Blockchain Bites: Capital-Constraining Compliance and Tether’s ‘Interoperability Bridge’

Blockchain Bites: Capital-Constraining Compliance and Tether’s ‘Interoperability Bridge’

Dutch regulations are causing capital constraints among crypto startups, a crypto exchange is extending credit lines and Kentucky is looking to blockchain to manage its critical infrastructure.

Last week, Bittr, a Dutch crypto exchange announced it would close shop citing the burden of complying with new anti-money laundering (AMLD5) regulations in the nation. This is likely the first of many such closures of cash-strapped companies that now have to meet a new definition of compliance. Here’s the story:

You’re reading Blockchain Bites, the daily roundup of the most pivotal stories in blockchain and crypto news, and why they’re significant. You can subscribe to this and all of CoinDesk’s newsletters here.

Regulatory Squeeze

Recent Dutch anti-money laundering (AMLD5) regulations are squeezing small crypto exchanges. Under Dutch law, businesses pay for their own regulations out of pocket, and often incentive firms to keep lawyers on retainer, pay a compliance officer or find a third party to manage costs. Announced Friday, Bittr, the first of what could be many crypto exchanges to fold under these capital constraints, announced it would shut down.

Crypto Credit

LGO Markets is taking an unusual step for a cryptocurrency exchange by letting clients trade without pre-funding accounts. The exchange is now offering intraday credit lines and to send cash to its client base of hedge funds and market makers when the trading day is over.

AI Advances

SenseTime, an artificial intelligence startup, has inked a deal with China’s Digital Currency Research Institute, which is building China’s Digital Currency Electronic Payment (DC/EP), “to pool their research and foster innovative new applications under a joint effort to deploy AI advances across the country’s financial sector,” the South China Morning Post reports.

Tether’s Line

Tether’s CTO hopes a new EOS-Bitcoin interoperability bridge could make tether cheaper and faster because users will be able to make transactions on less-congested blockchains, using wrapped pTokens. Launching Friday, the company will first support a bitcoin wrapper on the EOS mainnet – pBTC.

IPO Filing

Ebang International Holdings aims to raise up to $100 million from an initial public offering (IPO) in the U.S., according to an April 24 filing with the SEC. The mining hardware manufacturer attempted to go public in 2018 on the Hong Kong Stock Exchange (HKEX) in June 2018, with a targeted $1 billion sale.

Major Buyer

Grayscale, an institutional investment platform and sister company to CoinDesk, has purchased nearly half of ether mined since the start of 2020. Through the Ethereum Trust, the investment firm allows institutional investors to gain exposure to the asset, without owning the actual asset. (Decrypt)

Mining Pool

Binance launched a mining pool service focused on bitcoin using Full Pay-Per-Share, or a method of sharing block rewards and portions of transaction fees among pool participants. (The Block)

Timing the Future

BitMEX announced an ether futures product settled in bitcoin. The contract trades the ether-dollar pair, and expires in June, coinciding with the scheduled ETH 2.0 launch in July.

Site Seizure

The U.S. departments of Justice and Homeland Security have seized coronaprevention.org after its owner tried to sell the domain for bitcoin after posting about it in a “hacker’s forum.” The price tag was allegedly $500, payable in bitcoin. Such domains are usually closer to $20, the warrant states. The crime isn’t price gouging, but reportedly that an undercover agent said they wanted to use the site to sell fake COVID-19 testing kits, a plan the owner reportedly said was “genius.”

Trading Platform Approved

The Public Private Execution Network, an alternative trading system for exempted digital assets and other private securities, has regulatory clearance to launch in the U.S.

5-Year Plan

The Dole Food Company has a five-year blockchain plan for stronger food safety. The company will trial blockchain product tagging and other “advanced traceability solutions” across its three business divisions – tropical fruits, fresh vegetables and other diversified products – in a bid to enhance food safety operations by 2025.

Digital Commodities

“It turns out that commodity prices don’t have a floor,” said CoinDesk’s director of research, Noelle Acheson. Last week, oil began trading below zero, in a frightening reminder that commodities aren’t always safe bets. In the latest weekly installment of Crypto Long & Short, Acheson breaks down this market mystery, and what it could mean for bitcoin’s prospects as an approved ETF product.

Blockchain Utility

The U.S. state of Kentucky will create a working group to look at how blockchain can be used to secure the state’s critical infrastructure including its power grid, water supply and sewage. (The Block)

Blockchain Development

BitFlyer Blockchain, a wing of the Japanese crypto exchange, has launched a consultancy service firms looking to employ blockchain technology. (Finance Magnates)

Mining Arc

The history of bitcoin mining equipment is key to understanding how the network has evolved over the years into a multi-billion dollar industry. CoinDesk’s Christine Kim breaks down the period of intense technological development – from CPUs to application-specific integrated circuits (ASICs) – and takes a look at what may come soon.

