Bitcoin’s Upcoming Weekly Close Can Trigger The Most Bullish Buy Signal Since 2020 (BTC Price Analysis)

Recent BTC price action intensified after BTC closed above the 200-day moving average line on the daily time-frame, but then closed back below this significant key level on Thursday.

However, things turned bullish, as BTC price pulled back to near-term support, backtested the downtrend line at $43.8k, successfully held the support level, and then printed a bullish engulfing candle the next day to reclaim the 200-day moving average, starting the current weekend by trading on a positive note.

The Weekly Close: Why Is It Critical for the Bulls?

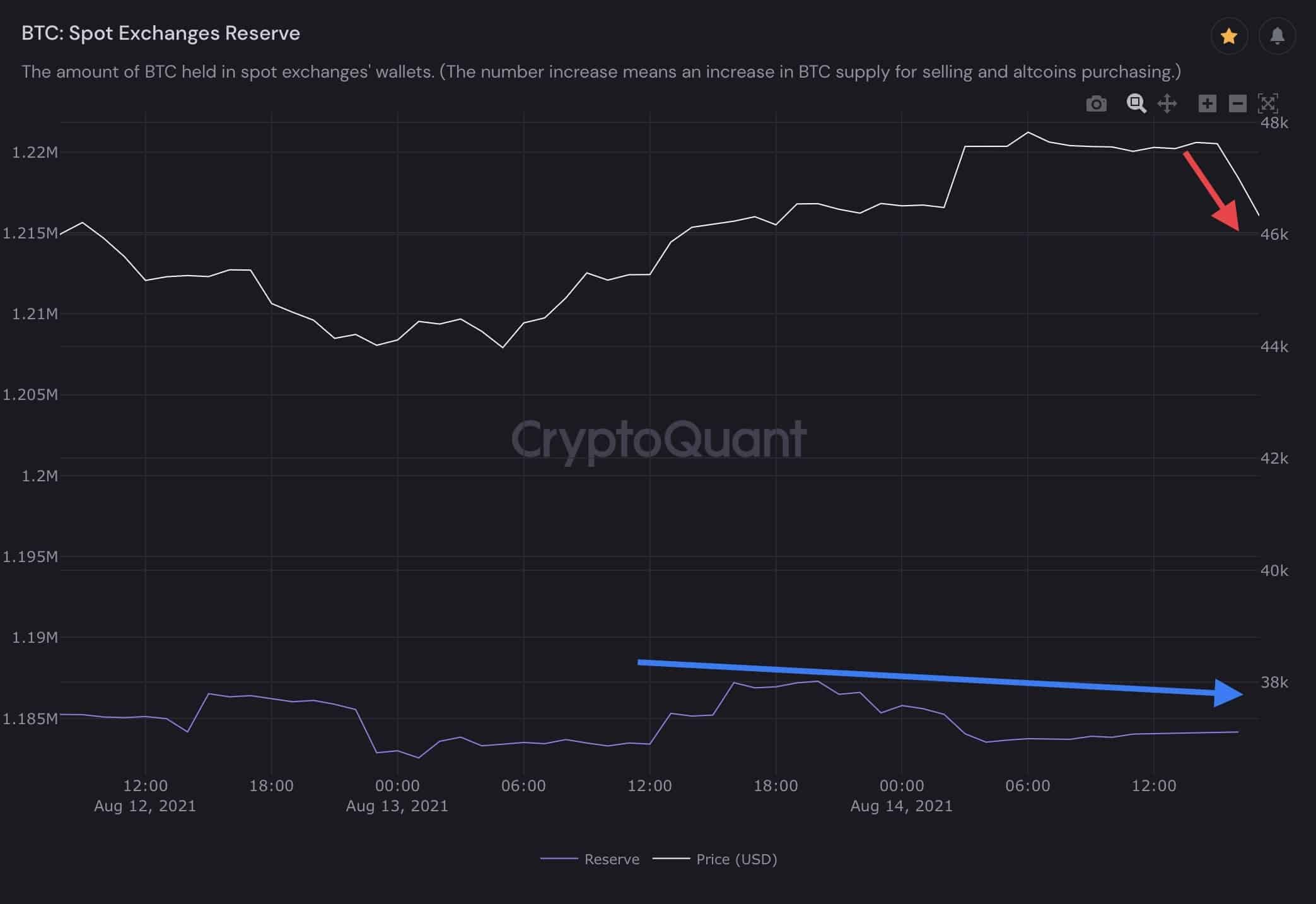

The near-term pullback saw declining volume, a sign of weakening selling pressure, along with consistent spot exchange outflows.

At the moment, no signs of large long-term holders selling. Therefore, the current pull-back can be seen as technical selling, as price action reached slightly overheated and overbought levels. However, it is critical for the bulls to protect the 200-day moving average as support.

