Bitmex shuts down US-based accounts: The speculations behind it and the possible relation to 1Broker

TL;DR

- Hong Kong-based cryptocurrency exchange, BitMEX, recently started shutting down accounts originated in USA.

- While the exchange doesn’t allow US traders to operate on its platform, many believed that it turned a blind eye on those who were doing so. Tone Vays, the famous trader, is the new victim.’

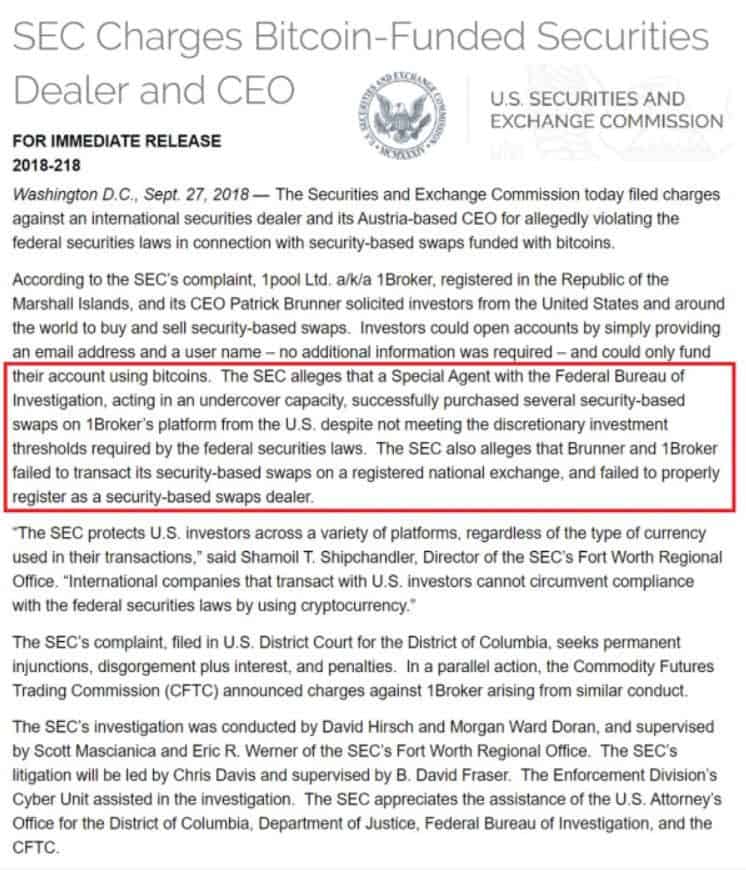

Less than two months ago, the SEC made a surprise announcement where it stated that Marshall Islands-based cryptocurrency exchange 1Broker would soon to be shut down. The decision came suddenly, and the move was performed before users managed to withdraw their funds, causing them to lose millions in the process.

Is the SEC keeping its eye on BitMEX?

Whether it is better prices, lower fees, or some other reason, foreign exchanges seem to be attracting the attention of many Americans, along with the minor KYC requirements, if at all (which can also be an advantage for some traders). This is also true for BitMEX, as it is one of a few Hong Kong-based exchanges that do not require KYC at all, as of writing these lines.

However, not requiring KYC creates a problem for it from the regulation point of view, as exchanges that accept US investors also need to comply with US securities laws. If they don’t, there will be consequences, as witnessed in 1Broker’s case. In other words, exchanges outside of the US can abide by any laws they like as long as they do not serve US citizens. If even a single American trades on the platform, that is a problem.

While BitMEX officially doesn’t provide service to the US investors, they were known to turn a blind eye to those that found their way to the exchange. However, things might be starting to change, as the exchange seemingly started terminating US traders’ accounts. One such report came from famous investor Tone Vays.

Just got my @BitMEXdotcom account terminated on suspicion of being a US Citizen. Anyone else find the timing of this odd?

The 900+ affiliates that accounted for half my income r gone going forward.

After #Unconfiscatable Conf expect prices on all services offered by me to rise. https://t.co/6bShmcdBEF— Tone Vays [@Bitcoin] (@ToneVays) November 12, 2018

Is Bitmex going to end like 1Broker?

After reports like this started coming in, the crypto community immediately started speculating what this might mean for the future of BitMEX. By looking at the 1Broker’s SEC report, it may be different it this Bitmex case:

In 1Broker’s case, the platform had a very loose set of rules when it comes to allowing US citizens to register and trade. BitMEX at least claims that it will ban traders that are US-based if it finds them. The ridiculous is that as long as there is no KYC, any American can turn on a cheap VPN software to trade on Bitmex. The question now is whether or not the exchange is responsible if US traders manage to operate on it without the exchange’s notice.

Many speculate that the entire point of the SEC going after 1Broker was only to send a message to other and more significant exchanges and force them indirectly to either comb through their users and ban US traders, or to start following US laws.

While 1Broker was not precisely discreet with what it offered and allowed, BitMEX is doing a much better job at that. The only question is if that is enough to keep the SEC from going after it. Some community members do not seem to think so. Whether or not this will happen remains to be seen.

The post Bitmex shuts down US-based accounts: The speculations behind it and the possible relation to 1Broker appeared first on CryptoPotato.