Free Ross

Last March marked the seventh year Ross Ulbricht has spent behind bars, part of a double life sentence handed down to the alleged operator of the Silk Road. The coronavirus pandemic worsens conditions for all prisoners (Ulbricht now spends 22 hours in his cell) but is also a moment for the United States, the world’s largest incarcerator, to reform its justice system.

CoinDesk Live: Lockdown Edition

CoinDesk Live: Lockdown Edition continues its popular twice-weekly chats with Consensus speakers via Zoom and Twitter, giving you a preview of what’s to come at Consensus: Distributed, our first fully virtual – and fully free – big-tent conference May 11-15.

Zoom participants can ask questions directly to our guests. Register to join our fourth session Tuesday, April 28, with speaker Carlos Acevedo of Brave to discuss financial inclusion in the cryptocurrency movement, hosted by Consensus organizer Stephanie Izquieta.

Market Intel

Dash for Cash

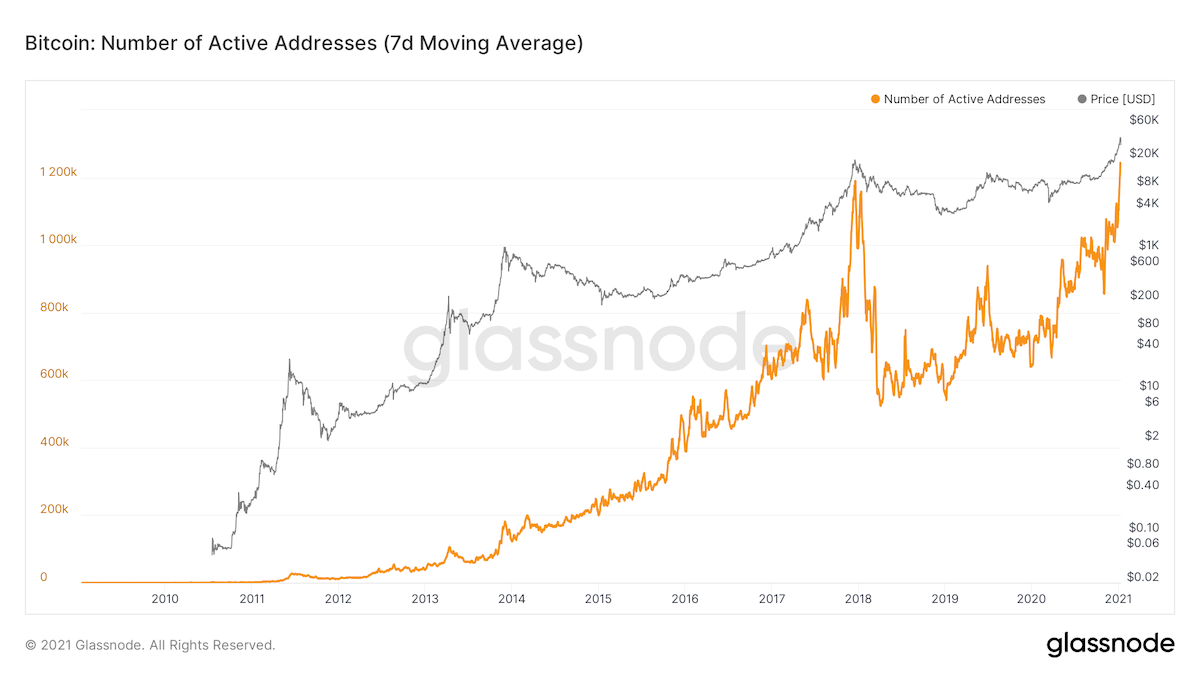

Ether’s price might be getting a boost from the crypto industry’s version of the dash for cash. As investors rush to US dollars, there’s been a corresponding demand for tether and other dollar-linked stablecoins, many of them built atop the ethereum blockchain network. Led by tether (USDT), the total outstanding amount of stablecoins surged this month to nearly $9 billion, from less than $6 billion in early March.

Halving Bump

Bitcoin’s rally is gathering pace with the mining reward halving 14 days away. The cryptocurrency rose to $7,800 early on Monday to hit its highest level since “Black Thursday” when prices dropped to $4,700 amid a larger coronavirus-led market selloff. Much of the recent price drive is coupled to a rally in traditional markets, but some indicators show the bullish narrative surrounding the upcoming halving is also contributing to bitcoin’s rise.

Bitcoin Halving Podcast Series

Miner Perspectives

The latest episode of the Bitcoin Halving 2020: Miner Perspective podcast series covers the evolution of bitcoin mining into a competitive industry.

Who Won #CryptoTwitter?

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.