Bitcoin’s Energy Revolution Could Happen Sooner Than We Think

Satoshi Nakamoto intended to create a monetary revolution with the invention of bitcoin, but his other unstated revolution may occur first in the energy sector.

This is an opinion editorial by Kent Halliburton, President and COO of Sazmining.

Though the intention of the Bitcoin white paper was to usher in a financial revolution by introducing the first effective peer-to-peer electronic cash system, we’re now seeing the inception of Bitcoin’s second revolution: Energy.

Bitcoin miners serve as energy buyers of last resort, can work from anywhere and can turn on and off with nearly infinite flexibility. As such, bitcoin mining can render viable renewable and remote energy sources that would have otherwise been unprofitable. Additionally, miners can convert waste energy into digital gold, drastically curbing humanity’s emissions problem. Interestingly, these improvements to our relationship with energy are already underway, even before bitcoin has evolved into the next global reserve asset. Could it be that Satoshi Nakamoto’s unstated energy revolution actually takes hold before the first revolution of a peer-to-peer cash system? Although we can’t know with certainty, the data suggests that could be the case.

The Energy Revolution Gains Steam

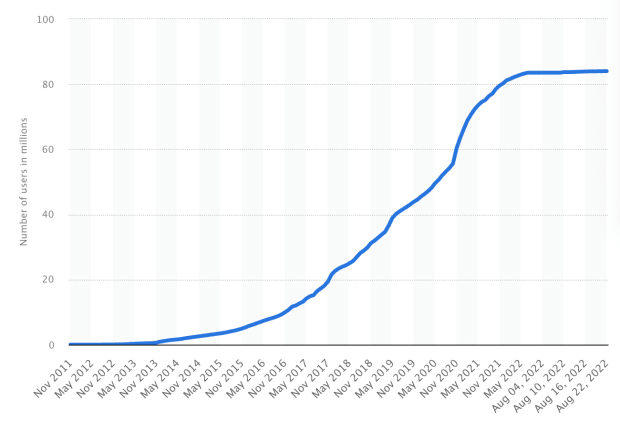

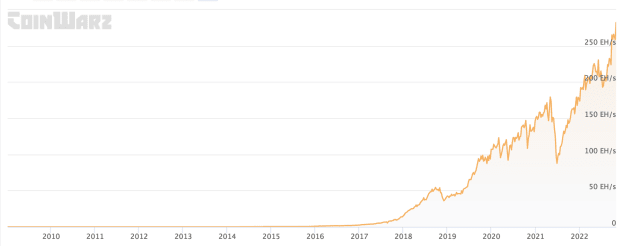

Though imperfect, the best metric for comparing Bitcoin’s monetary and energy revolutions is growth. Let’s look at growth rates between the total number of bitcoin holders and the total hash rate of all bitcoin miners. Hash rate, the total computational power used by miners to process bitcoin transactions and earn new bitcoin, serves as a good proxy for miners’ energy consumption. However, this still does not give us direct data about bitcoin mining’s increasingly positive effects on the energy sector. After all, if greater energy consumption by bitcoin miners simply corresponds to greater demand for energy, then Bitcoin will not have caused a paradigm shift in our relationship with energy at all. But, as we will see, the energetic benefits of bitcoin mining have risen along with Bitcoin’s energy consumption.

As you can see in the first chart, the number of bitcoin users increased at a rapid rate until mid-2021, when the rate of growth slowed. The drop in adoption roughly corresponds with bitcoin’s price drop from over $61,000 to under $32,000. While the hash rate also crashed around this time, it steadily climbed back and continues to reach new heights. Although bitcoin adoption has slowed, the network’s energy consumption and mining activity continues to grow significantly.

As mentioned earlier, bitcoin mining’s increase in energy consumption alone does not tell us that Nakamoto’s second revolution is underway. To argue that, we need to know how much of that energy comes from renewable, waste and stranded energy. The Bitcoin Mining Council’s Q3 2022 report explains that bitcoin mining’s sustainable electricity mix is nearly 60% as of October 2022, up by about 3% from a year ago. Bitcoin miners purchase renewable energy as buyers of last resort; they are not consuming energy that would have been bought by other consumers. Rather, they purchase the energy precisely when there is little demand from others, increasing the profitability — and therefore the viability — of renewable energy sources across the world. As bitcoin mining’s renewable energy consumption increases, so does the global market for clean energy.

Future Indicators Of Nakamoto’s Revolutions

In addition to measuring the number of bitcoin holders (or wallets) in existence, another metric by which to gauge the success of Nakamoto’s monetary revolution is the number of transactions per unit of time that involve bitcoin.

The Lightning Network, a Layer 2 technology designed to make bitcoin transactions cheap, quick and user-friendly, is growing in prominence as bitcoin evolves from a store of value into a medium of exchange. The number of transactions executed on the Lightning Network per unit of time will be a straightforward indicator of bitcoin’s growth as a monetary instrument.

As more and more energy projects take advantage of bitcoin mining, Nakamoto’s energy revolution will be measured by tracking all of the following:

- Tonnes of carbon dioxide equivalent reduced per unit of energy consumed by bitcoin miners per unit of time.

- Wattage output by stranded energy sources that would have been unviable in the absence of bitcoin mining.

- Wattage output by intermittent (and renewable) energy sources that would have been unviable in the absence of bitcoin mining.

As we receive more data about both the Lightning Network and the intersection between bitcoin mining and the energy sector, we will be able to compare how much each of Nakamoto’s revolutions is progressing over time. As stated earlier, although there will never be a single moment at which either revolution will have officially come to pass, we will at least be able to measure the speed at which each is progressing.

What We Now Know About The Dual Revolutions

Current data indicates that the growth of bitcoin owners has slowed relative to the growth of mining. If these trends continue and if bitcoin miners’ renewable energy mix continues to be among the greenest on the planet, then Nakamoto’s second revolution could indeed overtake his first. Bitcoin could acquire a reputation as a significant asset in the battle against global warming, rivaling its emerging reputation as the next global reserve asset.

Nakamoto’s unintended energy revolution will continue to grow in force. Fortunately for humanity, it does not matter which of Nakamoto’s revolutions is happening faster. We all win with drastically improved money and energy.

This is a guest post by Kent Halliburton. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.