public. Please wait patiently.”

Micro taxes?

Crypto microtransactions worth less than $1 are taxable events, according to a U.S. Internal Revenue Service (IRS) memo. Responding to a request for clarification from the tax agent’s own Small Business/Self Employed Division, the IRS senior technician Ronald Goldstein said cryptocurrency “acts as a substitute for real currency” and considered property for federal income tax purposes. One might imagine it’s like reporting cash tips. Examples of microtransactions include crypto rewards earned from downloading an app and leaving a positive review; downloading games and reaching particular milestones; completing online quizzes; or registering accounts with various online services.

Quick bites

- DeFi Is a ‘Complete Scam,’ Says Controversial Entrepreneur Craig Wright (Sebastian Sinclair/CoinDesk)

- Rep. Davidson: DeFi ‘gets at the heart’ of debate on financial regulation (Michael McSweeney/The Block)

- Maria Bustillos on Tokenizing Journalism, the Death of Civil and Rise of Brick House (Daniel Kuhn/CoinDesk)

- Money Reimagined: From COVID Generation to Crypto Generation (Michael Casey/CoinDesk)

- Chainlink Acquires Blockchain Oracle Solution From Cornell University (Will Foxley/CoinDesk)

At stake

Warring exchanges

OKEx and Huobi are caught in a battle for supremacy in the crypto derivatives market, as well as a Chinese market said not to exist, CoinDesk’s Muyao Shen reports.

The battle began in 2018, when then-OKEx CEO Chris Lee defected to Huobi to become vice president of global business development.

“There’s a natural friction between OKEx and Huobi,” Matthew Graham, chief executive officer of Beijing-based crypto consultancy Sino Global Capital, said. “While they have both pushed to enlarge their international footprints, they still prioritize their Chinese user base.”

A regional turf war takes place in the context of crypto’s illegality. Officially, Huobi doesn’t acknowledge the Chinese cryptocurrency market exists: “There is not a market in China. That is not legal,” a representative said, though Huobi appears to be getting nearly a third of its website traffic from Chinese visitors, versus 14% for OKEx, according to a website tracker.

However, other competitive fields are easier to quantify. OKEx is the world’s biggest crypto derivatives exchange, with outstanding contracts valued at $1.26 billion. Huobi trails with $1.25 billion in outstanding contracts.

The close competition has led to novel derivative products from both exchanges – though some see the real prize as winning a favored position with the Chinese government.

Last year, President Xi announced China would “seize the opportunity” of blockchain, spurring increased testing of a digital yuan, the establishment of an open blockchain-based services network and other digital infrastructure development.

On that count, Huobi might be one move ahead of OKEx: The Chinese branch of Huobi has joined the Blockchain-Based Service Network (BSN) Development Alliance, which aims to be one of the most influential infrastructure services providers in the country.

Market intel

August’s end

Bitcoin is eyeing an August gain for the first time in three years, but is lagging behind U.S. stocks for the month. The cryptocurrency is trading near $11,610 at press time, representing a 2.27% gain on a month-to-date basis, according to CoinDesk’s Bitcoin Price Index, while the S&P 500 is on track for a 7.25% gain this August. Bitcoin faced rejection at highs above 12,400 on Aug. 17 and has been restricted largely to a range of $11,100 to $11,800 ever since, CoinDesk’s markets reporter Omkar Godbole said.

Tech pod

Web3 wallet?

Private key management specialist Torus unveiled a one-click Chrome and Brave browser extension to provide Web3 experiences. Called tKey, the product is a custom version of two-factor authentication (2FA), that enables single login for their wallet and could be used to secure other devices – like a mobile phone. At a high level, Torus splits and distributes sensitive data needed to construct a user’s private key between the user and nodes on the Torus network, which includes Binance, Ethereum Name Service (ENS), Etherscan, Matic Network, Ontology, Skale, Tendermint Core and Zilliqa, CoinDesk’s Ian Allison reports.

Op-ed

Profound shift

Last week, Chairman of the U.S. Federal Reserve Jerome Powell announced the central bank will allow inflation to run higher than its longstanding 2% target, without raising interest rates. CoinDesk’s Head of Research Noelle Acheson sees this as a profound shift in the role of the central bank, which might have repercussions for the crypto industry. “If 2020 teaches us one thing, it has to be that assumptions don’t last, and that we all need to be flexible. In a world where everything is undergoing a transformation, barriers come down faster. And, as uncomfortable as it may be, change is always an opportunity, especially when it comes from unexpected areas. In our industry, it’s what we’ve been hoping for,” she writes.

Inflation solution

Frances Coppola, a CoinDesk columnist and author of “The Case for People’s Quantitative Easing,” thinks one way to increase inflation, which has consistently fallen below a targeted 2%, is to just give people money. “From beyond the grave, [John Maynard] Keynes sends a powerful message to today’s leaders. If you want inflation to rise, Mr. Powell, you need to get people spending. Announcing that you will permit prices to rise more quickly won’t achieve this. And neither will increasing the money supply, unless that money goes to people who are likely to spend it,” she writes.

Who won #CryptoTwitter?

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.