BitGo Unveils Token Management Service for Crypto Foundations

-

Protocol builders face a fragmented landscape when it comes to sorting out the mechanics of token management, BitGo says.

-

Protocols like Worldcoin, LayerZero, SUI and ZetaChain are among the first customers of the service.

00:59

Chances of 50 Basis Point Fed Rate Cut Next Week Jump to 47%

00:44

Ethereum Could Benefit Regardless of the Election Results: Analyst

15:41

Is Bitcoin a ‘Trump Trade’?

02:16

SUI Beat the Market With Nearly 20% Rally; Deutsche Bank Survey Shows Crypto Is Here to Stay

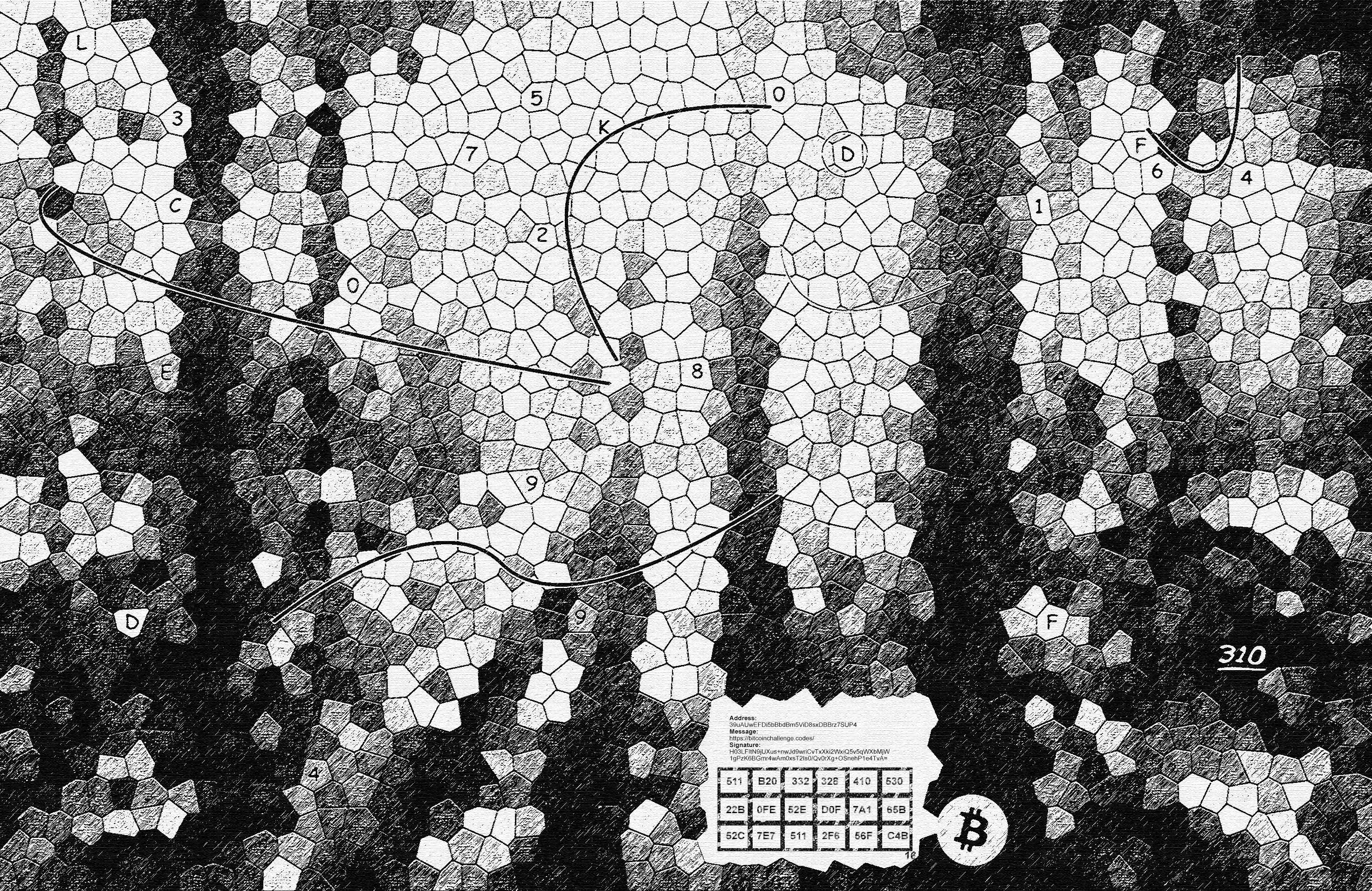

Cryptocurrency custody firm BitGo is offering foundations and organizations a simplified way to manage the lifecycle of digital assets they issue, with protocols like Worldcoin, LayerZero, Sui and ZetaChain among the first customers of the service.

Bitgo says it’s filling a gap in a fragmented market, with a one-stop, regulated and insured custody platform for seamless digital asset vesting, unlocking and on-chain activities. The custodial token management service uses the regulated confines of BitGo Trust, the firm’s qualified custodian offering.

The Web3 world has evolved far beyond straightforward digital asset transactions on a blockchain into a programmable economy where, with just a few lines of code, new protocols can be concocted, tokenomics invented and tokens minted.

This leads to a situation where protocol builders are primarily focused on refining technical details around tokenomics, validator steps and so on, while looking to grow adoption and justify the value proposition they gave to their venture-capital backers, said Thomas Chen, head of sales at BitGo. Leaving the nuts and bolts of token management until last can end up like a “slow moving train wreck,” Chen said.

“When it comes to managing their tokens, these firms encounter a fragmented landscape,” Chen said in an interview. “It’s a mix of non-custodial wallets, web-only solutions, with the need to use a smart contract for distribution. So if I’m the head of operations for some new token protocol, I’ve got to strike up at least two different relationships, manage two to three different integration points, all the while trying to have a successful mainnet launch. It’s a tactical nightmare.”

Edited by Sheldon Reback.