Bitcoin’s Scarcity: Can It Eventually Catch up With Gold and Silver?

Bitcoin’s scarcity is one of its distinctive characteristics. Moreover, industry experts and analysts consider it to be among its main benefits. Some even believe that it will eventually allow Bitcoin to get in line with traditional scarce assets such as gold and silver.

Bitcoin’s Scarcity

Scarcity is the limited availability of a commodity which is in demand in the market. Perhaps the most popular scarce commodity is gold. It’s scarce because there is a finite supply of gold in the world, and even though we don’t know exactly how much there is, we know for sure that it’s not unlimited.

Bitcoin is a digital asset – probably the most popular one. It’s also scarce because its protocol stipulates that only 21 million bitcoins will ever come into existence. More importantly, Bitcoin is the very first scarce digital object that we’ve seen.

Unlike gold or silver, however, Bitcoin can also be sent over the internet, which is a major differentiating factor.

Certain industry experts and analysts seem to believe that, eventually, Bitcoin will get in line with gold and silver. This was most recently stated by popular analyst PlanB.

Hypothesis: #bitcoin will get in line with gold and silver pic.twitter.com/rTe71mzunc

— PlanB (@100trillionUSD) August 10, 2019

Using Stock-to-Flow Ratio

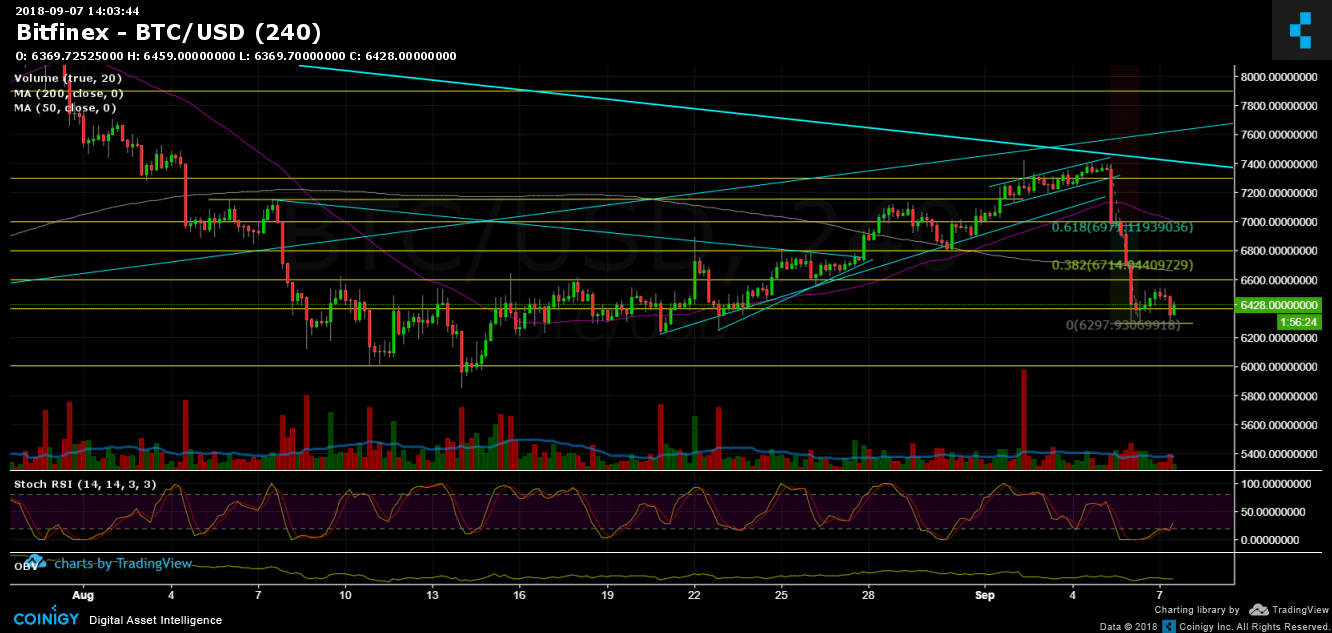

In a detailed post, the analyst explained how he’d come up with this hypothesis using Bitcoin’s stock-to-flow ratio.

He describes stock as the size of existing stockpiles or reserves. Flow, on the other hand, is the annual supply of Bitcoin on the market.

According to Saifedean Ammous, a popular economist and author with a focus on Bitcoin, Bitcoin’s stock-to-flow ratio is going to overtake that of gold around the year 2022.

The existing stockpiles of Bitcoin in 2017 were around 25 times larger than the new coins produced in 2017. This is still less than half of the ratio for gold, but around the year 2022, Bitcoin’s stock-to-flow ratio will overtake that of gold.

The hypothesis put forward by the study described above is that scarcity as measured by Stock-to-Flow is a direct driver of value. Supposedly, as the ratio grows, value tends to get higher as well. The analyst has come up with a model which puts Bitcoin’s market capitalization at $1 trillion after its upcoming halving in May 2020. Should this be true, the price per Bitcoin, factoring in the coins which will be mined by then, would be $55,000.

Bitcoin and Gold: A Preferred Hedge?

In the past week, we saw traditional markets tumble mainly because of growing trade tensions between the world’s largest economies – the US and China.

What was more interesting, however, was the fact that amid economic turmoil, Bitcoin thrived. As CryptoPotato reported, the cryptocurrency’s price surged $700 as President Trump slammed another $300 billion worth of Chinese goods with a 10 percent tariff, dragging global markets into the red.

This caused many to believe that Bitcoin is steadily beginning to be seen as a potential hedge against economic uncertainties – a quality which was historically true for gold. Furthermore, some industry experts have said that Bitcoin has a negative correlation with traditional markets, and the fact that it’s not correlated makes it a safe haven in situations of the kind.

The post Bitcoin’s Scarcity: Can It Eventually Catch up With Gold and Silver? appeared first on CryptoPotato.