Bitcoin’s Potential Rally Amid U.S. Dollar Weakness

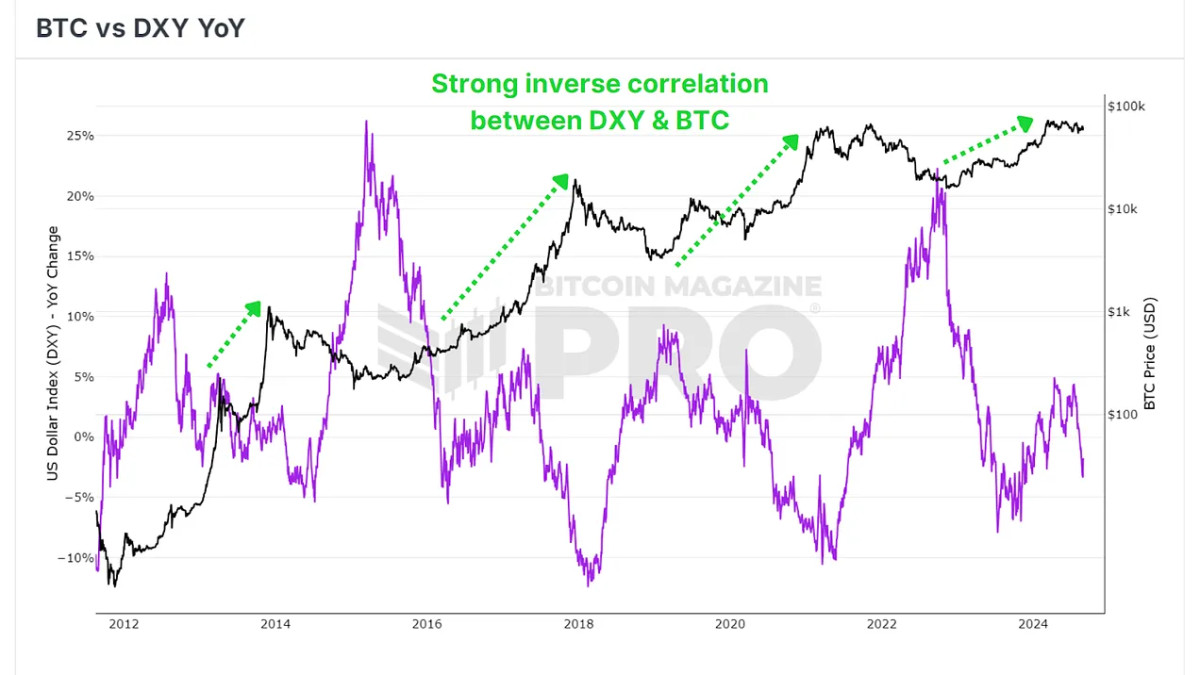

Bitcoin and the U.S. dollar have a long-standing inverse correlation, notably when observing the Dollar Strength Index (DXY). When the dollar weakens, Bitcoin often gains strength, and this dynamic might now be setting the stage for restarting the BTC bull cycle.

