BitMEX CEO Touts $1 Trillion Yearly Trading Volume

On June 29, 2019, Arthur Hayes, BitMEX’s co-founder and CEO, posted a tweet revealing that the exchange has seen over $1 trillion in trading volume over the past year.

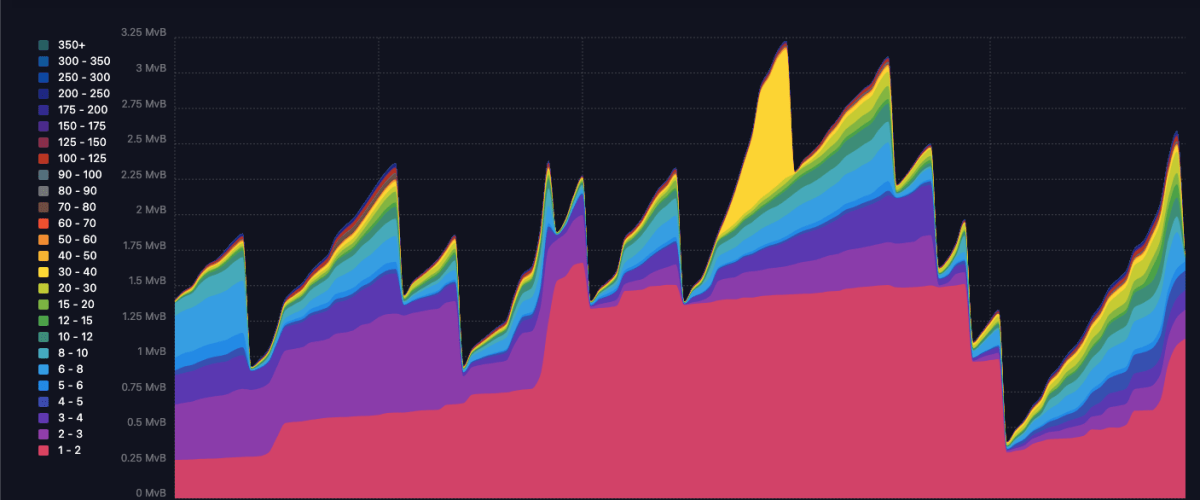

In another illustration of BitMEX’s dominance, according to data from market analysis platform Austerity Sucks, the exchange holds 53 percent of the total exchange market share, with over $7 billion in trading volume over a recent 24-hour period.

HuobiDM and its $2.24 billion came in second with about 16 percent of the market share, while OKEx came in third with 12.5 percent and $1.69 billion in trading volumes over the same period.

The tweet from Hayes was not only a bid to share numbers with the cryptosphere, but also to silence NYU Economist and longtime crypto-slanderer, Nouriel Roubini.

Roubini has questioned the authenticity of reported cryptocurrency exchange trading volumes, citing a Bitwise volume query report prepared for the U.S. Securities and Exchange Commission, and criticized a BitMEX Research tweet sharing trading statistics.

“How can one believe ANY of these figures when 95 percent of all bitcoin transactions on a typical exchange are fake? Fake-coins, shit-coins, fake-transactions, fake-pricing. The only true thing in crypto space is manipulation, pump n dump, front-running, wash trading, etc…” Roubini wrote.

The post BitMEX CEO Touts $1 Trillion Yearly Trading Volume appeared first on Bitcoin Magazine.