Blockchain Bites: Bitcoin’s New ETP, Ethereum’s ‘Woodstock Moment’ and Silvergate’s SEN Zen

(mockstar/Creative Commons)

Blockchain Bites: Bitcoin’s New ETP, Ethereum’s ‘Woodstock Moment’ and Silvergate’s SEN Zen

A crypto hedge fund is folding, Silvergate Bank’s bitcoin-collateralized loans surged this quarter and bitcoin futures markets record triple-digit growth.

You’re reading Blockchain Bites, the daily roundup of the most pivotal stories in blockchain and crypto news, and why they’re significant. You can subscribe to this and all of CoinDesk’s newsletters here.

Top shelf

Bitcoin ETP

Swiss crypto manager FiCAS AG announced what could be the first actively managed bitcoin exchange-traded product (ETP). The firm’s Chairman Mattia Rattaggi said the Bitcoin Capital Active ETP’s portfolio could contain up to 15 altcoins as determined by market capitalization, liquidity and the rules of its host exchange, the SIX Swiss Exchange. Product managers will trade bitcoin against ETH, XRP, BCH, LTC, BNB, EOS, ADA, XLM, XTZ, TRX and exit to Swiss francs, euros and U.S. dollars. Rattaggi said the list could shift based on coin performance.

De-Funded

Cryptocurrency hedge fund Tetras Capital is shutting down and returning investors’ money after quarters of low returns, an anonymous source told CoinDesk. The New York-based fund, founded in 2017, recorded a 75% loss life-to-date. At its height, Tetras managed upwards of $33 million, according to financial filings, with an investment thesis centered around shorting ether and investing in alt-coins. At least 68 crypto hedge funds closed last year internationally, almost double the number – 35 – in 2018, according to a Crypto Fund Research report.

SEN’s Zen

Silvergate Bank continued to book new cryptocurrency customers in the second quarter while its portfolio of bitcoin-collateralized loans nearly doubled. According to its latest earnings report, the bank’s $1.1 billion traditional loans increased only 0.1% from the first quarter. Bitcoin-collateralized loans through the bank’s SEN Leverage product surged 88% in the same period, to $22.5 million.

Tracing Tools

LocalBitcoins, a peer-to-peer crypto exchange, has added two Elliptic blockchain-tracing tools, as it continues to become regulatory compliant. The Helsinki-based platform announced Tuesday it will use Elliptic’s Navigator risk analysis tool and Lens wallet screener to crack down on illicit crypto. The platform has been bolstering its anti-money laundering (AML) safeguards in response to the European Union’s AMLD5 and new Finnish business regulations. Recently, LocalBitcoins has suspended cash-for-crypto trading and added mandatory identity verification.

Sustainable Investments

Fasset, a fintech company headquartered in the U.K., has launched an Ethereum-based operating system dedicated to the ethical financing of sustainable infrastructure. The system tokenizes investments made in sustainable infrastructure – like solar power plants, wind farms and fiber optic – and makes them tradable among global investors. By moving the entire financing process to the blockchain, the firm intends to improve liquidity in the sustainable infrastructure sector and lower barriers to entry that will enable asset owners to avoid costly middlemen and directly list their assets on exchanges.

Quick bites

- Revolut adds Stellar to its list of supported cryptocurrencies, citing “overwhelming demand”

- An Australian state treasury mulled “flexible” regulatory reform for blockchain

- Blockchain project Polkadot raises $43 million in a private token sale (The Block)

- Garmin confirms ransomware attack took down services (TechCrunch)

- Big Tech’s power, in four numbers (Axios)

At stake

CoinDesk’s Ian Allison recounts memories from the first Devcon, a gathering of Ethereans and other tech developers plotting the future of everything from finance to the internet. This excerpt is part of a series of stories, live-streamed conferences and a limited-run pop-up newsletter CoinDesk has created to celebrate Ethereum’s five year anniversary this week.

Ethereum’s Devcon 1, held in London in November 2015, was like Woodstock, except perhaps with less nudity.

Bankers and Big 4 consultants disguised in hoodies shared space with dreadlocked Ethereum coders, sitting cross-legged in the corners, their laptops open in front of them.

Packed into a Victorian banking hall in the heart of the City of London, the audience listened as ConsenSys chief Joe Lubin predicted a new future for firms; cryptographer Nick Szabo talked about decentralization in the context of Francis Drake and the Aztecs; and chief scientist Vitalik Buterin assembled shards of the path that lay ahead.

