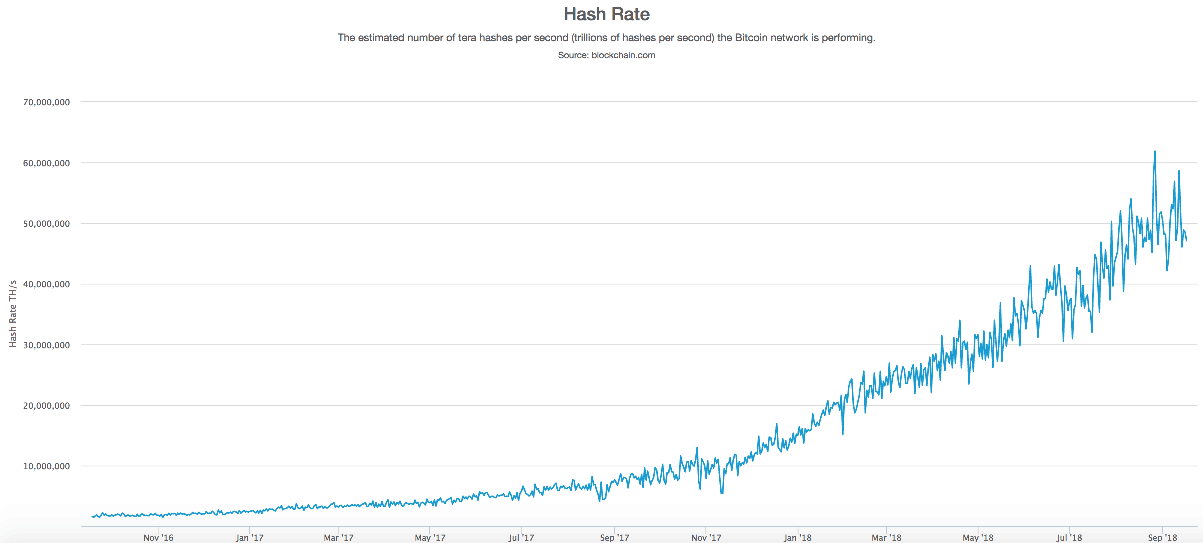

Bitcoin’s Hash Rate Continues to Increase despite the Bear Market

The price of Bitcoin has been a focal point of the crypto space for months now. Major financial media companies like CNBC constantly speculate on where the crypto market is heading based on Bitcoin’s price. Yet, despite the almost 70% decline that we’ve seen in this bear market, the hash rate of the Bitcoin network, (which represents the amount of computing power securing the blockchain) has continued to increase, proving that the network is still growing and there continues to be more miners committed to validating transactions.

According to David Sapper, chief operating officer at the Australian-based cryptocurrency exchange Blockbid, the growing hash rate is also a sign that investors are satisfied with the long-term trend of the crypto markets:

“The increased hash rate means people are here for the long-term because they’re happy to just accumulate what they have, potentially even run at a loss. At the same time, they do sometimes have to clear house and dump,” says David.

Mining cryptocurrencies has become less profitable during this year’s bear market. According to research conducted by Sam Doctor, a quantitative analyst at Fundstrat, Bitcoin mining costs have actually doubled since May. The amount of energy required to confirm transactions now costs more than $4,000 per Bitcoin.

Despite $BTC bear market, hashpower doubled since May to 57 EH/s – Even with upgrades to existing equipment, implies almost 1GW of new power consumption vs 5.2GW in May ’18. Breakeven now $7300 ($5300 cash BE) vs. $6000 in May – Mining becoming FCF -ive @fundstrat #Crypto pic.twitter.com/pTTWJWlrz0

— Sam Doctor (@fundstratQuant) September 14, 2018

Assuming the costs of setting up a mining rig have remained the same, miners are now being rewarded in BTC that is valued at ~$6,000, whereas nine months ago it was valued at $19,000. The natural conclusion would have been that the hash rate would also fall along with the price. However, the fact that it is increasing demonstrates resilience amongst miners and Bitcoin holders who see a longer-term view of where the crypto space is going. It also demonstrates an increase in the efficiency of mining technology, as companies like Bitmain are producing less costly and more effective mining equipment to make it easier than ever to mine Bitcoin and other cryptocurrencies.

Marco Streng, CEO of Genesis Mining has stated: “There are still major expansions happening, especially from more efficient miners. The expansion is so big that it compensated for the drop-out of not-so-efficient miners”.

This compensation for less efficient miners who are dropping out as the price declines has probably increased at a faster rate, which also explains the growing hash rate.

To sum up

Overall, despite the grim outlook of where Bitcoin’s price may be headed, there are still many who are optimistic about its future. So as long as we continue to see an uptrend in the hash rate, we can be confident that the long-term direction of Bitcoin’s price is upward (at least by the vast majority’s belief). This is unlike the situation that has happened recently around Ethereum’s hashrate.

The post Bitcoin’s Hash Rate Continues to Increase despite the Bear Market appeared first on CryptoPotato.