Blockchain Bites: Ethereum 2.0’s Deposit Contract Goes Live as ETH Miner Revenues Dwindle

Blockchain Bites: Ethereum 2.0’s Deposit Contract Goes Live as ETH Miner Revenues Dwindle

Predictive markets rollicked with U.S. ballot counting. Two more crypto payments cards are expected to market. Nearly $1 billion worth of BTC moved from a long-dormant wallet potentially connected with the shuttered Silk Road exchange.

Top shelf

Staking begins

Ethereum 2.0’s deposit contract is now live, as of 15:00 UTC. According to developer Afri Schoedon, the deposit contract (a bridge between the forthcoming proof-of-stake (PoS) blockchain and the current proof-of-work (PoW) mainchain) is the first physical implementation of Eth 2.0 for everyday users. On a practical level, Ethereum stakers can now begin depositing the 32 ether (ETH) required to stake on Eth 2.0. Once 16,384 validators have deposited funds equivalent to a total of 524,288 ETH into the contract, the Beacon chain – the spine of Ethereum 2.0’s multiple blockchain design – will kick into action in what is called the “genesis” event of Ethereum 2.0. That event is expected within the next few weeks.

On the road again

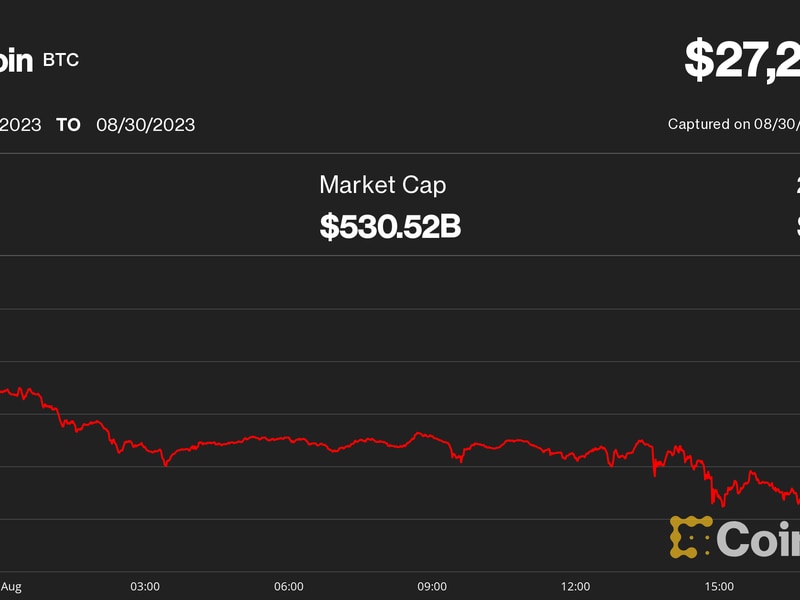

A wallet possibly belonging to early dark net market Silk Road moved almost $1 billion worth of bitcoin early on Wednesday, according to blockchain intelligence firm Elliptic. Nearly 70,000 BTC were transferred to an unknown wallet. This is the first transaction from the address since 2015 when it transferred 101 BTC to BTC-e – a now-shuttered cryptocurrency exchange allegedly favored by money launderers, per the post. “These funds likely originated from the Silk Road,” Tom Robinson, co-founder of Elliptic noted in a LinkedIn post, adding that the coins may have been moved by imprisoned Silk Road operator Ross Ulbricht or a Silk Road vendor.

Crypto cards

ZenGo, a wallet company, will be the latest to join Visa’s Fast Track program, with plans of launching a crypto-integrated payment card for the U.S. in early 2021. Using multi-party computation (MPC), ZenGo’s wallet, and eventual card, will allow users to convert their cryptocurrency into fiat so it can be spent in the Visa network and withdrawn from ATMs – without having to put their cryptographic keys into third-party custody. Visa’s Fast Track program has previously sponsored Bitcoin’s Lightning Network and rewards app Fold. Separately, China’s UnionPay, the world’s biggest credit and debit card company, has teamed up with a Korean payments firm to offer its Paycoin cryptocurrency for an upcoming virtual card offering.

Difficulty drop

Bitcoin’s mining difficulty dropped by more than 16% in its latest programmatic adjustment, the largest percentage decrease since the advent of ASIC mining machines in late 2012. Now at its lowest level since June, a drop in difficulty, preceded by the end of China’s rainy season, bitcoin miners are expected to see increased profits. Margins “for efficient miners will significantly widen,” John Lee Quigley, director of research at HASHR8, wrote, adding that less efficient miners will be able to mine profitably again. Mining difficulty is a measure of the amount of resources required to compete for mining fresh bitcoin, which changes roughly every two weeks based on changes to the total estimated hashpower consumed.

