Bitmain’s path toward a public listing can tell us a lot about the institutionalization of the Bitcoin mining industry at large.

It seems that the ground under Bitcoin businesses is shifting daily, first with a major shutdown and hash migration out of China, then with some wobbly prices and now with an attempt to legislate bitcoin in the U.S. Congress.

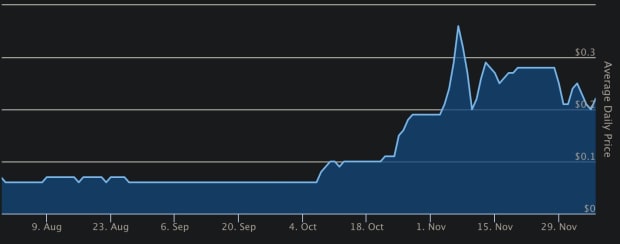

Compass Mining, a full-service mining host and equipment provider, recently released a detailed mining report that included a look at what it calls “hardware manufacturer institutionalization,” another major shift in the Bitcoin space.

The ultimate in “institutionalization” may be public listing, which brings a massive new avenue for investment, while also bringing regulatory and shareholder scrutiny.

“Miners are looking at public markets as a way to get access to robust capital markets to fuel their growth,” explained Ethan Vera, the COO of Luxor Technologies, who added that more than 16 exahashes of mining capacity is controlled by publicly-listed companies. “In the current market, public vehicles are the best way to grow a mega mining company.”

Mining equipment manufacturers Canaan and Ebang have both achieved listings on the NASDAQ exchange. Meanwhile, MicroBT is reportedly planning a U.S. IPO. But this institutionalization is especially significant for Hong Kong-based Bitmain, the largest ASIC manufacturer in the world, which easily outpaces the other major companies in the space (in its 2017 prospectus, Bitmain said it had 77% of the bitcoin mining equipment market share).

So, how is Bitmain embracing the growing institutionalization of the industry that it has pioneered?

The Miner’s Journey From Startup To Institution

In its report, Compass Mining makes the case that mining equipment manufacturers have evolved from once shady or opaque businesses, with stories about equipment getting lost or being used and then sold as if new.

“Manufacturers mining with hardware before delivering it to customers is an unconfirmed but widely believed facet of the early-stage Bitcoin ASIC manufacturing industry,” per the report.

But now, with the potential of drawing public investment, many of these businesses have opted to take a more professional approach, particularly Bitmain.

“With two of the five major hardware manufacturers after publicly listing, and the market leader Bitmain working towards an IPO, such purported practices are quickly becoming anachronistic as professionalism improves among the major manufacturers,” according to the report. “The reality of being a publicly traded company servicing a multi-billion dollar annual market starkly contrasts the conditions facing a 2013 Chinese startup that is venturing into a high-risk market with immensely uncertain prospects.”

The Motivations For Bitmain’s Corporate Restructurings

That reality also likely influenced one of the most significant corporate restructurings Bitcoin has ever seen, as Bitmain significantly altered its structure and leadership at the beginning of the year.

In January 2021, Bitmain cofounder Jihan Wu announced that a longstanding feud with fellow Bitmain cofounder Micree Zhan had been resolved through his resignation as CEO and chairman, according to a timeline of control over the company compiled by Compass Mining.

The battle for control between Bitmain’s cofounders has been a major storyline within the Bitcoin space and its resolution saw cloud mining platform BitDeer spun off as a separate entity, controlling mining facilities in the U.S. and Norway, with Wu as its chairman, while major bitcoin mining pool AntPool was also spun off, falling under the control of Zhan.

Regarding the spinoff of AntPool, a recent blog post from Bitmain explained that this will allow it to focus on “the R&D and sales of computing power chips and servers relying on its technological advantages in chip design, hardware R&D and manufacturing.”

But the spinoff might also have been motivated by regulatory considerations as the company prepares for a public listing. In an interview with Bitcoin Magazine, Compass Mining’s Will Foxley commented on Bitmain’s divestiture of AntPool.

“Mining pools are an obvious attack surface for regulators given their centralized nature,” Foley said. “It’s unclear if regulators ‘like’ or ‘dislike’ pools, but rather it seems they wish to enforce old regulatory regimes on newer financial entities. Public companies do use mining pools here in the U.S. and will have to navigate this process with legal experts.”

As Compass Mining’s report phrased it, these changes have set the stage for realizing public ambitions.

“While Bitmain has yet to IPO, a corporate restructuring in January 2021 has set the tone for an IPO in 2021,” according to the report.

Regarding the likelihood of a successful public listing for Bitmain, Foxley emphasized that the company’s previous experience in this realm may offer key lessons and, ultimately, success this time around.

“Bitmain tried listing in Hong Kong in 2018/2019 but eventually pulled its application,” he said. “As they plan to go public with a more streamlined, manufacturing-only approach, I’d expect them to seek a Hong Kong listing, given most of their core business operations still reside in China.”