Bitcoin’s Future in Payments: Overcoming Stablecoin Dominance with Fiatless Fiat

Stablecoins have so far dominated the crypto payment market, but some Bitcoin developers believe there’s a proposal out there that could offer a legitimate alternative.

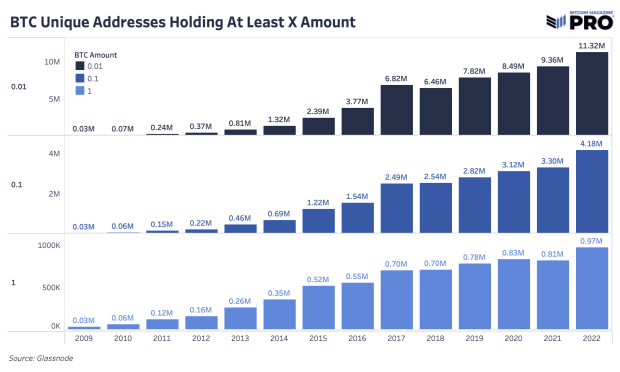

Seven years ago, Dorier, a long-time developer, set out to democratize bitcoin payment processing by launching a free and open-source alternative to the then-dominant BitPay: BTCPay Server. Today, despite the project’s strong grassroots success among Bitcoin enthusiasts and online merchants, the landscape of cryptocurrency payments has evolved dramatically from when Dorier first began his journey. The rise of stablecoins has quickly dominated the space, pushing bitcoin—the world’s largest digital asset—to the sidelines in the payment processing arena.

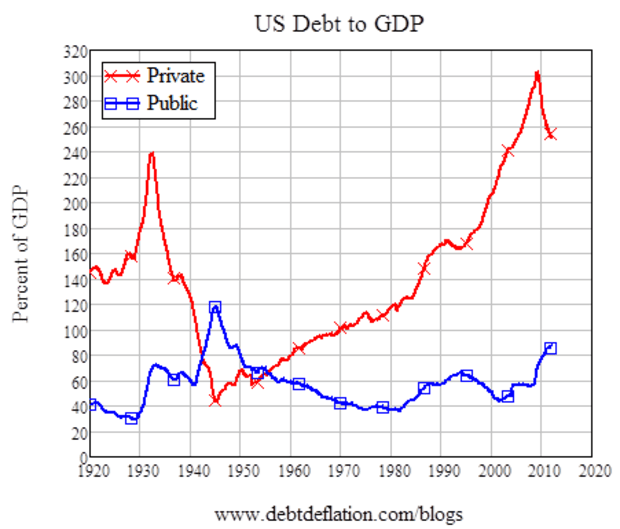

Fueled by growing demand for stable currency options, particularly US dollars, stablecoins have swiftly taken over the cryptocurrency payments market. This surge has left many Bitcoin enthusiasts struggling to cope with the reality that these dollar-pegged assets could reinforce the very system Bitcoin was designed to challenge—the hegemony of the US dollar. As stablecoins continue to gain traction, Bitcoin promoters find themselves at a crossroads, questioning how to preserve Bitcoin’s vision of financial sovereignty in a market increasingly leaning toward stability over decentralization.

A new proposal emerging from the Lightning ecosystem has caught Dorier’s attention, and the veteran developer believes it could address this obstacle. Speaking to a packed audience at BTCPay Server’s recent annual community gathering in Riga, Dorier introduced the concept of “fiatless fiat”—a Bitcoin-native alternative to treasury-backed stablecoins like Tether and USDC.

Synthetic USD

Back in 2015, BitMEX co-founder and then-CEO Arthur Hayes outlined in a blog post how to use futures contracts to create synthetic US dollars. Although this idea never gained widespread traction, it became a popular strategy among traders seeking to hedge against bitcoin’s volatility without having to sell their underlying bitcoin positions.

For readers less familiar with financial derivatives, a synthetic dollar (or synthetic position) can be created by two parties entering a contract to speculate on the price movement of an underlying asset—in this case, bitcoin. Essentially, by taking an opposite position to their bitcoin holdings in a futures contract, traders can protect themselves from price swings without having to sell their bitcoin or rely on a US dollar instrument.