Layer1 lawsuit

Bitcoin miner Layer1 Technologies is being sued by a co-founder who claims he invested millions of dollars and was then forced out of the firm. In a complaint filed in the U.S. District Court in the Western District of Texas Pecos Division, the plaintiff, Jakov Dolic, claims he co-founded Layer1 with its CEO Alexander Liegl, with the assumption the firm would be able to raise $50 million from investors for a bitcoin mining facility. Though the investments never arrived. Dolic said he invested $16.24 million of his own funds to purchase a power substation as well as a further $3.5 million to expand the power facility – and now says the funds should be refunded, per a contractual agreement.

Quick bites

- An Australian senator said blockchain technology could help facilitate “one touch” government and tighten financial regulation. (CoinDesk)

- Telegram will pay some $620,000 in legal fees after conceding defeat in its copyright lawsuit related to the messaging apps “GRAM” token ticker. (Decrypt)

- Hong Kong plans to ban retail investors from buying crypto. (Modern Consensus)

- Blockchain analytics firms have privacy advocates worried. (CoinDesk)

- Atari token falls 70% just days after public sale concludes. (Cointelegraph)

- Binance said has recovered nearly all $345,000 worth of cryptocurrencies stolen in an October scam that launched on its Binance Smart Chain. (CoinDesk)

Market intel

Fees flee

Ethereum miners’ income more than halved in October as DeFi mania dropped off. Ethereum users paid $57.49 million in transaction fees in October – down 65% from September’s record monthly tally of $166.39 million, according to data source Glassnode. Further, the maximum “gas” price declined from 5.18 million gwei to 0.6 million gwei in October, according to data source Bitquery. “Transaction costs declined as volumes on decentralized exchanges dropped, reducing demand for network’s bandwidth,” Alex Mashinsky, CEO and founder of crypto lender Celsius, told CoinDesk. Trading volume on decentralized exchanges fell by nearly 25% to $19.4 billion in October to register the first monthly decline since April.

At stake

What happens to the prediction markets?

With the U.S. presidential election hanging in the balance, one thing has become clear: The primary sources for predictive election analysis – mainstream media and pollsters – will see their worth and trust degrade following a significant miscalculation leading up to Nov. 3.

What was predicted to be a possible blowout election for former Vice President Joseph Biden has turned into a nail-biting count in a few swing states. With clear “paths to victory” giving way to “toss ups,” many in the crypto industry turned their attention to predictive markets instead. The theory hinges on the bet that those with “skin in the game” (re: cold, hard cash) might yield greater insight.

In the lead up to the election, CoinDesk reported that volumes on decentralized crypto prediction markets boomed. Polymarket, a non-custodial platform where users place bets in the dollar-backed stablecoin USDC, saw volumes surge from zero to almost $3 million in a three-week span. Other crypto-based platforms, like YieldWars and Augur also began attracting attention, after long periods of dormancy.

Of course, the interest in trustless betting occurred amid a greater surge in use of centralized platforms like PredictIt. More than $1 billion had been locked into various prediction markets seeking to determine who will enter the Oval Office come January.

In the tumult of state-by-state ballot counts, prediction markets saw many take bets that President Donald Trump would keep his office – reversing a trend that previously favored Biden.

Noted industry venture capitalist Nic Carter tweeted last night that “trump is way overpriced at 68c” on FTX’s in-house prediction market. $TRUMP, a bet that the U.S. president would prevail ultimately crossed $.80 before tanking by press time.

All this is to say, election oddsmakers are just as fickle as the polls, though in different ways. In an election where crypto largely stayed out of the picture – both as a matter of candidate mandates and as a figure of political contributions – betting markets are just another alpha-seeking avenue.

Prediction markets are more entertainment than anything, Carter said over Telegram. “Generally though they are a useful albeit lossy compression of news, especially in volatile situations that are hard to parse (like last night).”

“Betting markets are not great barometers. I went to several PredictIt meet-ups in 2016. The big guns were daytraders who just wanted to day trade more. There is no secret sauce there. Sometimes they’re right, sometimes they’re wrong, but oracular they are not,” NBC News reporter Ben Collins weighed in.

Even less certain? The future of decentralized prediction markets.

YieldWars’ pseudonymous co-founder, Owl, previously told CoinDesk that the sudden rise in trading volume was to be expected, given the weight of the election. Though it’s unclear if this will last.

“Crypto-based prediction markets should be flourishing on blockchain right now but have failed to deliver up to this point. The election has breathed life into prediction markets but what is going to happen when it ends? Are people going to be as enthusiastic about them?” Owl said.