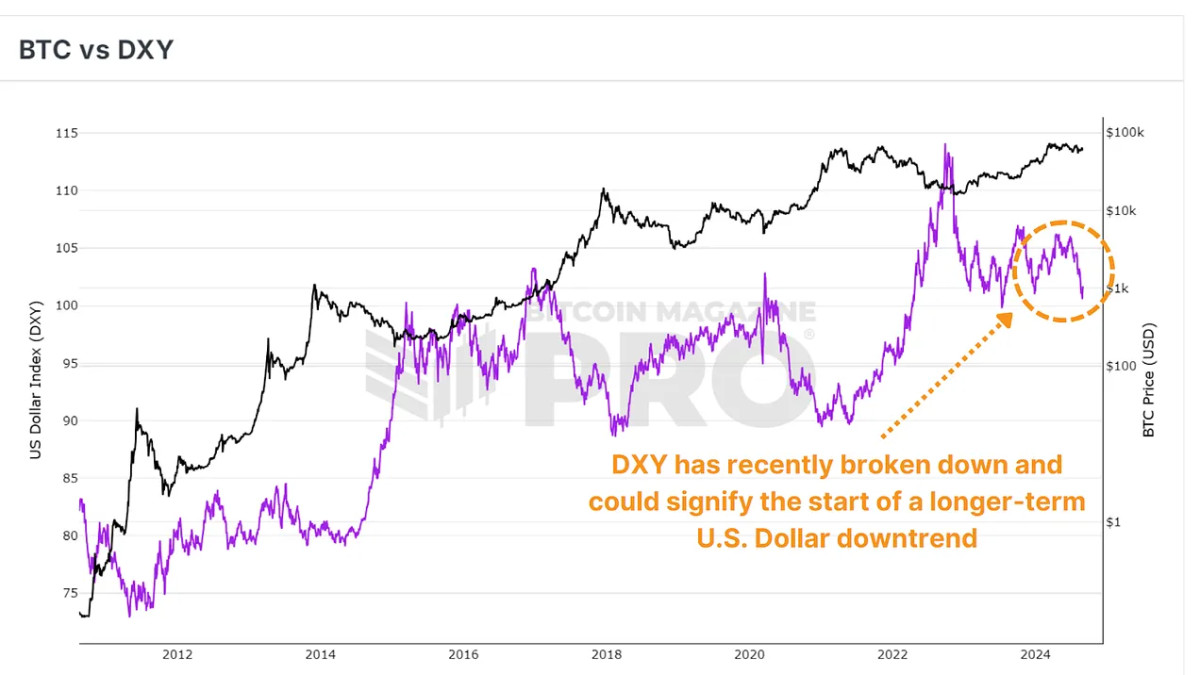

DXY

The Dollar Strength Index (DXY) measures the value of the U.S. dollar against a basket of other major global currencies. Historically, a declining DXY has often coincided with significant rallies in Bitcoin’s price. Conversely, when the DXY is on the rise, Bitcoin tends to enter a bearish phase.

We have recently seen a significant decline in the DXY, which could be signaling a shift toward a more risk-on environment in financial markets. Typically, such a shift is favorable for assets like Bitcoin. Despite this downturn in the DXY, Bitcoin’s price has remained relatively stagnant, raising questions about whether BTC might soon experience a catch-up rally.