As we reported earlier, this week is particularly important for bitcoin’s technicals: The bulls must push BTC higher into the weekly close above the 21-week moving average, which currently lies around $43.9K, along with the 200-day moving average line, which currently lies around $45.3K, in order to trigger one of the most bullish technical buy signals in re-entering bull market continuation.

The last time we had such a bullish weekly 21-week MA cross was in April 2020, post COVID19 crash.

Fundamentals are Strong: Be Ready for Corrections Along The Way

At this point, there have been multiple fundamental long-term buy signals flashing such as the Hash Ribbon confirming a bullish cross, exchange reserves at multi-year lows, and BTC miners’ reserves trending higher for multiple months. This suggests further upside in the coming months.

Despite the bullishness, and just in every healthy bull-run, market rallies must have corrections to cool off momentum, rebuild a base, then continue higher.

This helps make the rally more sustainable. BTC has rallied significantly from the low at $28.8k to a recent intraday high of $48.1k at the time of writing, this is over 65% in 3.5 weeks.

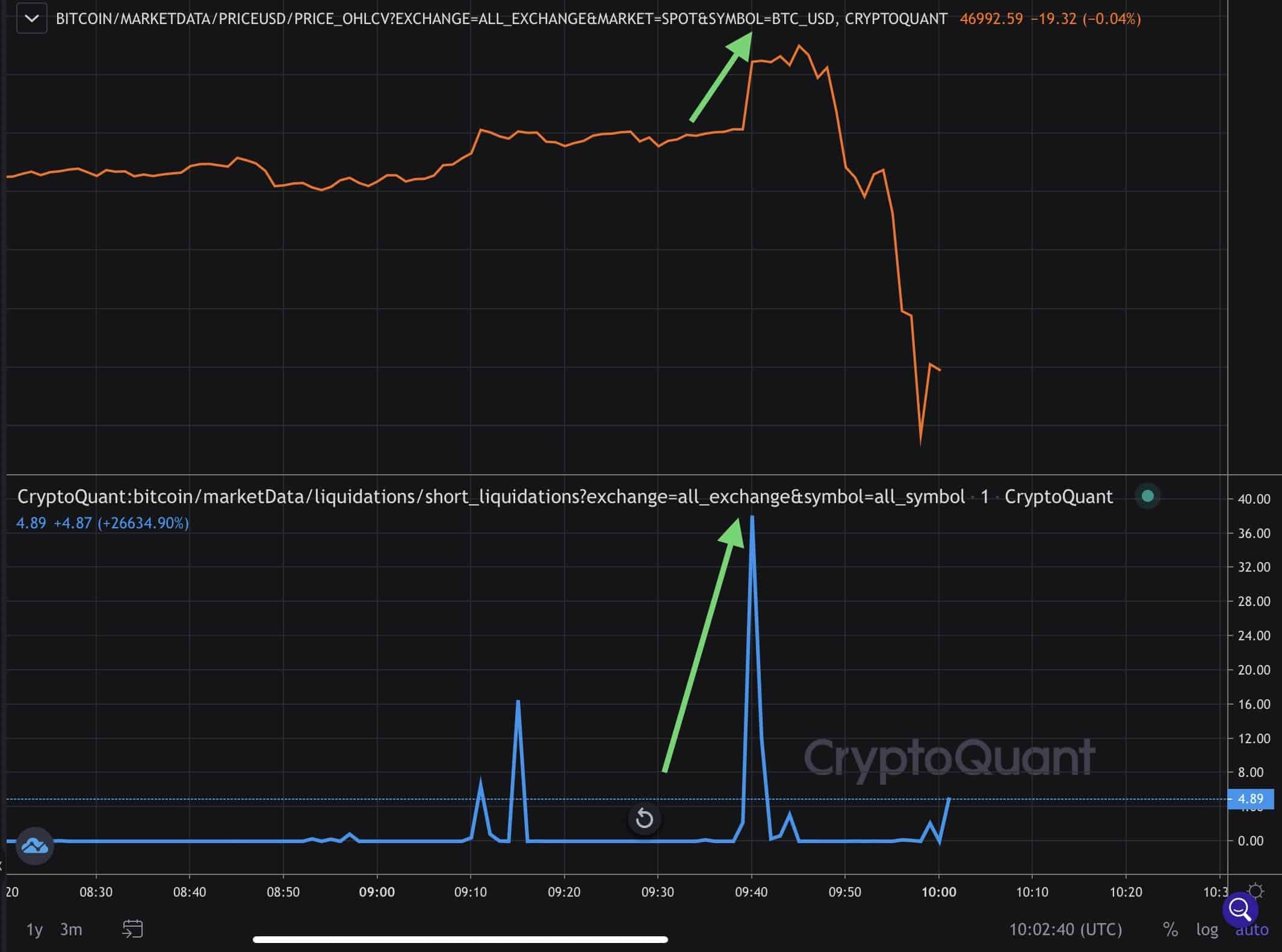

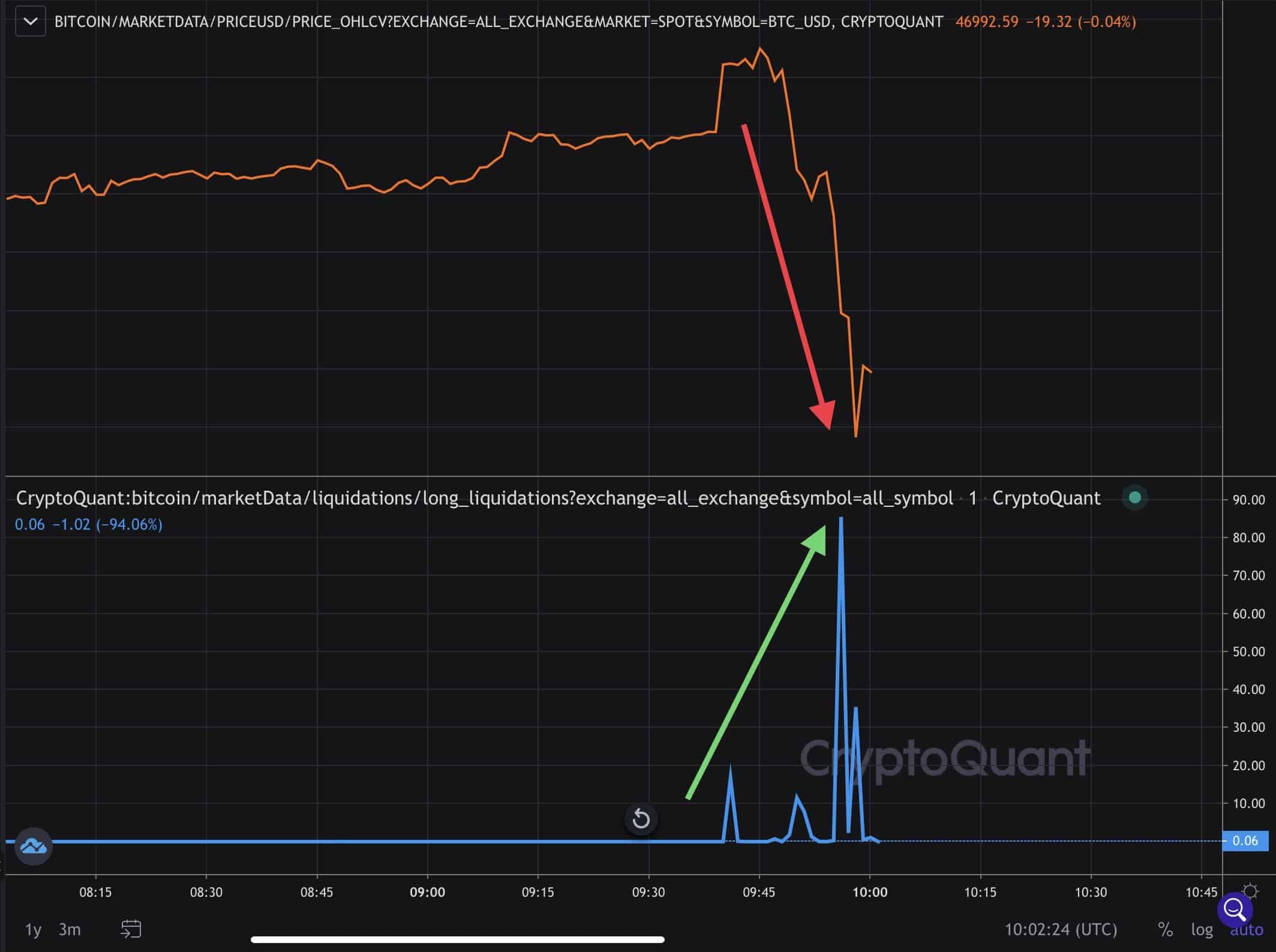

Following that, and over the past hours, we witness some wild swings up and down in the price of bitcoin, liquidating both longs and shorts, as shown in the charts below. These near-term swings are most likely leverage being flushed out.

Data by CryptoQuant shows that Spot Exchange Reserves have remained flat during this recent pullback, which suggests that the selling is coming from existing supply on spot exchanges. Typical retail hands leave their BTC on exchanges, while institutions and whales immediately remove their BTC off exchanges after buying due to counterparty risk.

In conclusion, we will have to see where BTC closes the weekly candle (Sunday’s midnight) relative to the 21-week and 200-day moving average. BTC bulls are waiting for maybe the most critical technical buy signal to flash to re-enter bull market continuation.