“The internet kind of sucks,” said Ethereum wallet designer Alex Van de Sande during his opening keynote. “It’s centralized, and it’s broken – but we can fix it this week.”

Such was the optimism in the room.

Keeping with the Woodstock motif, this moment in time possessed a kind of prelapsarian innocence: The DAO debacle and hard fork decision that followed was at least six months away, and further off still was the ICO gold rush.

An earlier confab, Berlin’s Devcon 0, preceded Ethereum’s launch. In London, things were starting to get real.

Market intel

Bitcoin’s Bounce

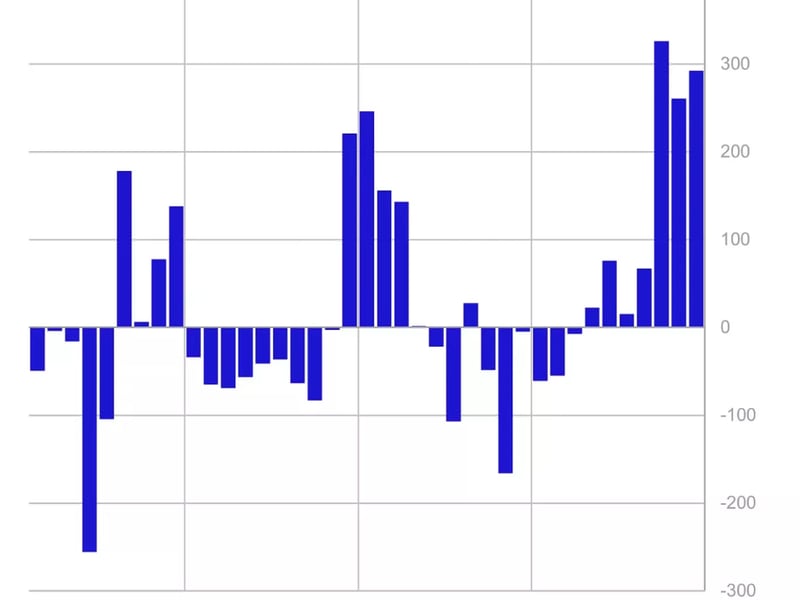

Bitcoin’s futures trading volume recorded triple-digit growth Monday, as institutions and investors raced into a market primed for a bull run. Aggregate daily futures volume on major exchanges reached $43 billion, the highest single-day volume since March 13, according to data source Skew. Daily trading volume on institutional exchange CME rose 570% to a yearly high of $1.32 billion, Bakkt registered a record volume of $132 million and total open interest for all exchanges rose to $5 billion – the highest since February.

Yearly Highs: Bitcoin & Gold

Bitcoin’s 13% price jump to 2020 highs of $11,180 on Monday came as the dollar’s value slides. This move was in tandem with gold’s newly set all-time high, both of which are referred to as inflation hedges. Bitcoin is up 57% year to date, more than double the 28% gain this year for gold, while the S&P is flat for the year. “Given gold has just set a new all-time high, and with bitcoin’s correlation to stocks breaking down while being replaced by a strong correlation to gold, we envisage further tests to the upside this coming week,” Diginex wrote in a report. Meanwhile, the U.S. Dollar Currency Index, a gauge of the greenback’s value versus other major currencies, has fallen for seven straight sessions. A weakening dollar “mechanically pushes up the prices of the commodities invoiced in greenbacks,” according to the Wall Street Journal.

Tech pod

Launchpad Before Launch

Ethereum developers have released a “validator launchpad” on the Medalla testnet to educate and prepare future validators as part of a multi-stage roll out of Ethereum 2.0. The transition to a proof-of-stake consensus mechanism, the core component of Eth 2, is designed to improve the system’s scalability. According to an announcement, three phases of the roll out are planned, with the first, phase 0, focusing on the underlying tech behind staking by tracking validators and their balances. The launchpad, which comes before phase 0, will enable validators to track and deposit test stakes on the upcoming Medalla multi-client testnet.

Opinion

Millennial Moves

Matt Luongo, CEO of Thesis, thinks millennials are shaping the future of money. From fashion to tech, a millennial “desire for autonomy and granular choice” is now extending to finance. “For most of the past hundred years, retail finance was dominated by a small number of regional, and later national, institutions. No more: 71% of millennials would change banks based on the quality of an app, and a full third of us say we won’t need a bank at all in the future,” he writes.

Podcast corner

What Sex Workers Want

CoinDesk’s Leigh Cuen and OnlyFans performer Savannah Solo talk about fintech and the sex industry.

Who won #CryptoTwitter?

Disclosure

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.