Bitcoin’s Huge Surge Pushes Crypto Market Cap to $1.19T, the Highest Since June

Alex Thorn

Head of Firmwide Research

Galaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

Alex Thorn

Head of Firmwide Research

Galaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

Alex Thorn

Head of Firmwide Research

Galaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

Alex Thorn

Head of Firmwide Research

Galaxy

Hear Alex Thorn share his take on “Bitcoin and Inflation: It’s Complicated” at Consensus 2023.

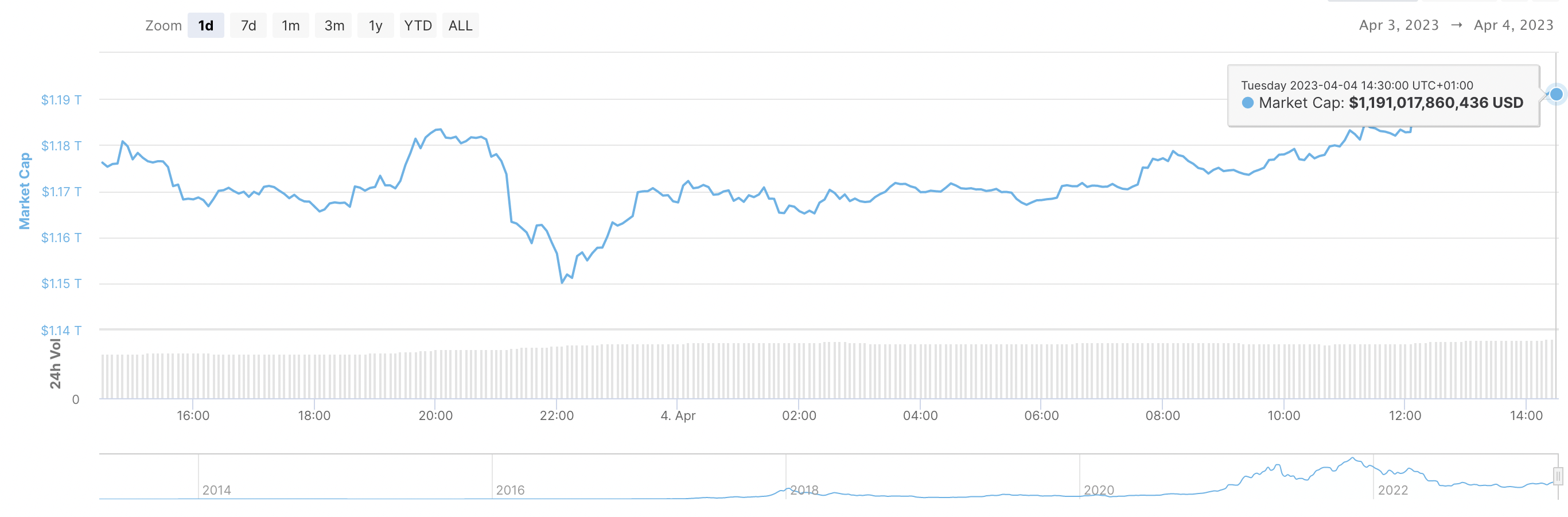

The total market capitalization for all cryptocurrencies has climbed to the highest level since June, helped by bitcoin’s (BTC) massive 70% rally to begin the year.

The rise in overall crypto wealth stands out because it coincides with the industry facing one of the strongest crackdowns in its history. Despite that bleak regulatory outlook, the market cap for digital assets has risen to $1.19 trillion, according to data from CoinMarketCap. The figure stood at about $800 billion at the beginning of 2023.

Bitcoin’s share of the overall market has risen amid the surge. Its so-called dominance hit a nine-month high of 45.5% last month as the cryptocurrency posted its best quarterly performance in two years and turned into one of the top-performing major assets in the world.

April has historically been a good month for BTC, so there’s precedent for the rally to continue. Bitcoin has gained in six of the past 10 Aprils, returning 17% on average, according to data from Matrixport.

Edited by Nick Baker.

DISCLOSURE

Please note that our

privacy policy,

terms of use,

cookies,

and

do not sell my personal information

has been updated

.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a

strict set of editorial policies.

CoinDesk is an independent operating subsidiary of

Digital Currency Group,

which invests in

cryptocurrencies

and blockchain

startups.

As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of

stock appreciation rights,

which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG

.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

:format(jpg)/www.coindesk.com/resizer/Nmp3uOLrfZuoxAeaCg5z6b27KoU=/arc-photo-coindesk/arc2-prod/public/S65B2QZAVNEBRBOGNCIVH5F7F4.png)

Lyllah Ledesma is a CoinDesk Markets reporter currently based in Europe. She holds bitcoin, ether and small amounts of other crypto assets.