Bitcoin’s Price Is up by 205% in 2019, and the Masses From 2017 Are Not Here Yet (Which Is Positive)

Bitcoin, currently trading at around $11,400, is up about 205% since the start of this year. However, it appears that retail interest is not quite there yet. Institutions, on the other hand, seem a lot more involved than they were during the previous parabolic cycle.

Retail Interest in Bitcoin Is Still Lacking

It appears that retail interest in Bitcoin is still not quite there, despite this year’s major price increase.

The cryptocurrency began the year trading around $3,700 and has since surged an impressive 205% to its current price of $11,400. However, this doesn’t appear to have gotten retail investors interested yet.

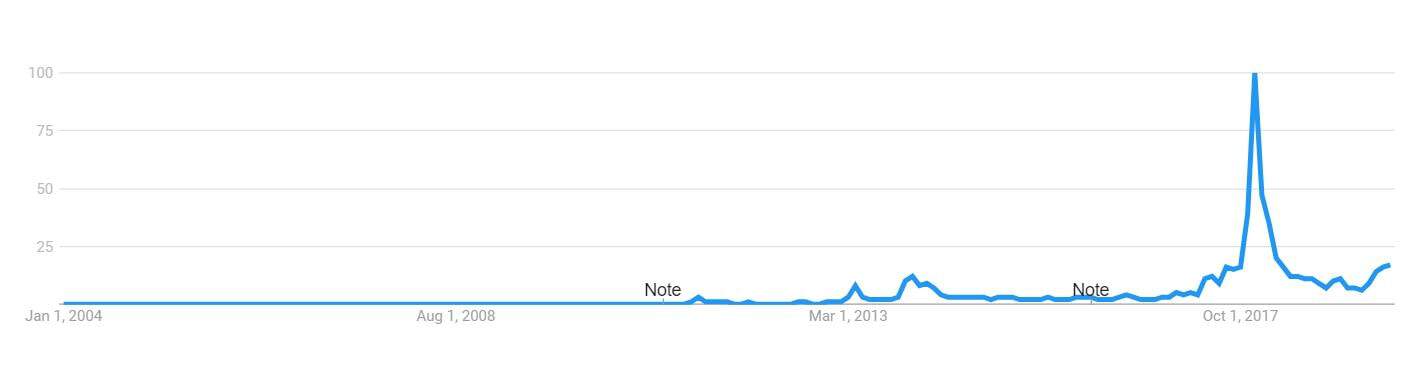

Looking at the chart, we can see that Google searches for “Bitcoin” peaked during December 2017 when the cryptocurrency reached its all-time high value of around $20,000. Now things are looking different as interest in it is significantly lower. This was recently highlighted by Dovey Wan, a founding partner at Primitive Ventures and a popular cryptocurrency commentator. Wan noted that she hadn’t heard from anyone in her circle asking about Bitcoin. This was the prevailing sentiment throughout the entire thread as well.

I’ve received 0 request from remote family members or acquaintances asking about Bitcoin this time so far, while getting a few messages reminding me to take profits

What’s the outside sentiment around you?

— Dovey Wan ? ? (@DoveyWan) July 7, 2019

Signs of a Maturing Market?

While retail has yet to catch up, we can see that institutions are definitely getting more involved in the space.

Fidelity, a Boston-based investment company and one of the world’s largest asset managers, has finally confirmed that it is in the final testing phase of its new Bitcoin trading platform. As CryptoPotato reported, the platform will provide services to institutional investors who are used to the high-quality services that the company has been offering so far.

Moreover, Bakkt, the Bitcoin futures trading platform of the Intercontinental Exchange (ICE), which is also the owner of the New York Stock Exchange (NYSE), has announced plans to launch user acceptance testing for Bitcoin futures trading and custody in July. The platform also revealed that there will be two types of contracts – one which will enable customers to transact in a same-day market, and one which will have a monthly settlement.

Furthermore, the Grayscale Bitcoin Investment Trust currently has a price per share of $14,67. This puts Bitcoin around $16,400 which marks a premium upwards of 30%. It’s important to understand that GBTC shares are supposed to be the very first publicly quoted securities whose value is derived from the price of Bitcoin. They allow institutional investors to gain exposure to the cryptocurrency’s price movement without having to worry about storing, buying, or managing their private keys. Hence, the high premium.

In other words, while retail is lagging behind, institutions are seemingly getting on board. This could be seen as a sign of a maturing market – something that we didn’t have back in 2017.

The post Bitcoin’s Price Is up by 205% in 2019, and the Masses From 2017 Are Not Here Yet (Which Is Positive) appeared first on CryptoPotato.