Bitcoin’s Q1 2021 – the Best One in Eight Years? Analysis

Despite dumping by nearly $10,000 in a few days, bitcoin’s price has still increased by about 80% in the first quarter of the new year. This makes it the best-performing Q1 in eight years, and history shows that it could propel an even more impressive Q2.

BTC’s Best Q1 in Eight Years

The primary cryptocurrency entered the new year at around $29,000. It didn’t take long to reaffirm its bull run and overcome several round-numbered milestones such as $30,000, $40,000, $50,000, and just a few weeks ago – even $60,000.

By doing so, BTC’s value more than doubled in the span of around ten weeks. However, the asset failed to continue on its remarkable run north and has slumped by more approximately $10,000 since its peak to a price tag of $52,000 as of writing these lines.

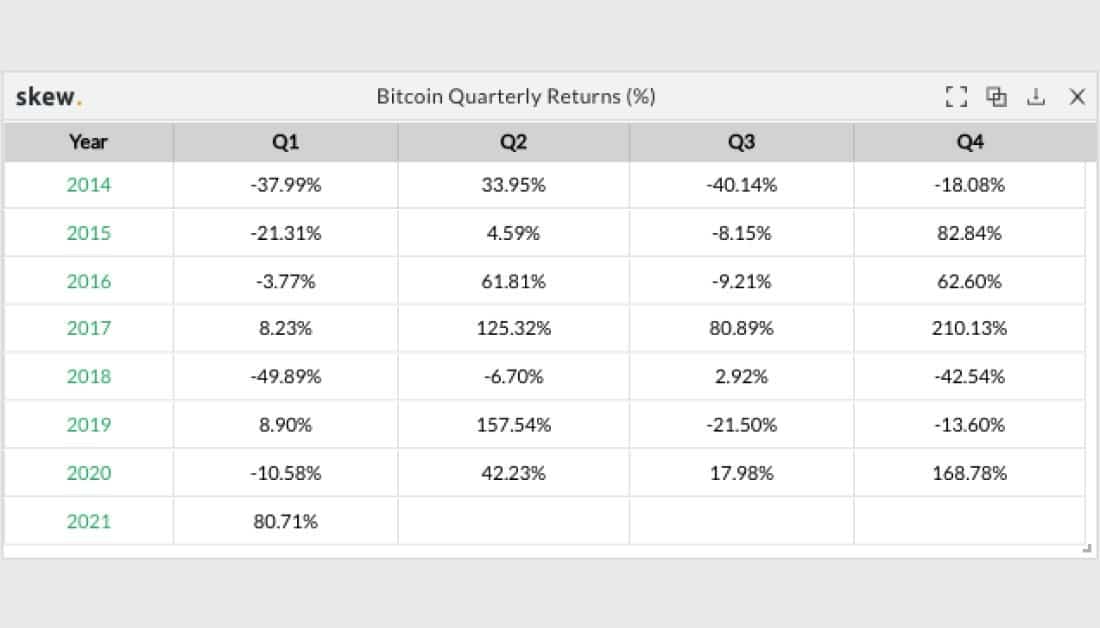

Despite this vigorous decline, though, the cryptocurrency is still well ahead during this quarter. Although Q1 2021 will end on March 31st, meaning that there’s still some time for BTC’s infamous volatility to kick in, bitcoin is about 80% up in this particular timeframe.

According to the analytics resource Skew, this means that bitcoin is on its way to “deliver its Best Q1 in eight years.” Moreover, this would be BTC’s fourth consecutive positive quarter with a minimum performance of at least 18% gains and a maximum of 168%.

Skew also noted that the Q2s are historically even better, especially when the preceding Q1 was positive. As the graph above illustrates, the past two such examples, in 2017 and 2019, led to 125% and 157% price increases in the subsequent three months. If BTC mimics any of those two increases, its price will go well within a six-digit territory.

