Bitwise Launches Polygon Fund for Ethereum-Scaling Exposure

Cryptocurrency index fund manager Bitwise Asset Management formed a Polygon fund to give investors exposure to the layer 2′s native MATIC token. The fund will test the thesis of whether the popular Ethereum scaling solution has staying power.

Polygon allows developers to build applications that integrate with the Ethereum mainnet, Bitwise highlighted in a statement Wednesday.

“For years, the excitement around crypto’s most promising use cases, including DeFi [decentralized finance] and NFTs [non-fungible tokens], has been muted by the fact that Ethereum simply isn’t built to handle it all yet,” Matt Hougan, Bitwise’s chief investment officer, said in a statement. Hougan sees Polygon as a platform to improve these issues.

Bitwise is the world’s largest crypto index fund manager, with over $1.2 billion in assets under management as of March 31, according to its website.

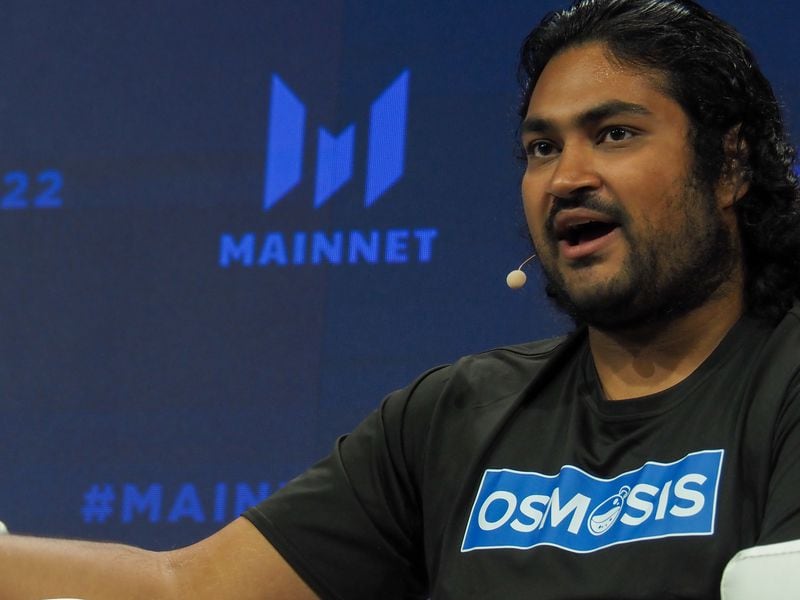

“We’re thrilled that a broader range of accredited and institutional investors will now be able to gain exposure to the MATIC token and help encourage greater development of the Polygon ecosystem,” Polygon co-founder Sandeep Nailwal said in a statement.

Michael Bellusci is CoinDesk’s crypto payments reporter.

Subscribe to The Node, our daily report on top news and ideas in crypto.

By signing up, you will receive emails about CoinDesk product updates, events and marketing and you agree to our terms of services and privacy policy.