BitMEX Is Making Bitcoin Network More Expensive for Everyone, Researcher Finds

BOTTLENECK: If too many bitcoin transactions are sent at one time, miners prioritize ushering through those with higher fees. Those with smaller fees must wait. (Credit: Shuttertsock)

BitMEX Is Making Bitcoin Network More Expensive for Everyone, Researcher Finds

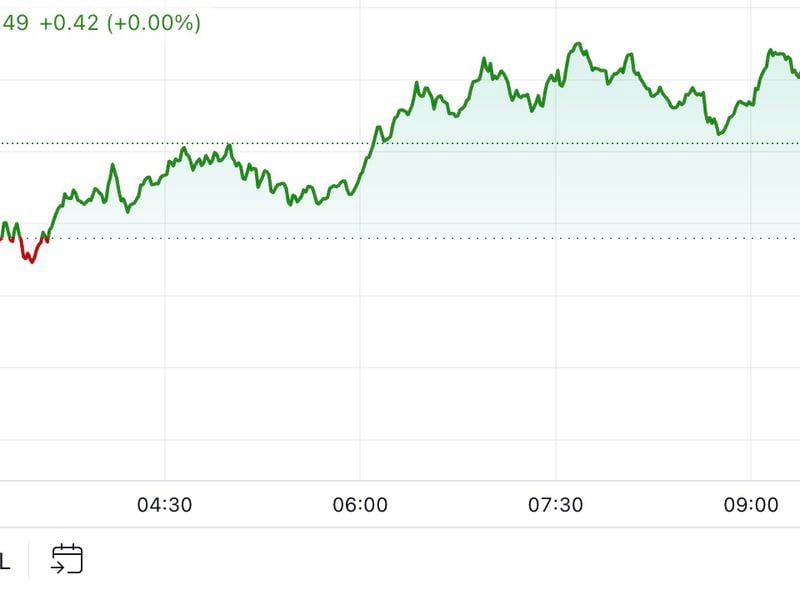

Every day, around mid-morning New York time, the average fee bitcoin users worldwide pay to send the cryptocurrency spikes for up to an hour, then returns to normal. A respected researcher thinks he’s found the reason: BitMEX.

If the crypto derivatives exchange used more efficient technologies when broadcasting transactions, users could save as much as roughly 1.7 bitcoin (worth more than $15,000 at press time) in fees every day, or about 7 percent of total daily fees paid, argues pseudonymous bitcoin engineer 0xb10c.

“The daily broadcast has a significant impact on the Bitcoin network and user fees,” 0xb10c wrote in a recent report.

Nearly every time a user sends a bitcoin transaction, they tack on a (usually) small fee along with it. Fees fluctuate all the time, depending on how much congestion is in the network. That’s because there is limited space for transactions to go through. If there are too many transactions sent at the same time, miners will prioritize ushering through those with higher fees. Those with smaller fees will have to wait.

Because BitMEX broadcasts thousands of transactions at once at the same time every day, it leads to a fee increase every day, 0xb10c contends.

“Every day at around 13:08 UTC (9:08 a.m. ET), multiple megabytes of optimized transactions, mostly user withdrawals, are broadcast by BitMEX. The effect is immediately noticeable as a spike in the feerates, which estimators recommend and users pay,” 0xb10c told CoinDesk. His research indicates that this has been going on since at least September.

BitMEX, which is based in Seychelles, did not answer a request for comment by press time.

0xb10c has been writing a series of posts about insights he gleaned as he built the Bitcoin Transaction Monitor, a data tool for exploring transactions on the network in detail.

Fee pressure

Most bitcoin wallets have fee estimators built in that estimate what fee a user should add to a transaction to ensure it is accepted in a timely fashion. If the network is handling too many transactions at once and the fee is too small, it could take longer for the transaction to go through.

Because of BitMEX’s many transactions going on at once, clogging the blockchain, the estimators move the fee up and many users pay them.

BitMEX broadcasts thousands of bitcoin transactions at once at the same time every day, leading to a fee increase every day.

While users obviously prefer lower fees, higher fees strengthen the network’s security, especially when block rewards (miners’ main source of income right now) decrease every four years, 0xb10c added. The third halving of mining rewards is expected to take place next week, and has only highlighted long-term worries about network security.

That said, developers and other bitcoin enthusiasts have long been trying to push big exchanges and wallet providers (far beyond just BitMEX) to adopt scaling technologies that could cut fees and make the network run more efficiently. These include Segregated Witness, or SegWit, a scaling upgrade that became available in 2017.

“It’s a bit strange to realize that fees would be close to 0 if exchanges used better practices. Their profligacy helps maintain the fee pressure,” tweeted Nic Carter, co-founder of crypto data provider CoinMetrics, in response to 0xb10c’s research.

Illustrating the problem, on March 12, the day bitcoin’s price crashed in tandem with the equity markets as the coronavirus pandemic shook the world’s economies, the usage of SegWit-updated nodes dropped 5%.

Binance, the world’s largest exchange, saw outsized volume day on March 11-12 — over $1 billion and $945 million respectively instead of the seven-day rolling average across January and February of $637 million, according to CryptoCompare — but hadn’t yet moved to SegWit wallets. Binance spokesperson Jessica Jung said the exchange has not updated to SegWit, “but it’s in the pipeline.”

Beyond SegWit, 0xb10c recommended BitMEX use “output batching,” a years-old technique of cramming many transactions into one to save on transaction space. He also mentioned Schnorr/Taproot, a Bitcoin upgrade that’s been in the pipeline for years that some developers estimate will finally be deployed over the next year.

“By utilizing scaling techniques, some of which have been industry standards for multiple years, the impact could be reduced. BitMEX is stepping in the right direction by planning to switch to nested SegWit. They, however, shouldn’t stop there,” 0xb10c wrote.

William Foxley contributed reporting.

Disclosure Read More

The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups.