Bitcoin’s Supply Liquidity Crisis is Extremely Bullish For BTC Price, Says Glassnode CTO

Bitcoin could be headed towards a bullish supply and liquidity crisis, said Glassnode’s Chief Technology Officer. He came to this conclusion after reviewing recent BTC developments, including institutional adoption, bitcoin hodlers, exchange balances, and miners’ supply.

BTC Wallets, Lost Coins, And More

Rafael Schultze-Kraft, the CTO at the analytics company Glassnode, explored different BTC stats, metrics, and recent developments that point out an ongoing supply and liquidity crisis.

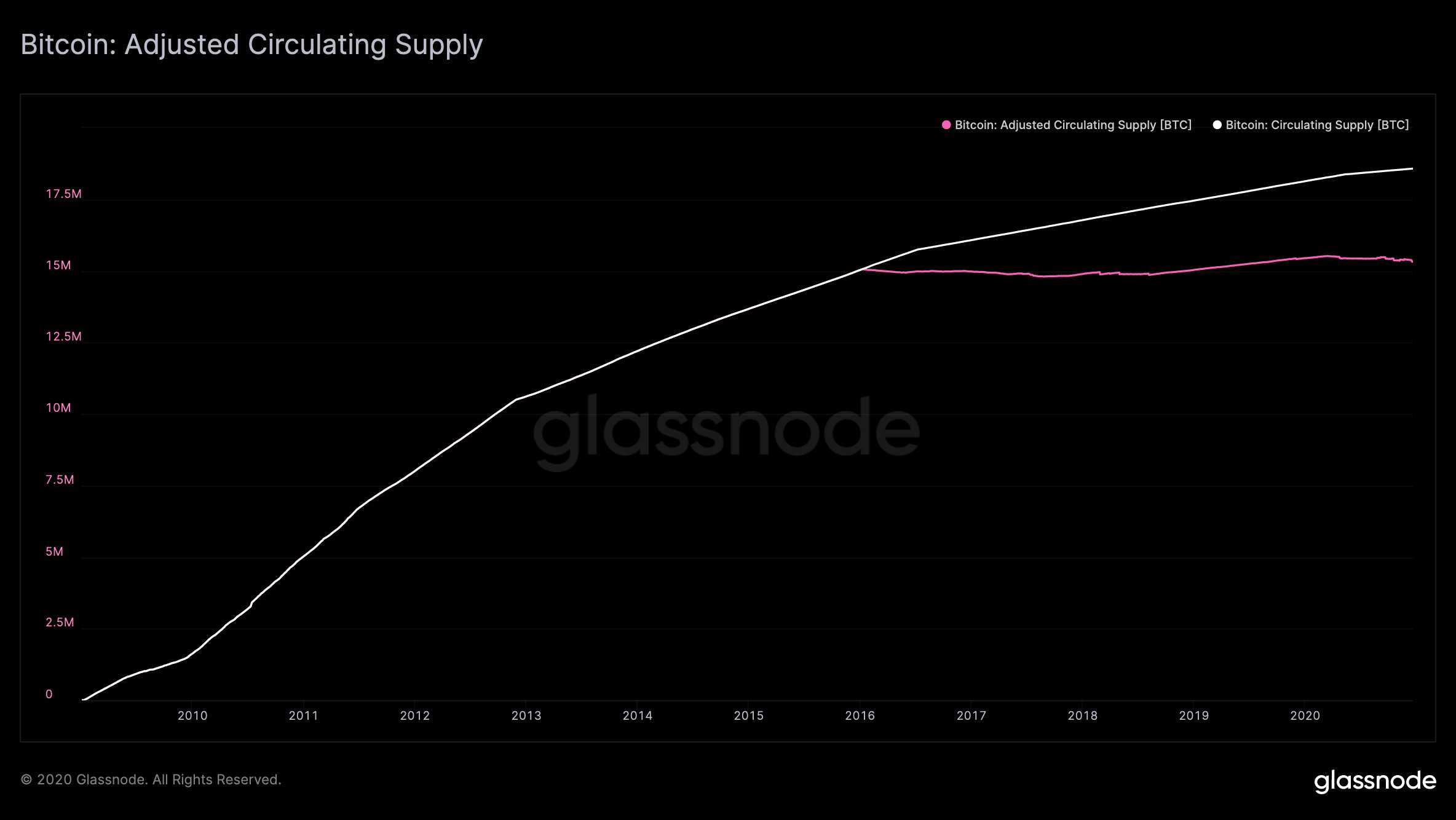

He addressed the well-known maximum supply of 21 million bitcoins ever to exist but noted that the real number is substantially smaller. At least three million coins are considered lost and unretrievable, accounting for about 16% of the hard cap.

Glassnode’s executive further reviewed the so-called Bitcoin accumulation addresses that contain 2.7 million coins. Those are wallets that have only received bitcoins and have never spent any funds. Schultze-Kraft described them as “true hodlers,” that own 14.5% of the circulating BTC supply.

The number of bitcoins stored on cryptocurrency exchanges has declined by 20% since the start of the year. Schultze-Kraft classified this as the “longest depletion of exchange funds” as investors have continually transferred their holdings to long-term storages. Ultimately, this means that the liquidity on trading venues has decreased significantly this year.

Miners have averted from cashing out at these prices as the current miner balance stands at 1.7 million bitcoins. In fact, the number of BTC that has never left miners’ addresses has only increased since the 2020 halving.

Institutional Adoption And Grayscale’s Role

BTC experienced the grand entrance of large corporations, institutions, and prominent investors in the past several months. Names as the NASDAQ-listed business intelligence company MicroStrategy, Jack Dorsey’s Square, insurance giant MassMutual, hedge fund One River Asset Management, and Wall Street behemoth Guggenheim Partners purchased in total billions of dollars worth of bitcoin.

Schultze-Kraft outlined these developments, saying that they have dried up the liquid supply even more. He also suggested that more similar companies could follow soon.

Additionally, he addressed the growing role of the leading digital asset manager – Grayscale. Schultze-Kraft said that the company had bought approximately 210,000 bitcoins for its clients in the past six months. Interestingly, this amount actually surpassed the number of mined coins since then – about 185,000 bitcoins.

It’s also worth noting that the 2020 halving slashed in half the BTC production to 6.25 coins per block. Basic economic principles dictate that if an asset’s supply decreases, while the demand stays the same or increases, that asset is primed for value appreciation.

Consequently, Schultze-Kraft concluded BTC is in a supply and liquidity crisis, which is a “highly underrated” but “extremely bullish” narrative. He added that “we will see this significantly reflected in Bitcoin’s price in the upcoming months.”