More recently, services like Blink Wallet have adopted this concept through the Stablesats protocol. Stablesats allows users to peg a portion of their bitcoin balance to a fiat currency, such as the US dollar, without converting it into traditional currency. In this model, the wallet operator acts as a “dealer” by hedging the user’s pegged balance using futures contracts on centralized exchanges. The operator then tracks the respective liabilities, ensuring that the user’s pegged balance maintains its value relative to the chosen currency. (More detailed information about the mechanism can be found on the Stablesats website.)

Obviously, this setup comes with a significant trade-off. By using Stablesats or similar services, users effectively relinquish custody of their funds to the wallet operator. The operator must then manage the hedging process and maintain the necessary contracts to preserve the synthetic peg.

Stable channels and virtual balances

In Riga, Dorier pointed out that a similar effect can be achieved between two parties using a different type of contract: Lightning channels. The idea follows recent work from Bitcoin developer Tony Klaus on a mechanism called stable channels.

Instead of relying on centralized exchanges, stable channels connect users seeking to hedge their Bitcoin exposure with ‘stability providers’ over the Lightning network. A stable channel essentially functions as a shared Bitcoin balance, where funds are allocated according to the desired exposure of the ‘stability receiver.’ Leveraging Lightning’s rapid settlement capabilities, the balance can be continuously adjusted in response to price fluctuations, with sats shifting to either side of the channel as needed to maintain the agreed distribution.

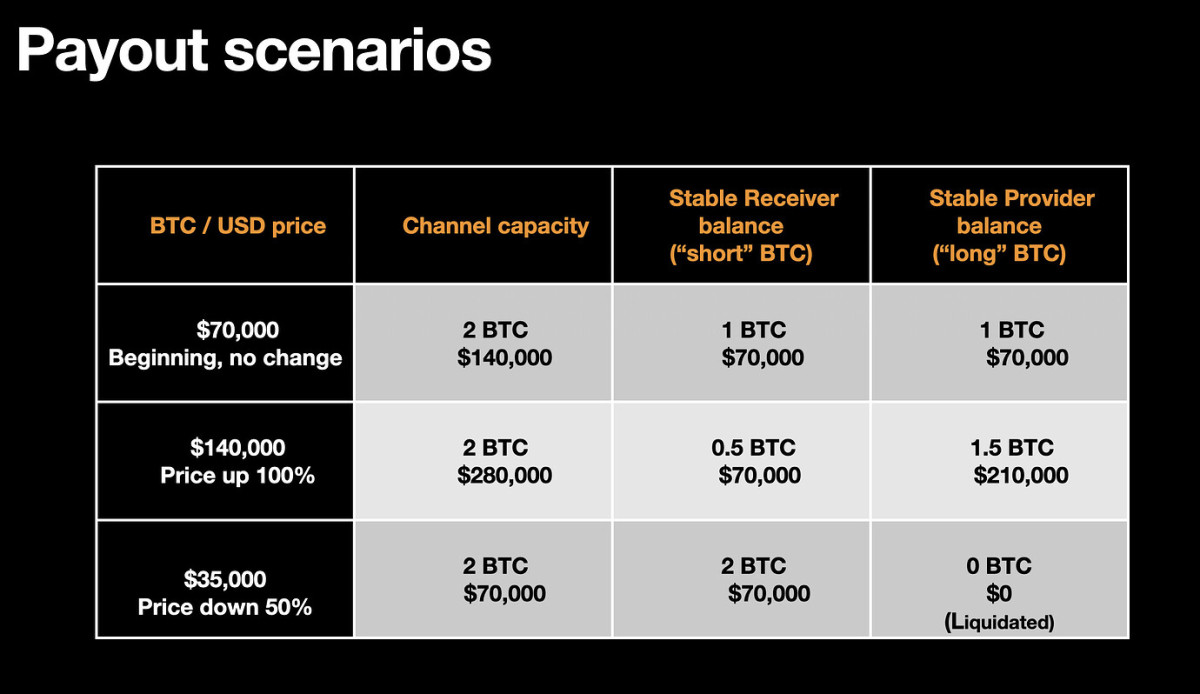

Here’s a simple chart to illustrate what the fund’s breakdown may look like over time:

Clearly, this strategy entails considerable risks. As illustrated above, stability providers taking leveraged long positions on the exchange are exposed to large downside price volatility. Moreover, once the reserves of these stability providers are exhausted, users aiming to lock in their dollar-denominated value will no longer be able to absorb further price declines. While those types of rapid drawdowns are increasingly rare, Bitcoin’s volatility is always unpredictable and it’s conceivable that stability providers may look to hedge their risks in different ways.

