BitMEX CEO: Five Countries Will Accept Bitcoin As Legal Tender By The End Of 2022

Remittances, inflation, and politics will prompt at least five developing countries to accept BTC as legal tender by the end of 2022, says Alexander Höptner.

- “My prediction is that by the end of next year, we’ll have at least five countries that accept Bitcoin as legal tender. All of them will be developing countries,” the BitMEX CEO wrote.

- High inflation rates, hefty remittance fees, and political incentives might spur developing countries to follow El Salvador’s steps and adopt BTC as a legal tender next year.

- In Alexander Höptner’s opinion, mainstream media criticism of the Central American country’s Bitcoin law is unfair.

The recent move by El Salvador to make bitcoin a legal tender alongside the dollar spurred some criticism worldwide, but mainly among mainstream media, such as the Financial Times and Wall Street Journal, and renowned financial institutions, including the International Monetary Fund (IMF) and the World Bank.

Alexander Höptner, the CEO of bitcoin exchange BitMEX, explained in a blog post on October 6 that the immediate backlash sparked by the Bitcoin law in the Central American country reflects the opinion of those who benefit from the status quo.

“What the critics fail to recognise is that developing countries like El Salvador are leading the world in embracing decentralised digital currencies and payments,” Höptner wrote. “They’ve had decades to analyse how the global financial system works – and doesn’t work – for their populations. They acknowledge their powerlessness to influence monetary policy decisions that can have grave consequences on their citizens.”

Höptner went on to explain that making bitcoin a legal tender as El Salvador did in September doesn’t mean a complete opt-out of the established financial system. Instead, it means countries are looking for alternatives to better benefit their population and economy.

“They aren’t quite opting out of the monetary system status quo (El Salvador still retains its other legal currency, the US dollar), but they are choosing to try something new. This deserves praise, not derision,” he said.

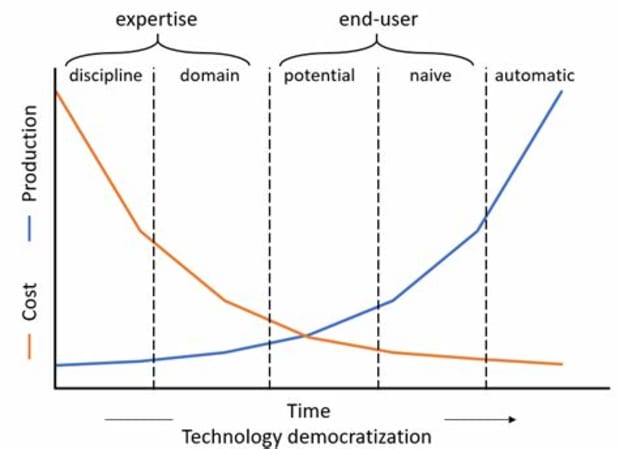

Developing countries usually face an economic reality much different from developed ones. As a result, the status quo might not suffice — alternatives have the potential to provide a better quality of life for citizens, thereby improving the country as a whole. For that reason, the head of BitMEX predicts that more countries will follow El Salvador’s steps and bet on the alternative.

“My prediction is that by the end of next year, we’ll have at least five countries that accept Bitcoin as legal tender,” Höptner shared. “All of them will be developing countries.”

High fees in remittance inflows that reduce the actual amount of money transferred, recurrent high inflation rates, and political incentives might make the perfect environment for Bitcoin adoption to spur further.

Low and middle-income countries received around $540 billion in remittances in 2020, nearly 75% of total global remittances, according to the World Bank. The IMF has forecast that developing countries will experience over double the inflation rates that developed economies will take this year.

“Faced with an inherently unequal financial system, those who have the most to lose by continuing the status quo are acting in their self-interest to explore alternative options like Bitcoin. It would be wrong – and hypocritical – to thumb our noses at them while continuing to benefit from that same unequal system.”