Bitcoin’s Recent Raging Volatility: The Good and the Bad

Bitcoin markets have been known to be volatile. Historically, the cryptocurrency has experienced major moves in both directions. As such, there’s been a constant debate as to whether or not this volatility is a positive trait or a massive disadvantage. As always, a case can be made in favor of either side.

Bitcoin’s Volatility Can Be a Good Thing

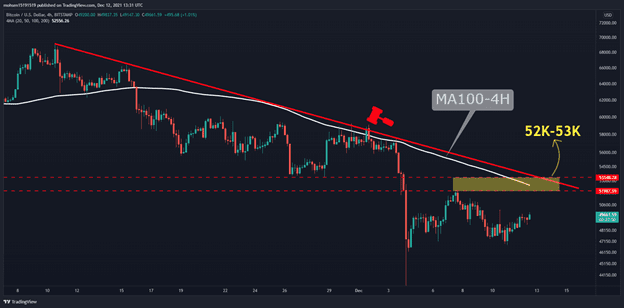

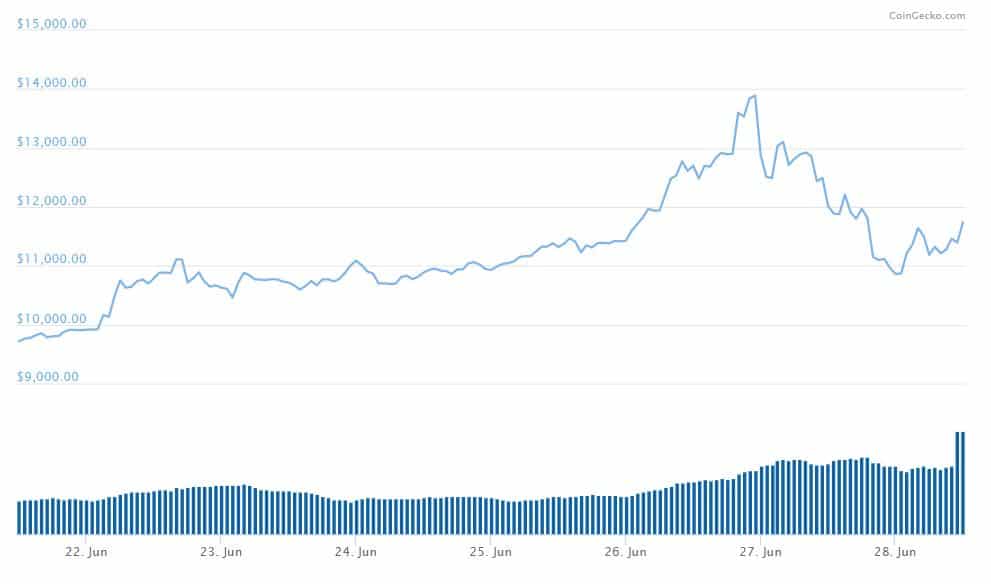

The 7-day chart alone shows us that Bitcoin is, indeed, volatile.

The cryptocurrency surged to almost $14,000 before dropping to around $10,800. And all of this happened within the short span of a few days.

However, according to popular Bitcoin proponent Conner Brown, the cryptocurrency’s volatility has a lot of benefits.

Volatility is good.?

1)It shakes out weak hands and makes sure Bitcoins go to the strongest of hodlers.

2) It’s free Bitcoin advertising. Volatility makes headlines.

3) It’s a direct function of Bitcoin’s unparalleled absolute scarcity. Supply is static so price is volatile.

— Conner Brown (@_ConnerBrown_) June 28, 2019

According to him, volatility is what shakes out weak market participants and guarantees that Bitcoin goes “to the strongest of hodlers.” He also makes the case that it puts Bitcoin in the spotlight, as the more volatile it is, the more media headlines it generates.

From a more fundamental perspective, Bitcoin’s volatility is a direct function of its absolute scarcity. Brown argues that because its supply is static, the price is volatile.

At the same time, he emphasizes that volatility is needed in order for something to go “from nothing to a global reserve asset.” He says that it’s a natural part of Bitcoin’s evolutionary process and that “new money” is not born suddenly as a perfectly stable and liquid “store of value overnight.”

Brown is not the only person in favor of Bitcoin’s raging volatility. Arthur Hayes, CEO of the popular Bitcoin margin trading exchange BitMEX, has also spoken of it as a benefit.

You want as much volatility as possible to have as much chance that Bitcoin goes to $50,000, $100,000, $1,000,000, whatever that high number is.

But There’s Also a Bad Side

Bitcoin’s high volatility also has its pitfalls. It’s commonly associated with price and market manipulation. This is one of the reasons why the US Securities and Exchange Commission (SEC) has yet to approve a Bitcoin ETF.

Last year, the Commission denied the application of Cameron and Tyler Winklevoss on the grounds that Bitcoin is subject to a serious amount of fraud as well as manipulation.

Hence, it’s probably safe to assume that the SEC sees this raging volatility as one of the roadblocks for approving an ETF.

Also, Bitcoin’s high volatility makes trading a lot riskier. While some see this as an opportunity, others are definitely challenged by the frequent and major swings.

In any case, it’s clear that Bitcoin’s volatility comes with its fair share of pros and cons. It’s important to keep that in mind when you trade or invest in the asset in order to prevent major losses.

The post Bitcoin’s Recent Raging Volatility: The Good and the Bad appeared first on CryptoPotato.