On the other hand, the structure of this construct allows participants’ exposure within the channel to be linked to any asset. Provided both parties independently agree on a price, this can facilitate the creation of virtual balances on Lightning, enabling users to gain synthetic exposure to a variety of traditional portfolio instruments, such as stocks and commodities, assuming these assets maintain sufficient liquidity. Researcher Dan Robinson originally proposed an elaborated version of this idea under the name Rainbow Network.

The good, the bad, the ugly

The concept of “fiatless fiat” and stable channels is compelling because of its simplicity. Unlike algorithmic stablecoins that rely on complex and unsustainable economic models involving exogenous assets, the Bitcoin Dollar, as envisioned by Dorier and others, is purely the result of a voluntary, self-custodial agreement between two parties.

This distinction is critical. Stablecoins usually involve a centralized governing body overseeing a global network, while a stable channel is a localized arrangement where risk is contained to the participants involved. Interestingly, it does not even have to rely on network effects: one user can choose to receive USD-equivalent payments from another, and subsequently shift the stability contract to a different provider at their discretion. Stability provision has the potential to become a staple service from various Lightning Service Provider types of entities competing and offering different rates.

This focus on local interactions helps mitigate systemic risk and fosters an environment more conducive to innovation, echoing the original end-to-end principles of the internet.

The protocol allows for a range of implementations and use cases, tailored to different user groups, while both stability providers and receivers maintain full control over their underlying bitcoin. No third party—not even an oracle—can confiscate a user’s funds. Although some existing stablecoins offer a degree of self-custody, they by contrast remain vulnerable to censorship, with operators able to blacklist addresses and effectively render associated funds worthless.

Unfortunately, this approach also inherits several challenges and limitations inherent to self-custodial systems. Building on Lightning and payment channels introduces online requirements, which have been cited as barriers to the widespread adoption of these technologies. Because stable channels monitor price fluctuations through regular and frequent settlements, any party going offline can disrupt the maintenance of the peg, leading to potential instability. In an article further detailing his thoughts on the idea, Dorier entertains various potential solutions to a party going offline, mainly insisting that re-establishing the peg of funds already allocated to a channel “is a cheap operation.”

Another potentially viable solution to the complex management of the peg involves the creation of ecash mints, which would issue stable notes to users and handle the channel relation with the stability provider. This approach already has real-world implementations and could see more rapid adoption due to its superior user experience. The obvious tradeoff is that custodial risks are reintroduced into a system designed to eliminate them. Still, proponents of ecash argue that its strong privacy and censorship-resistant properties make it a vastly superior alternative to popular stablecoins, which are prone to surveillance and control.

Beyond this, the complexity of the Lightning protocol and the inherent security challenges posed by keeping funds at risk in “hot” channels will need careful consideration when scaling operations.

Perhaps the most pressing challenge for this technology is the dynamic nature of the peg, which may attract noncooperative actors seeking to exploit short-term, erratic price movements. Referred to as the “free-option problem,” a malicious participant could cease honoring the peg, leaving their counterparties exposed to volatility and the burden of reestablishing a peg with another provider. In a post on the developer-focused Delving Bitcoin forum, stable channel developer Tony Klaus outlines several strategies to mitigate this issue, offering potential safeguards against these types of opportunistic behaviors.

While no silver bullet exists, the emergence of a market for stability providers could potentially foster reputable counterparties whose long-term business interests will outweigh the short-term gains of defrauding users. As competition increases, these providers will have strong incentives to maintain trust and reliability, creating a more robust and dependable ecosystem for users seeking stability in their transactions.

Concluding his presentation in Riga, Dorier acknowledged the novelty of this experiment but encouraged attendees to also consider its enticing potential.

“It’s very far-fetched, it’s a new idea. It’s a new type of money. You need new business models. You need new protocols and new infrastructure. It’s something more long-term, more forward-looking.”

Users and developers interested to learn or contribute to the technology can find more information on the website or through the public Telegram channel.