BlackRock CEO’s Turnabout on Bitcoin Elicits Cheers, Skepticism of Crypto Cred

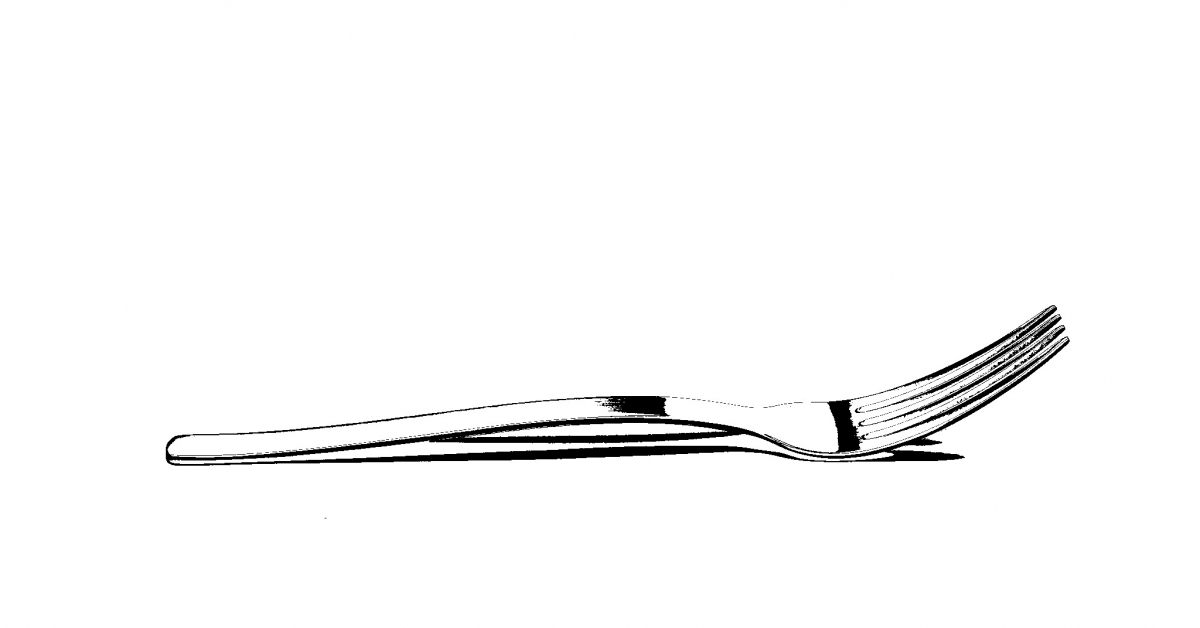

BlackRock CEO Larry Fink’s change of heart on bitcoin (BTC) could make it easier for fellow Wall Street executives to embrace cryptocurrencies, but some experts warn that his favored financial instrument – the exchange-traded fund, or ETF – is an investment vehicle that’s categorically different from the original ideals of digital assets and could push the industry in the wrong direction.

The key distinction is that an ETF is simply a traditional investment vehicle, with bitcoin as the asset, but traded on a regulated stock exchange, via regulated brokers. Such structures might be anathema to Bitcoin, designed and then launched in 2009 by a pseudonymous creator – partly as a backlash against the Wall Street excesses that fueled the global financial crisis a year earlier – as an internet-based, peer-to-peer payments network that would be free from government control.

So the reception from the crypto faithful might be mixed, even if Fink’s newfound fondness might have helped to support the recent rally in bitcoin’s price, now up 82% year-to-date.

“Crypto is losing the plot,” said Jim Bianco, president of Bianco Research. “It is supposed to be about decentralization, permissionless and self-sovereignty. Getting excited that it is going to become a more accessible poker chip is nice and will help degens in the short term, but it will not help to fulfill the real promise of crypto.”

Fink, who until this week was known to be a skeptic of crypto and at one point called bitcoin “an index of money laundering,” said on Wednesday that it could “revolutionize finance.”

However, rather than praising the core idea behind the newly-built digital asset market, mainly decentralization, Fink said that the asset manager’s main goal was to make it easier and cheaper to trade and invest in bitcoin. Some industry experts worried whether BlackRock might be in it for the wrong reasons.

“Arguments have been made that ETFs, as well as bitcoin exchanges, ignore what some believe is the single most important feature of bitcoin, the ability to control their funds without the need to place trust in a third-party to manage the asset,” said Jim Iourio, managing director of TJM Institutional Services and a veteran futures and options trader. “This flies in the face of Bitcoin’s entire point of existence.”

Crypto was built on the idea that money shouldn’t have to be tied to a third-party or middlemen, such as banks or even governments, and is therefore immune to manipulation of any sort.

When it comes to ETFs, the provider (in this case BlackRock, if it wins regulatory approval to launch the product) owns the underlying asset and sells shares of the fund to investors. It works in a way that crypto was built to change.

“So-called mainstream adoption will bring waves of new entrants to bitcoin, and the risk is that they won’t care, and won’t protect the decentralization properties that make it valuable over centralized alternatives in the first place,” Alex Thorn, head of research at the digital-asset financial firm Galaxy, wrote this week in a report.

Nevertheless, when the leader of the biggest asset manager in the world openly admits that, contrary to his opinion a few years ago, he now sees bitcoin as “digitizing gold,” it can’t be all so negative – at least for now.

Validation from people like Fink could help with mass adoption, further ingraining bitcoin in mainstream usage and public consciousness.

Paul McCaffery, managing director at boutique investment firm Keefe Bruyette & Woods, or KBW, said he believed Fink’s embrace could pave the way for other Wall Street investors to express comfort with Bitcoin, and allocate more money to the cryptocurrency.

“It’s a game-changer,” he said. “His commentary was not about this being a good economic decision for BlackRock but rather about the promise of digital wealth.”