BTC Outperforms Gold, SPX, Dollar, WTI

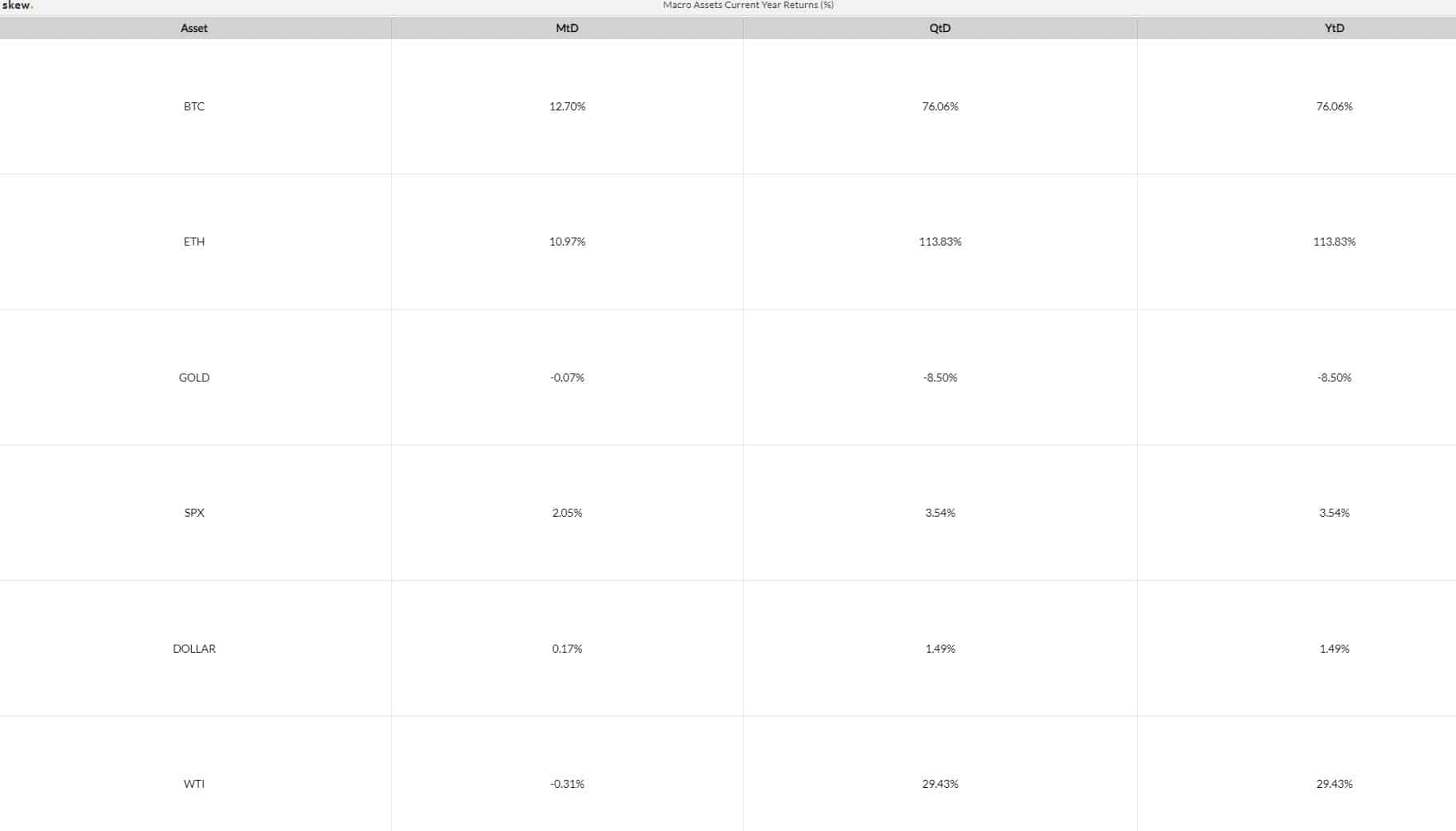

Further data from the company reveals that BTC, and for that matter Ethereum (ETH), have significantly outperformed representatives of the traditional financial scope.

As mentioned above, bitcoin’s YTD increase is north of 70%. At the same time, ETH’s three-month gains are over 110%. Simultaneously, the most popular US-based index – the S&P 500 – is just 3.5% up. The US dollar is 1.5% north, while crude oil (WTI) has increased by nearly 30%.

Nevertheless, WTI suffered a major blow last year when it even went negative due to the COVID-19-induced consequences on the global markets.

It’s worth noting that while the so-called digital gold is more than 70% up since the start of the year, the physical gold – also known simply as gold – has lost some value. The precious metal is 8.5% down so far in 2021.