Sentiment Shifting

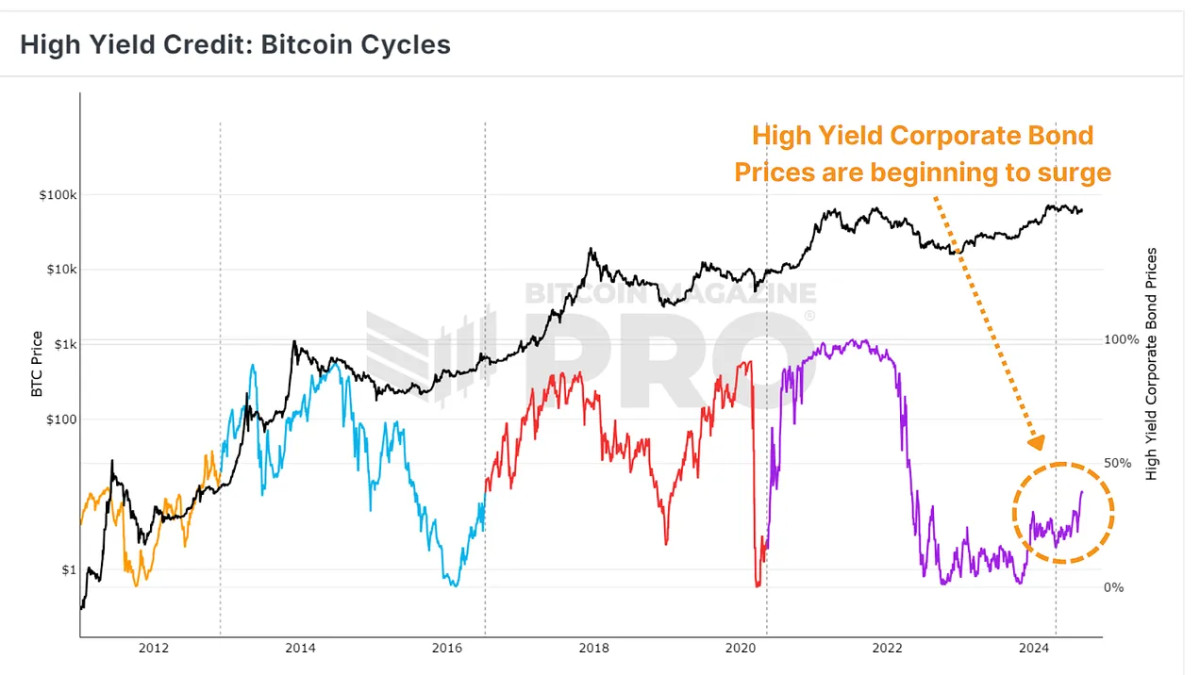

Coinciding with the decrease in demand for the U.S. dollar, the high-yield credit data suggests increasing demand for higher-yielding corporate bonds. This indicates that investors are more eager to obtain outsized returns, and historically this appetite has resulted in more significant capital inflows and higher prices as a result for Bitcoin.

Lagging Behind?

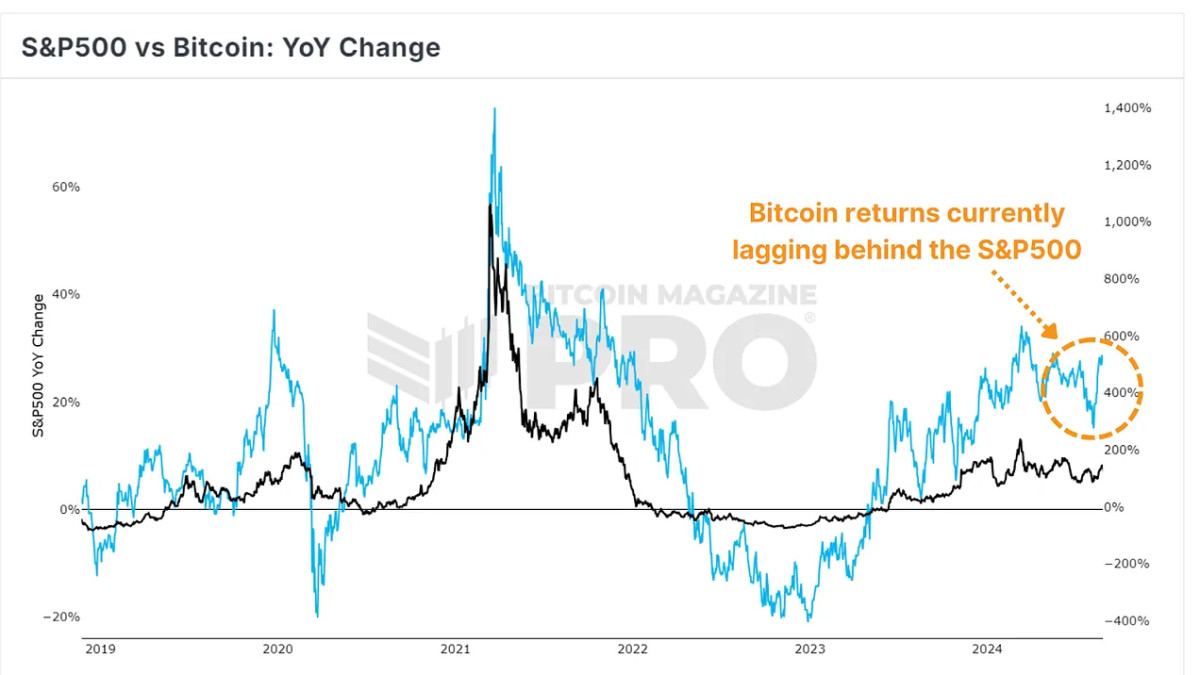

In comparison, the S&P 500 has seen substantial growth in recent weeks, while Bitcoin has remained relatively stagnant. However, the increasing correlation between Bitcoin and the S&P500 suggests that Bitcoin might soon follow the upward trend we’ve seen in traditional equities.

Conclusion

In summary, while Bitcoin has been slow to react to the recent decline in the DXY, the broader market conditions suggest a potential for a bullish phase in our current cycle. We’ve seen a shift in sentiment amongst traditional market investors and, subsequently, a period of outperformance for the S&P500.

Whether the market is overestimating the impact of the dollar’s decline remains to be seen, but the potential for a rally is there.

For a more in-depth look into this topic, check out a recent YouTube video here: The US Dollar Decline Will Be the BTC Bull Market Catalyst