Bitfinex and Tether (USDT) in Trouble: NYAG Calls LEO $1B IEO a Securities Offering

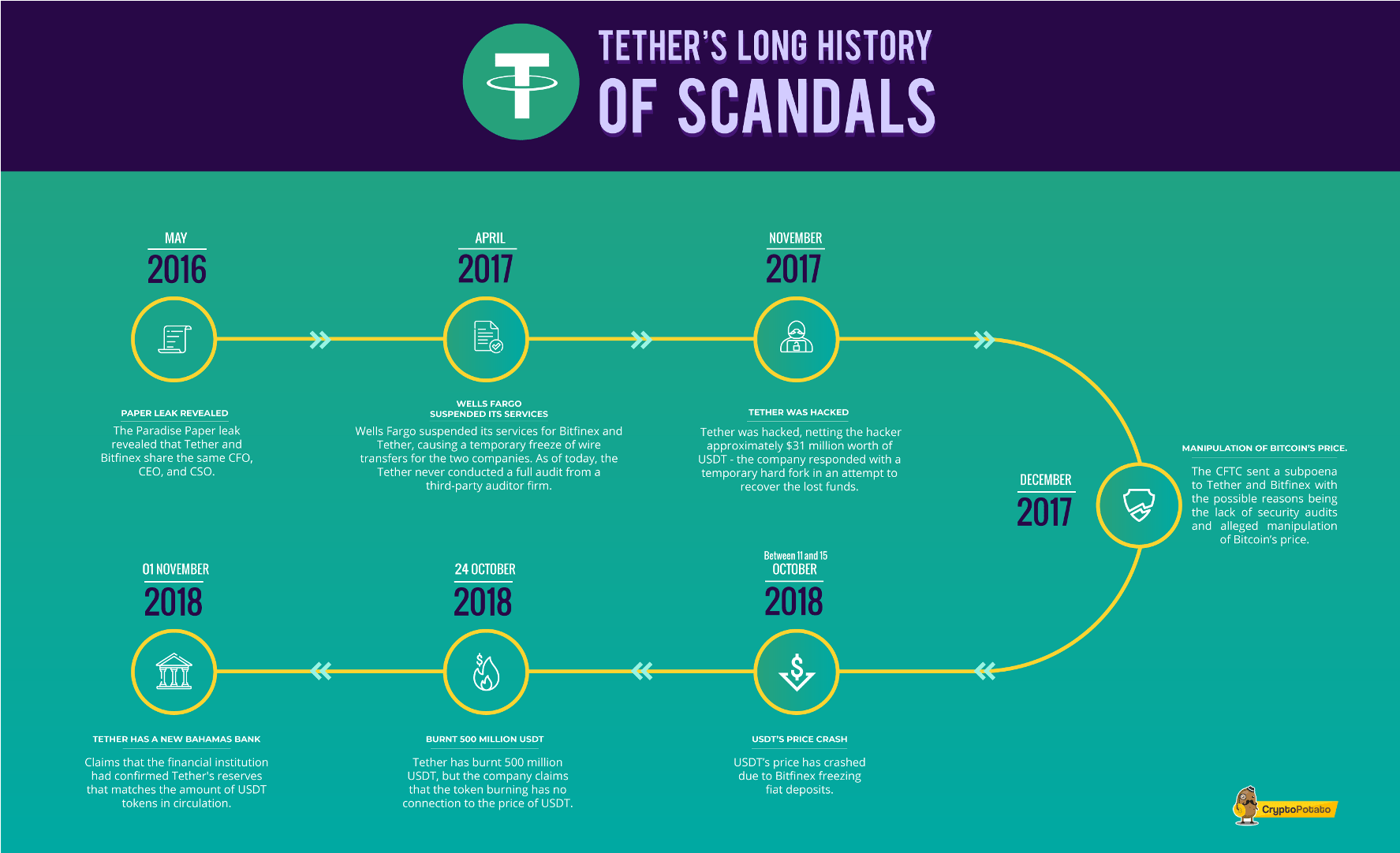

Bitfinex and Tether have previously been involved in a large number of scandals. Therefore, it shouldn’t come as a surprise that these companies are in trouble again.

The New York Attorney General’s Office has provided new evidence in Bitfinex and Tether’s court case yesterday, indicating that the two companies had served New York customers longer than they claimed.

Covering up an $850 Million Loss

The NYAG started an investigation against iFinex – the parent company of Bitfinex and Tether – related to fraud in April, alleging that Bitfinex had covered up an $850 million loss by accessing at least $700 million worth of $900 million in USDT tokens from Tether’s reserves.

Soon after the investigation started, Tether published a blog post stating that the documents had been written in “bad faith” and were “riddled with false assertions.” Tether maintained in the blog post that both the stablecoin issuer and Bitfinex were cooperating with the NYAG’s office.

The two companies have since filed a motion to dismiss the NYAG’s case against Bitfinex and Tether, claiming that the firms ceased its services for New York customers in 2015.

In May, Judge Joel Cohen granted a partial stay on the NYAG’s office’s request for documents from the two companies until their hearing takes place on July 29.

New Evidence Presented

Responding to the motion, the Office of the Attorney General filed a Memorandum of Law in Opposition, 28 pieces of exhibits, and an affirmation to the New York Supreme Court. It stated in part:

The OAG has uncovered substantial ties between Respondents and New York concerning Respondents’ corporate operations; trading on the Bitfinex platform; the issuance, redemption and trading of tethers; use of financial institutions to move money and process customer deposits and withdrawals; and representations to the market that might have been misleading.

According to the NYAG’s office, New York customers could access Bitfinex’s trading platform until January 2017 while New Yorkers could purchase and redeem USDT until November 2017.

Furthermore, the “most senior executives” of the two companies – who the NYAG’s office deems the “largest stakeholders” – allegedly resided and worked in New York between 2014 and 2018.

Between 2017 and 2018, the firms opened accounts at two New York-based banks – Metropolitan Commercial Bank and Signature Bank – and used accounts at Noble Bank, a New York-based financial institution, according to the court document.

The NYAG’s office also revealed that in 2019, the companies loaned USDT to a New York-based trading firm and opened an account at a digital currency firm in New York. Tether also hired New York-based auditors in 2017 and 2018 to provide proof for its 1:1 peg of USDT tokens.

Attacking Bitfinex’s $1 billion IEO

In the document, the NYAG’s office also took aim at Bitfinex’s recent Initial Exchange Offering (IEO), in which the cryptocurrency exchange sold $1 billion worth of its LEO tokens to private investors.

“Respondents’ recent ‘initial exchange offering,’ for instance, has every indicia of a securities issuance subject to the Martin Act, and there is reason to believe that the issuance is related to the matters under investigation,” the document stated.

Moreover, flaws in the token’s code could allow Bitfinex to commit fraudulent activities, including printing or minting an unlimited number of LEO tokens as well as deleting tokens belonging to users.

The post Bitfinex and Tether (USDT) in Trouble: NYAG Calls LEO $1B IEO a Securities Offering appeared first on CryptoPotato.