BlackRock’s Ethereum ETF Plan Is Confirmed in Nasdaq Filing

/arc-photo-coindesk/arc2-prod/public/LXF2COBSKBCNHNRE3WTK2BZ7GE.png)

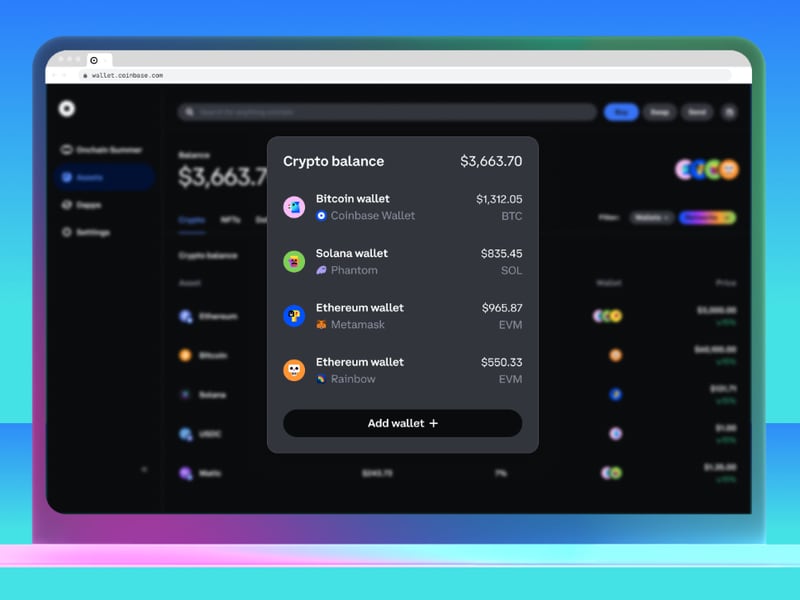

BlackRock wants to create an ETF that holds Ethereum’s ether (ETH), a plan that deepens the world’s largest asset manager’s commitment to cryptocurrencies.

The company’s plan was revealed in a filing by Nasdaq, the U.S. exchange where BlackRock will seek to list the product – which will need regulatory approval. Earlier Thursday, it emerged that the corporate entity “iShares Ethereum Trust” had been registered in the state of Delaware; iShares is the name of BlackRock’s ETF division.

BlackRock has already made waves in crypto by seeking to list a bitcoin ETF, the sort of easy-to-trade product that could dramatically broaden access to crypto to average investors.