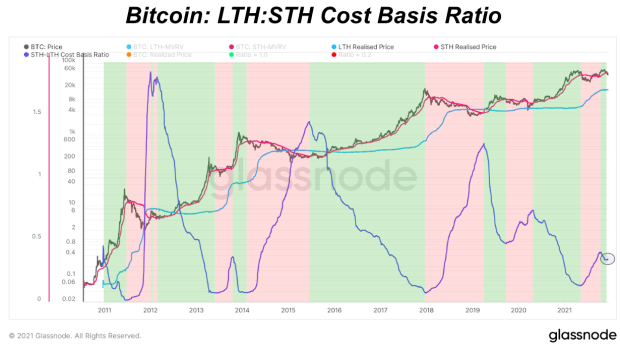

Bitcoin’s Long-Term Holder To Short-Term Holder Cost Basis Ratio

What the ratio of short-term bitcoin holders to long-term bitcoin holders can tell us about the market.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

We have mentioned the cost basis ratio of bitcoin’s long-term holders (LTH) and short-term holders (STH) a numerous amount of times in our previous analysis.

For an introduction to the metric, read The Daily Dive #070 – Short-Term:Long-Term Cost Basis Ratio.

A TLDR:

When the STH:LTH realized price ratio is increasing, it means that the cost basis of STHs is increasing relative to LTHs, and conversely, when STH:LTH realized price ratio is decreasing, the cost basis of LTHs is increasing relative to the cost basis of STHs.

This is extremely insightful, as the price of bitcoin rises when the marginal seller is exhausted. This is why you see the cost basis of LTHs stay somewhat stagnant during explosive bull markets, while the cost basis of STHs (many of whom are new market participants) explode upwards — there are simply not enough coins to go around to meet newfound demand. Thus, “number go up.”

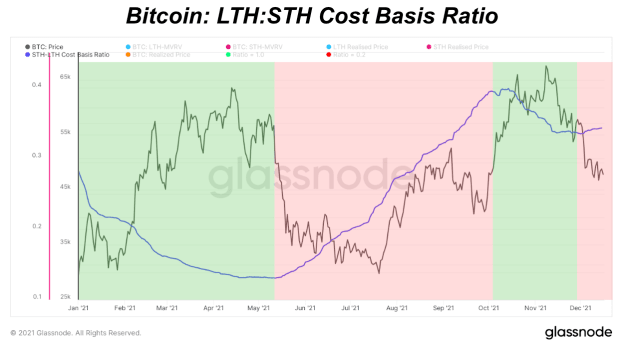

Looking at the metric recently, with price recently breaking below the cost basis of short-term holders, their cost basis is decreasing, and thus the metric is just barely increasing.

This is occuring as some recent market participants are capitulating and taking on-chain losses. A downtrend will resume once price has reclaimed the cost basis of short-term holders, ($52,495), or the aging in of coins into the long-term holder cohort causes their respective cost basis to increase against that of short-term holders.

Final Note

The secular trend of global bitcoin adoption will continue. Despite various macroeconomic uncertainties heading into 2021, there is never a bad time to increase your share of the world’s most sound monetary system. Consolidation to finish 2021 is the most likely scenario.

Sat stackers rejoice.